NurPhoto/NurPhoto via Getty Images

Jefferies caught the eye of investors last week when it highlighted the often-overlooked beneficiaries of the burgeoning weight loss drug market following Novo Nordisk’s parent company’s decision to acquire the U.S. contract manufacturer Catalent. This strategic move is aimed at bolstering the Danish drugmaker’s presence in the obesity drug business.

Upon the completion of the $11.6 billion Catalent acquisition later this year, Novo, renowned for its diabetes and weight loss medications Ozempic and Wegovy, is poised to gain control of three CTLT fill-finish sites from its parent, Novo Holdings.

Thermo Fisher and its Swiss counterpart Lonza, alongside Catalent, are major players in the fill and finish segment of the weight loss drug market, where Novo and its U.S. rival Eli Lilly dominate with their GLP-1 drugs.

Pfizer and Amgen are also among the developers of GLP-1 drugs, seeking to capture a share of the obesity drug market which, according to Morgan Stanley, is forecasted to reach $77 billion by 2030.

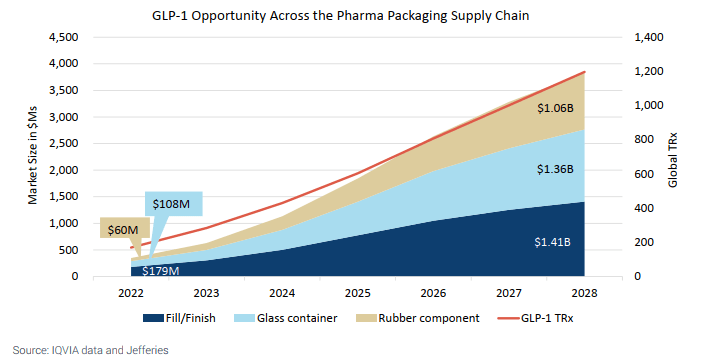

Jefferies predicts that “pick-and-shovel” opportunities in the obesity drug market, including those focused on the fill-and-finish process of manufacturing, will represent a $3.8 billion market by 2028, as GLP-1 prescriptions surge to approximately 1.2 billion from 284 million in 2023.

Jefferies analyst David Windley expressed, “Recent FDA approvals of GLP-1s to treat obesity are dramatically expanding the opportunity for the manufacturing supply chain.”

According to Windley, contract manufacturers such as Thermo Fisher and Catalent will likely lead the fill-and-finish process for GLP-1, as their smaller counterparts struggle to meet the technology and capacity demands of the industry.

He further noted that the injectable fill/finish market is characterized by high competition and slim margins, with tens of players instead of a few, and mentioned Societal CDMO, Rovi, and Pfizer as notable operators in the fill-and-finish manufacturing process.

Moreover, with the newer GLP-1s requiring disposable, pre-filled pens for delivery, Windley underscored the opportunities for key glass and rubber vendors in the GLP-1 market.

The analyst emphasized that the growing number of FDA-approved injectables is another positive factor for the industry.

The increasing demand for cartridges and pre-filled syringes used to administer GLP-1s is driving over double-digit growth for many pharmaceutical-grade glass suppliers, including Becton, Dickinson, Stevanato Group, and Gerresheimer, according to Jefferies.

The GLP-1 glass market is expected to reach about $1.4 billion by 2028, up from $197 million currently, with the firm also raising its price target on Stevanato. Despite that, the analyst maintained a Hold rating on the Italian firm due to softness in demand for some of its products unrelated to GLP-1s.

Jefferies estimated that the market for rubber components tied to GLP-1 drug delivery could grow from $130 million in 2023 to about $1.1 billion by 2028, mainly benefitting West Pharmaceutical, which claims over 90% exposure to the segment.

Dätwyler and AptarGroup are other operators in this space. However, West dominates both, as Windley highlighted when he upgraded the Exton, Pennsylvania-based company to a Buy from Hold, raising its price target by as much as 66% to $536 per share.

This upgrade comes as West is set to release its Q4 2023 results this week, with analysts expecting it to report around $3.0 billion for the past year with approximately 5% year-over-year growth. However, the consensus points to an approximately 11% year-over-year revenue increase for the company in 2026.

“GLP-1s will require a global footprint with plenty of capacity. WST has that, and we think neither Aptar nor Datwyler are likely to take meaningful share of GLP-1s at their smaller scale,” Windley wrote.