“`html

Market Volatility: Understanding the Reasons Behind Recent Changes

Here’s why you shouldn’t worry about the recent gyrations…

The market’s wild swings over the past week likely had you reaching for antacids.

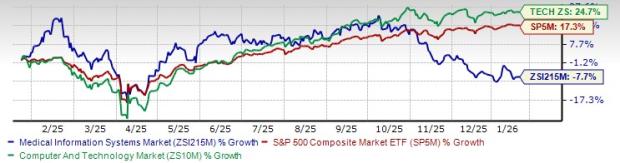

Investors returned from the holiday season optimistic, pushing the S&P 500 up 1.6% during the first three trading days of the year. The NASDAQ performed even better, surging 2.9% in the same period.

However, all major indices have since reversed their early January gains. What could be the cause of this downturn?

One significant factor is rising Treasury yields. Today in Market 360, we’ll explore the bond market dynamics and their impact on yields. I will also discuss why the recent market fluctuations may not be a cause for concern and share two upcoming factors that might lead to another market rally.

Understanding Bond Market Movements

Treasury bond yields have continued to cause anxiety on Wall Street in early trading days of 2025.

Just five weeks ago, the 10-year Treasury yield was at 4.17%. Today, it stands at 4.8%.

This shift is substantial within the bond market.

Concerns are arising that inflation may resurface under a potential Trump 2.0 administration. Market observers—often called “bond vigilantes”—fear that the Biden administration’s heavy spending may lead to inflation, driven by increased deficits and tariffs with the new administration. In response, they have sold off bonds, raising Treasury yields. In this sense, the bond vigilantes are trying to send a message to the market.

Bond vigilantes are investors who sell bonds in protest against government spending. This action increases interest rates, making borrowing more expensive. Their goal is to flag concerns about excessive spending, inflation, and accumulating debt.

I personally believe the bond vigilantes may be mistaken in their predictions.

Additionally, the recent jobs report did not sit well with them. The Labor Department announced on Friday that 256,000 jobs were created in December, exceeding economists’ expectations of 165,000. The unemployment rate also fell to 4.1% in December, down from 4.2% in November. Overall, two million jobs were added throughout 2024.

While the December jobs report is optimistic, it also raises concerns that the Federal Reserve may slow down key interest rate cuts. Following the jobs report, bond yields increased, contributing to stock declines.

The Road Ahead

While discussions about bonds may seem tedious, they are crucial. James Carville, a well-known political strategist, once highlighted the influence of the bond market by stating:

I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.

This illustrates the power the bond market holds.

Moreover, the U.S. dollar has strengthened since the year’s start. A stronger dollar tends to lower inflation for imported goods. As inflation eases, Treasury yields could decline, especially if central banks worldwide continue lowering interest rates to bolster weaker currencies and stimulate growth.

I anticipate the Federal Reserve may follow this trend, despite a strong dollar and economy. Recently, Fed Governor Christopher Waller expressed optimism about inflation nearing the Fed’s 2% target and supported additional rate cuts this year, emphasizing that decisions will depend on economic data.

Further clarity on inflation should come soon. This morning’s Producer Price Index (PPI) indicated that wholesale inflation eased in December. Tomorrow’s Consumer Price Index (CPI) is expected to show similar cooling, with projections of flat month-on-month inflation at 0.3% and an annual rise to 2.9% from 2.7%. Core CPI is anticipated to remain steady at 3.3%. I will cover these reports in depth later this week.

Preparing for the Coming Rally

The recent market turbulence can be unsettling. However, this environment favors savvy stock-picking, as shares with robust fundamentals—such as strong earnings, sales momentum, and positive analyst outlooks—are likely to stand out.

The fourth-quarter earnings season begins tomorrow with reports from major banks.

FactSet projects that S&P 500 earnings will show an average growth of 11.9% in the fourth quarter, with growth accelerating throughout 2025. Quarterly earnings growth is expected to be 11.9%, 11.6%, 15.2%, and 16.6% this year, respectively. Year-over-year earnings for 2025 are forecast to leap by 14.8%, a significant increase from the 9.5% estimate for 2024.

I predict that better-than-expected earning reports will boost my Growth Investor stocks in the coming weeks, supported by strong earnings and sales growth.

My Growth Investor stock list shows an impressive average annual earnings growth of 515.9% and average annual sales growth of 23.6%. In the third quarter, these stocks had a remarkable earnings surprise average of 21%. With continued upward revisions in analysts’ earnings estimates, I am optimistic about upcoming earnings surprises.

Beyond earnings, I also see potential positive market influences from Donald Trump. I anticipate that upon taking office on January 20, Trump will quickly enact several executive orders within his first 100 days, which I believe will spark a “Trump’s 100-Day Melt-Up.”

Now is the time to consider your positioning. I have identified several companies that are likely to thrive in this environment.

I’ve compiled all the details in a new special presentation.

In this presentation, you’ll discover:

- My top pick for a manufacturing renaissance under Trump 2.0.

- A little-known company that’s contributing to the next generation of AI development through data centers.

- An energy investment poised for growth focused on increased drilling activities.

“`

Exploring the Financial Benefits of Trump’s Bitcoin Policies

How Bitcoin and Emerging Stocks Could Thrive Together

As the AI revolution continues to gain momentum, significant changes in financial policies could play a crucial role. Former President Donald Trump’s approach to Bitcoin may prove beneficial for certain under-the-radar stocks, enabling extraordinary growth opportunities.

It’s important to consider the potential impact of Trump’s pro-Bitcoin stance. Investors should pay close attention, as it could lead to a surge in stock prices that many might underestimate. A small, lesser-known stock might become a major player in this evolving market.

For further information on how to capitalize on these trends and seize the 100-Day Trump Melt-Up, click here.

Best regards,

Louis Navellier

Editor, Market 360