B of A Upgrades Kinder Morgan: Analysts Forecast Minor Price Drop

Fintel reports that on October 11, 2024, B of A Securities upgraded their outlook for Kinder Morgan (LSE:0JR2) from Neutral to Buy.

Analyst Price Target Indicates Potential Decline

As of September 25, 2024, the average one-year price target for Kinder Morgan is 22.72 GBX/share. Predictions range from a low of 19.00 GBX to a high of 25.99 GBX. Notably, the average price target suggests a decline of 4.00% from its most recent closing price of 23.67 GBX/share.

Kinder Morgan’s Financial Growth Projection

The projected annual revenue for Kinder Morgan is 20,324MM, representing a significant increase of 32.94%. Additionally, the projected annual non-GAAP EPS is 1.19.

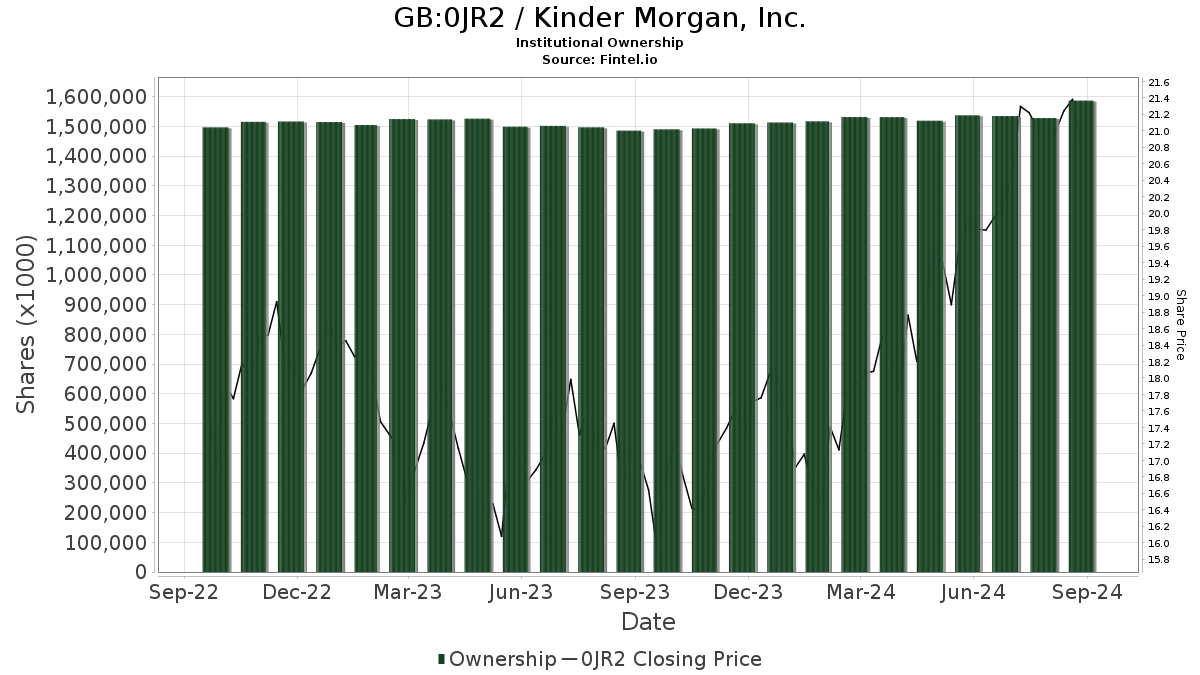

Fund Sentiment Trends

Currently, there are 2,182 funds or institutions reporting positions in Kinder Morgan. This marks an increase of 48 owners, or 2.25%, from the previous quarter. The average portfolio weight of all funds dedicated to 0JR2 stands at 0.42%, which has risen by 4.12%. Over the past three months, total shares owned by institutions have grown by 5.51% to reach 1,588,063K shares.

Institutional Shareholder Activity

Bank of America currently holds 63,408K shares, representing 2.86% ownership of the company. This reflects a decrease from its previous holding of 63,900K shares, a reduction of 0.78%. Moreover, the firm has lowered its portfolio allocation in 0JR2 by 74.80% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has increased its holdings to 59,676K shares, or 2.69% ownership, up from 59,141K shares, marking an increase of 0.90%. The firm has raised its portfolio allocation in 0JR2 by 6.31% over the last quarter.

The Energy Select Sector SPDR Fund (XLE) owns 53,452K shares (2.41% ownership), reflecting an increase from earlier holdings of 46,196K shares, a rise of 13.57%. Their portfolio allocation in 0JR2 has jumped by 31.43% during the past quarter.

Geode Capital Management has increased its shares in Kinder Morgan to 50,845K, representing 2.29% ownership, up from 42,406K shares, an increase of 16.60%. However, this firm decreased its portfolio allocation in 0JR2 by 35.60% in recent months.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 49,558K shares or 2.23% ownership, which is an increase from 48,736K shares, amounting to a growth of 1.66%. They have also raised their portfolio allocation in 0JR2 by 4.29% over the last quarter.

Fintel is a highly regarded investment research platform serving individual investors, traders, financial advisors, and small hedge funds.

The platform provides comprehensive data, including fundamentals, analyst reports, ownership data, fund sentiment, and various trading insights to enhance investment strategies.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.