“`html

The average one-year price target for Booz Allen Hamilton Holding (NYSE:BAH) has been revised to $109.01 per share, down 16.09% from the prior estimate of $129.90 on September 27, 2025. The revised target range from analysts varies from a low of $80.80 to a high of $168.00, indicating a potential increase of 27.40% from the last reported closing price of $85.56.

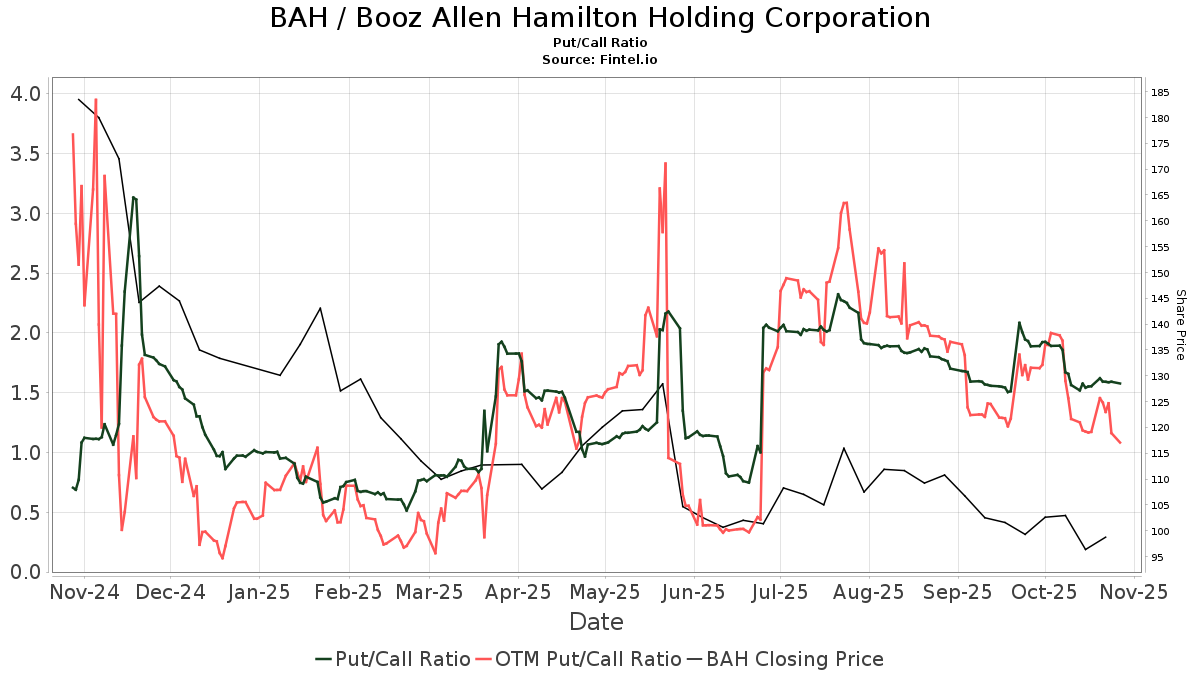

Currently, 1,304 institutional funds hold positions in Booz Allen Hamilton, representing a slight decrease of 0.38% over the last quarter. Total institutional shares increased by 0.26% to 140,784K shares. The put/call ratio for BAH stands at 1.58, suggesting a bearish sentiment among investors.

Significant shareholders include Price T Rowe Associates with 5,600K shares (4.62% ownership, down 25.84%), Vanguard Total Stock Market Index Fund with 3,997K shares (3.30% ownership, down 0.06%), and Eaton Vance Atlanta Capital SMID-Cap Fund with 3,371K shares (2.78% ownership, up 7.18%). Many funds have reduced their portfolio allocations in BAH over the past quarter.

“`