“`html

B of A Securities Upgrades Tanger to Buy Amid Mixed Outlook

Analyst Price Forecast Shows Possible Decline

Fintel reports that on November 11, 2024, B of A Securities changed their outlook for Tanger (NYSE:SKT) from Neutral to Buy.

Projected Share Prices and Revenue Trends

As of October 22, 2024, the average one-year price target for Tanger is $33.15 per share. The estimates range from a low of $30.30 to a high of $36.75. This average price target represents a decline of 8.22% compared to its most recent closing price of $36.12 per share.

Tanger’s projected annual revenue is $433 million, which reflects a significant decrease of 17.12%. Additionally, the expected annual non-GAAP EPS stands at 0.58.

Institutional Ownership on the Rise

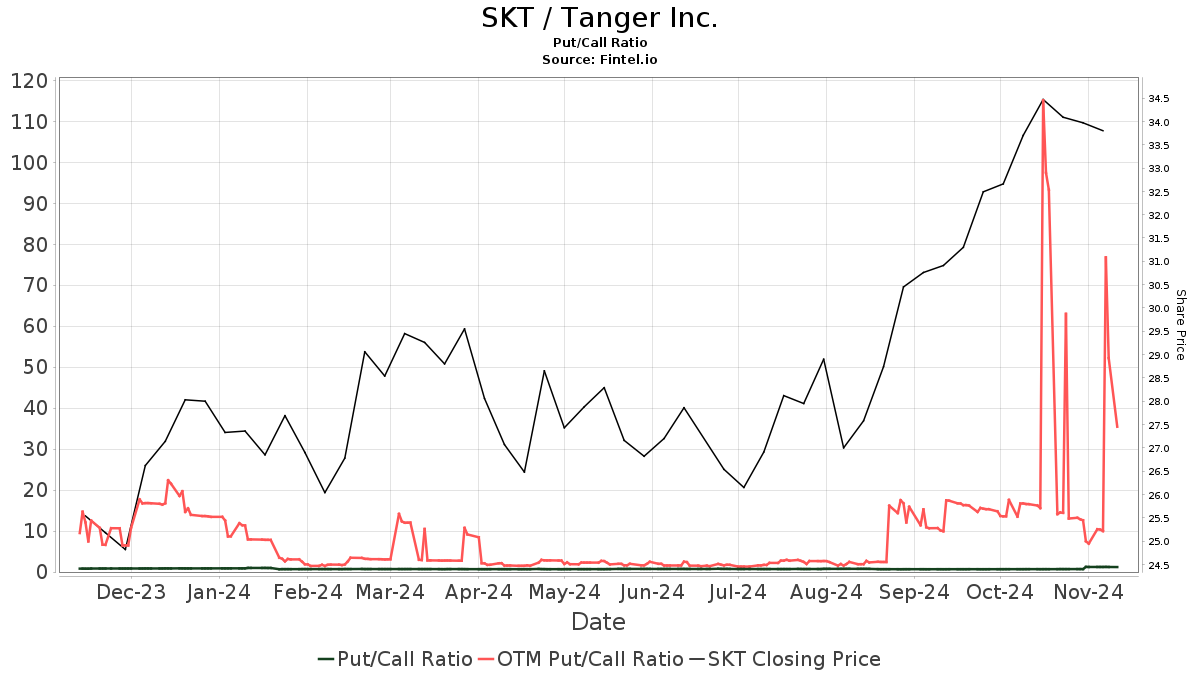

Investor sentiment towards Tanger shows growing interest, with 664 funds or institutions reporting positions in the company—an increase of 3.59% from the previous quarter. The average portfolio weight for all funds dedicated to SKT is now 0.19%, a rise of 1.00%. Over the last three months, total shares owned by institutions have increased by 4.44% to reach 103,212K shares.  Notably, the put/call ratio for SKT is currently 1.21, indicating a bearish outlook.

Notably, the put/call ratio for SKT is currently 1.21, indicating a bearish outlook.

Changes Among Major Shareholders

IJR – iShares Core S&P Small-Cap ETF holds 7,072K shares, accounting for 6.39% ownership of the company, down from 7,298K shares—a decrease of 3.20%. The firm reduced its allocation in SKT by 7.61% over the last quarter.

VGSIX – Vanguard Real Estate Index Fund Investor Shares owns 4,362K shares, representing 3.94% ownership. This is a slight decrease from 4,396K shares, a drop of 0.78%. The fund has cut its portfolio allocation in SKT by 9.88% in the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has increased its holdings to 3,485K shares (3.15% ownership), up from 3,292K shares, an increase of 5.51%. However, the fund also reduced its portfolio allocation in SKT by 5.51% over the last quarter.

Wellington Management Group LLP holds 2,914K shares, representing 2.63% of the company. This is down from its previous holding of 3,112K shares, a decrease of 6.82%, reflecting a substantial reduction of 87.80% in its portfolio allocation to SKT over the last quarter.

NAESX – Vanguard Small-Cap Index Fund Investor Shares now holds 2,746K shares (2.48% ownership), an increase from 2,635K shares, marking a 4.06% rise. The firm has slightly increased its portfolio allocation in SKT by 0.38% since last quarter.

About Tanger Factory Outlet Centers

(This description is provided by the company.)

Tanger Factory Outlet Centers, Inc. operates upscale open-air outlet centers, owning or having ownership interest in a portfolio of 36 centers across 20 states and Canada. The company, with over 40 years in the outlet industry, manages approximately 13.6 million square feet of retail space leased to over 2,500 stores from more than 500 different brand-name companies. As a publicly-traded REIT, Tanger has established itself as a leader in the outlet market.

Fintel provides one of the most comprehensive investing research platforms tailored for individual investors, traders, and financial advisors.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`