The Case for Investment

BorgWarner (NYSE:BWA) is a pioneering force in the automotive sphere, producing a diverse array of ICE and EV components, solutions, and parts. The company’s sturdy economic moat, rooted in substantial intellectual properties, switching costs, and concrete competitive advantages, sets it apart.

The market has seemingly overlooked a notably favorable Q1-Q3 of FY23, as the company’s shares remain deeply undervalued both by traditional metrics and The Value Corner’s proprietary intrinsic value calculation, presenting an alluring investment opportunity.

BorgWarner’s strategic positioning to capitalize on the burgeoning EV market, bolstered by ongoing innovation and distinctive designs, coupled with a staggering 65% discount in shares, underscores its status as a Strong Buy in my evaluation.

Unveiling BorgWarner’s Background

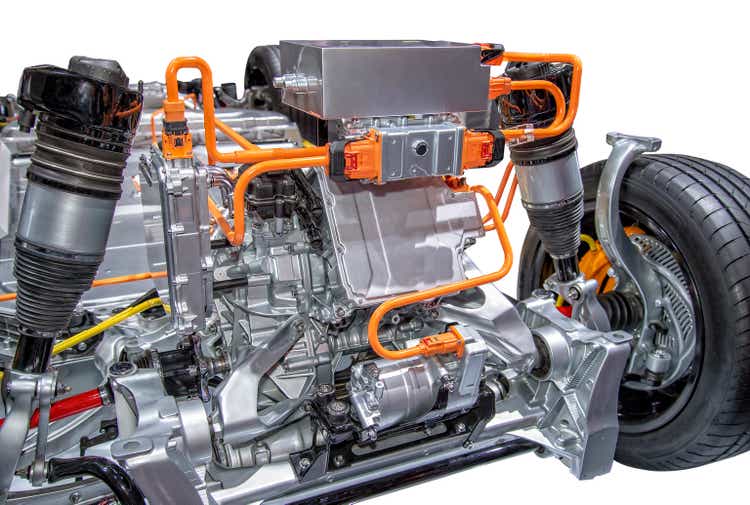

BorgWarner is an automotive industry stalwart, specialized in crafting solutions for ICE, hybrid, and electric vehicles. The company boasts a diverse product portfolio, ranging from traditional combustion turbochargers to cutting-edge eBoosters for electric motors, along with an array of automotive components, including emissions systems, ignition technology, heaters, battery packs, and automotive software.

Amidst the transformative shift from ICE vehicles to HEVs, BEVs, and alternative fuel vehicles, BorgWarner has continually reinvigorated its product range to solidify its foothold in the automotive industry. By venturing into eBoosters and eTurbos and providing essential components for electric vehicles, the company hasn’t just maintained relevance but has also expanded its competitive edge.

As of Q3 FY23, BorgWarner operates across 61 manufacturing locations spanning 19 countries and employs over 38,000 individuals, including 7,500 engineers. The recent spin-off of its Fuel Systems and Aftermarket segment as PHINIA reflects BorgWarner’s commitment to unlocking inherent value.

At the helm of BorgWarner is Frédéric B. Lissalde, who assumed the role of CEO in 2018, leveraging his extensive industry experience and educational background in automotive engineering to steer the company’s growth trajectory.

Delving Into BorgWarner’s Economic Moat

BorgWarner’s dominance in automotive solutions manufacturing and development has fostered a formidable economic moat, fortified by decades of industry knowledge and unwavering innovation. The company’s strategic response to the global push for efficiency and environmental responsibility has been pivotal in maintaining its supplier relationships and relevance with major automakers.

Embracing a forward-looking approach, BorgWarner has tactically acquired businesses to swiftly expand its e-power product lineup. Notable acquisitions, such as Eldor Corporation’s Electric Hybrid Systems Business and Hubei Surpass Sun Electric Charging business, underscore the company’s commitment to positioning itself as a linchpin in the EV automotive landscape.

Underpinning its transformation is the Charging Forward 2027 strategic initiative, emblematic of BorgWarner’s concerted efforts to curtail ICE-related manufacturing while exponentially ramping up its offerings of electric power-oriented products to automakers.

BorgWarner’s robust investment in electric vehicle technologies and its comprehensive portfolio of EV-related solutions underscore its resolve to not only stay relevant but to thrive in the evolving automotive terrain, cementing its status as an indispensable industry player.

In sum, BorgWarner’s industry prowess engenders a substantial economic moat, as the capital and time required for competitors to match its R&D and innovation outlays would be exorbitant. Additionally, the company’s long-term supplier contracts with automotive OEMs further buttress its moatiness, ensuring sustained revenues and production volumes.

Unlocking BorgWarner’s Moat and Financial Prosperity

Preserving Strong Business Relationships

In the automotive industry, BorgWarner (BW) triumphs as a steadfast supplier, benefitting from substantial switching costs that bind original equipment manufacturers (OEMs) to their services. The expense and complexity of transitioning to alternate suppliers result in a considerable barrier for OEMs, compelling them to stick with BorgWarner for engine and drivetrain components. Furthermore, the firm thrives on enduring affiliations as OEMs often integrate existing designs (incorporating BorgWarner’s components) when engineering new engines or drivetrains.

These symbiotic ties and substantial switching costs foster a formidable economic moat for BorgWarner, substantially diminishing the likelihood of customers gravitating toward emerging component manufacturers.

Financial Fortitude and Steady Performance

From a financial standpoint, BorgWarner exhibits commendable profitability and operational success. With an average return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC) of 5.63%, 13.31%, and 8.99% respectively over the last five years, the company surpasses inflation with its returns on equity and invested capital.

Despite a shift in market dynamics, driven by the growing demand for electric vehicles, BorgWarner sustains robust profits, reaffirming its adeptness in meeting OEM demands for automotive products.

Moreover, BorgWarner’s weighted average cost of capital (WACC) stands at around 7.07%, underscoring the company’s capacity to yield higher returns on investments compared to the cost of capital procurement.

When juxtaposed with industry counterparts like Magna International and Vitesco Technologies, BorgWarner outshines with ROA, ROE, and ROIC figures approximately 5-9 percentage points higher.

Triumphant Q3 Performance and Strategic Acumen

Entering Q3, BorgWarner flourishes, evident in its 12.5% surge in net sales driven by amplified demand for “e”-related products in North America, Europe, and China.

Noteworthy triumphs include securing contracts with prominent North American, European, and Asian OEMs for the provision of diverse electric vehicle solutions, signifying substantial milestones for the company.

Furthermore, the company navigates adeptly as it sustains stable profitability amidst a seismic market shift, reflected in a 7.4% rise in gross profits, propelled by unparalleled cost control measures.

The firm’s strategic prowess is highlighted by astute management, maintaining unyielding profitability while expanding the range of EV offerings.

Geographical Diversification and Forward-Thinking R&D

Geographically, BorgWarner showcases formidable revenue diversification, with North America, Europe, and Asia contributing evenly to the firm’s income. This robust distribution insulates the company from localized economic downturns and bolsters its resilience against geopolitical turbulence.

Despite increased expenses in electric vehicle research and development, totaling $10 million in 2023, BorgWarner steadfastly believes in the indispensability of these investments for achieving its strategic goals as encapsulated in Charging Forward 2027, marking the company’s foresight and determination to stay ahead in the automotive industry.

In conclusion, with a “B+” profitability rating from Seeking Alpha’s Quant, BorgWarner continues to demonstrate its financial prowess and resilience, positioning itself as a stalwart force in the automotive sector.

BorgWarner’s Financial Health and Valuation Analysis

BorgWarner (BW) is facing headwinds due to a highly inflationary macroeconomic environment, which has impacted its gross profit margin, net income margin, and return on assets, compared to their 5-year averages. Nevertheless, the company’s long-term contracts bring stability to their revenue stream, and the significant development of electric vehicle-oriented products is expected to sustain the firm’s competitiveness over the next 15 years.

Balancing the Books

When assessing BW’s balance sheet, it is evident that the firm is adept at capital allocation, showcasing conservative financial management despite its acquisitive tendency. With $5.9B in total current assets and only $3.57B in total current liabilities, BorgWarner exhibits robust short-term liquidity, yielding an excellent quick ratio of 1.21x and a current ratio of 1.65x.

This strong liquidity position stands out notably when compared to competitors like Magna and Vitesco, reflecting favorably on BorgWarner’s financial discipline and resilience in the face of economic challenges.

With total assets amounting to $14.1B and total liabilities at just $8.1B, the firm maintains a healthy debt/equity ratio of 0.67x and a financial leverage ratio of 2.35x for FY22, indicating a prudent and balanced approach to its capital structure.

Debts and Dividends

BorgWarner concluded Q3 FY23 with $3.67B in long-term debt, posing a manageable debt profile primarily made up of fixed-rate notes, reflecting management’s cautious strategy towards growth. However, the burden of a small yet high-interest rate loan on the company’s balance sheet remains a concern for discerning investors.

Despite the apprehension around high-interest loans, the low rates on other maturities signal the company’s thoughtful financial planning in acquiring new businesses, underscoring management’s commitment to conservative capital allocation.

The recent spree of acquisitions in the electric vehicle (EV) segment has led to a substantial increase in intangibles, with $2.94B worth of goodwill on the balance sheet. However, the company’s emphasis on acquiring intellectual property within these deals augurs well for the accuracy of the goodwill representation, assuaging concerns over its inflated value.

Credit and Confidence

Moody’s affirmation of a Baa1 credit rating for BorgWarner’s senior unsecured domestic notes, along with a P-2 rating for the firm’s domestic commercial paper, underscores the company’s stable financial position and instills confidence in its creditworthiness. While Moody’s classifies “Baa1” as being within the “speculative grade”, the stable outlook reflects a certain degree of confidence in BorgWarner’s financial stability.

Investor Perspective

To sweeten the deal for investors, BorgWarner offers an attractive dividend, reinforcing management’s commitment to rewarding shareholders. Notably, the company has maintained a consistent dividend payout for 9 years, with a dividend yield FWD of 1.28% and an annual payout FWD of $0.44, setting an encouraging precedent for income-oriented investors.

While the potential impact of an economic downturn on BorgWarner’s dividend remains a consideration, the fundamental desire of the management to reward shareholders is a reassuring aspect for long-term investors.

Investors eagerly await the Q4 earnings report for insights into FY24 expectations and further data on BorgWarner’s progress in executing their Charging Forward business plan, which is pivotal for assessing the company’s trajectory.

Assessing Valuation

BorgWarner’s valuation metrics present a compelling case for investors, with the company trading at highly attractive levels relative to historical averages. The firm’s P/E ratio, P/CF ratio, EV/EBITDA, and Price/Sales ratio reflect the deeply undervalued nature of BorgWarner’s shares.

Moreover, the significant discount in current share prices compared to previous valuations, along with underperformance against the S&P500 index, further emphasize the distressed state of BorgWarner’s valuation and present an enticing opportunity for value-oriented investors.

Unlocking BorgWarner’s Hidden Value: A Deep Dive Analysis

BorgWarner, a well-established automotive parts and solutions supplier, is currently trading at a significant discount, presenting investors with an enticing opportunity. At the current share price of $34.30, an estimated 2023 EPS of $3.78, and a realistic “r” value of 0.08, the calculated intrinsic value sets the stock at $77.20, marking a substantial 56% undervaluation.

Even in a more pessimistic scenario with a conservative CAGR value for “r” at 0.03, the stock still shows a 25% undervaluation at approximately $45.70. This compelling valuation suggests that BorgWarner is currently in deep-value territory, presenting an attractive proposition for investors.

Road Ahead: Long-term Growth

In the long term (2-10 years), BorgWarner is poised to reinforce its position as a pivotal automotive components supplier, propelled by its holistic Charging Forward strategic initiative. As the company expands into the EV market, it is expected to capitalize on substantial growth opportunities and garner a larger market share. With a firm focus on research and development, BorgWarner aims to gain a competitive edge, solidifying its foothold in the evolving industry.

Challenges on the Horizon

However, BorgWarner faces challenges stemming from the cyclical nature of the automotive sector and the resultant fluctuating demand for automotive parts. Despite the industry standard of suppliers reducing contract prices over time, BorgWarner is working diligently to streamline its production processes to mitigate the impact on margins and returns. The company’s pricing power in the EV market hinges on sustained R&D investment, as any lapse could allow competitors to gain an advantage in this rapidly evolving landscape.

ESG Commitment

From an environmental, societal, and governance (ESG) perspective, BorgWarner demonstrates a strong commitment to driving the transition towards a cleaner and less carbon-dependent future. With initiatives to maintain gender pay equity and foster diversity in its workforce, the company is aligned with sustainability goals and regulatory compliance, making it an attractive choice for ESG-conscious investors.

Striking Undervaluation

Despite the robust performance and growth prospects, BorgWarner’s share prices have remained stagnant, reflecting a substantial 56% undervaluation. Even under a more conservative analysis, the stock presents a healthy 25% undervaluation, offering a considerable margin of safety for value-oriented investors.

In conclusion, BorgWarner stands as a compelling deep-value investment, signaling a strong buy recommendation. The company’s comprehensive strategic initiatives and the favorable valuation make it akin to a real fat-pitch idea for discerning investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.