Brace yourselves for some financial news! On February 20, 2024, Brady Corporation revealed to the investing world that its board of directors has decided to declare a steady quarterly dividend of $0.24 per share, which translates to $0.94 annually. This dividend figure remains unchanged from the previous quarter.

To partake in this dividend, investors must purchase shares before the ex-dividend date of April 8, 2024. Holders of record as of April 9, 2024, will be gleefully savoring the dividend payment on April 30, 2024.

Delectable Dividend Yields:

As of today, with the current share price standing tall at $57.46 per share, the stock’s dividend yield comes in at a respectable 1.64%. Now, let’s paint a broader picture. Delving into the past five years and sampling weekly, the average dividend yield has clocked in at 1.79%. This yield can be mercurial, ranging from a modest 1.48% to a whopping 2.33%. If we take a statistical magnifying glass to this, the standard deviation of yields stands at a sprightly 0.18 based on a sample size of 234. Interestingly, the current dividend yield finds itself languishing at 0.87 standard deviations below its historical average, sparking curiosity among keen investors.

On top of these tantalizing numbers, the company also proudly displays a dividend payout ratio of 0.24. This ratio is instrumental in revealing how much of a company’s earnings are deduced for dividends. A ratio of one (1.0) suggests a company distributing all its earnings as dividends, while anything above one indicates a dipping dive into savings to sustain dividends – a cautionary tale for investors. Companies with slow growth prospects often pour out a substantial chunk of income as dividends, landing their payout ratio between 0.5 and 1.0. Conversely, companies with glowing growth potential tend to squirrel away earnings for investment, leading to a payout ratio of zero to 0.5.

Inspectors nod approvingly at Brady’s 3-Year dividend growth rate of 0.07%, signifying a gradual upward trend in dividend payouts. It seems the roots of growth are steadily deepening within Brady Corporation’s financial orchard.

What’s Brewing in the Fund World?

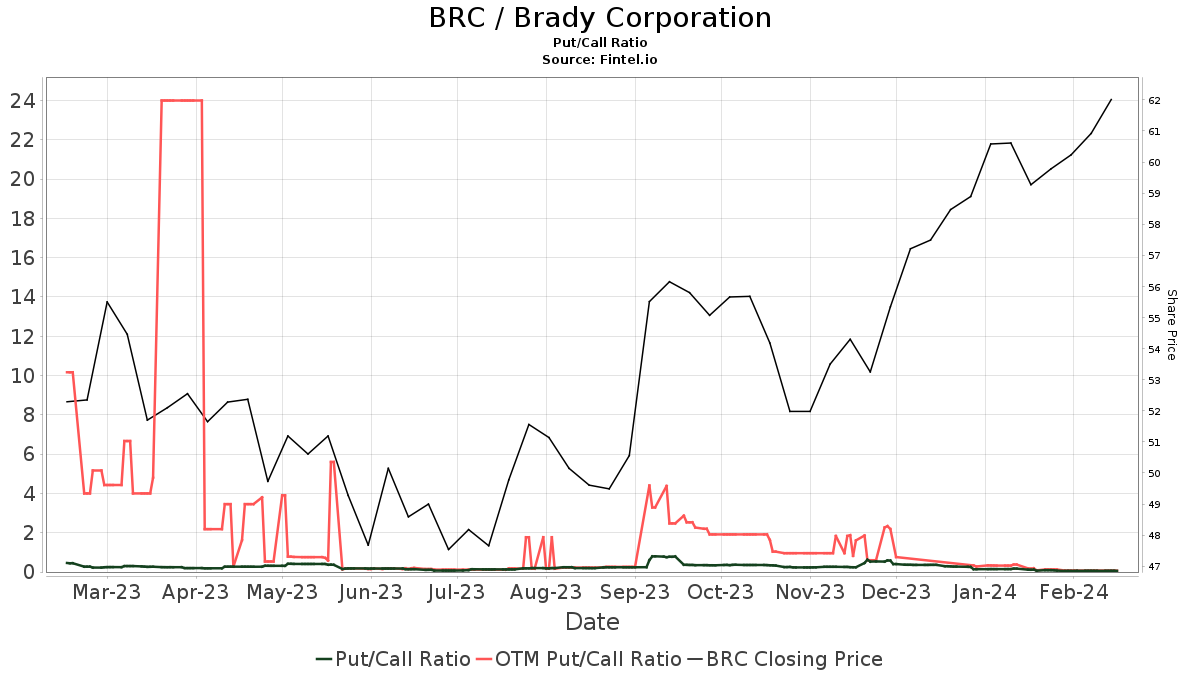

In the realm of funds and institutions, there are 479 parties brandishing positions in the esteemed Brady. This crowd has undergone a slight thinning, losing 19 shareholders or a 3.82% decrease in the previous quarter. On average, the combined portfolio weight dedicated to the Brady Corporation registers at a nutritious 0.18%, witnessing a plump 4.08% uptick. The grand total of shares clasped by these institutions has ebbed by 0.52% in the last three months, settling at a cozy 42,582K shares.  The put/call ratio of Brady Corporation stands at 0.06, resonating a rather bullish sentiment in the air.

The put/call ratio of Brady Corporation stands at 0.06, resonating a rather bullish sentiment in the air.

Forecasting Analysts Predict 23.08% Upswing

Fast forward to February 24, 2024, and we stumble upon a telling tale of price predictions swirling around Brady. The collective crystal ball hints at an average one-year price target of $70.72. This forecast enchants us with a spectrum of possibilities, oscillating between a modest low of $65.65 to a dizzying high of $76.65. The average price target offers a sumptuous 23.08% growth from Brady’s most recent closing price of $57.46.

Dive deeper into prognostications by perusing projected annual revenue for Brady, bobbing along at 1,345MM, marking a fresh 0.55% surge. Harmonizing with this tune, the anticipated annual non-GAAP EPS whispers sweetly at 3.84.

Insights into Shareholder Moves:

IJR – iShares Core S&P Small-Cap ETF has a strong grip on 2,999K Brady shares, translating to a tasteful 6.20% ownership slice of the company’s delicious pie. In a recent reveal, the firm disclosed a slight shedding of shares, down by 3.40%. The portfolio dance moves from IJR underscore a striking 10.62% decrease in Brady allocation over the last quarter.

Tiptoeing to the next player, we catch T. Rowe Price Investment Management carefully holding 1,693K shares, cozying up to a 3.50% slice of the ownership pie. But in a puzzling twist, the previous filing showed a 14.47% trimming of their Brady bushel. The strategic shuffle results in a 14.13% portfolio pivot away from Brady in the last quarter.

Navigating our shareholder seas, we encounter VTSMX – Vanguard Total Stock Market Index Fund Investor Shares, waltzing with 1,360K shares equivalent to a dainty 2.81% share cherry-picked from Brady’s bountiful basket. A pleasant revelation unfolds as the previous filing ticked up by a mere 0.03%, hinting at a 19.87% increase in VTSMX’s commitment to Brady over the last quarter.

Amidst this shareholder soiree, Janus Henderson Group emerges with 1,279K Brady shares firmly in its grasp, aligning with a poised 2.65% ownership stake in the company’s ensemble. However, a note of discord whispers of a 10.15% reduction in siblinghood with Brady, halting a significant 71.07% portfolio shift away from Brady over the last quarter.

Amidst the ebb and flow of ownership stories, Van Berkom & Associates showcases a polished dance with 1,241K Brady shares, tucked away within a 2.57% ownership crevice. In a minor tune, the previous filing whispered of a mere 0.88% shedding of their Brady treasure chest. The quiet rhythm resonates with a serene 5.26% adjustment in favor of stepping back from Brady in the recent quarter.

Peeking Behind Brady’s Curtain

(This tale was spun by the very company.)

Brady Corporation is a multinational luminary in the realm of manufacturer and marketing, offering a bouquet of solutions to identify and safeguard people, products, and places. Illuminating the path to enhanced safety, security, productivity, and performance, Brady’s repertoire boasts high-performance labels, signs, safety apparatus, printing systems, and software. With roots planted deep in 1914, the Company boasts a diverse patronage across electronics, telecommunications, manufacturing, electrical, construction, medical, aerospace, and a plethora of other industries. Nestled in the confines of Milwaukee, Wisconsin, Brady paints its canvas global, with approximately 5,400 skilled artisans employed in their endeavors worldwide as of July 31, 2020. The melodic notes of Brady’s fiscal 2020 sales create a harmonious tune, amounting to approximately $1.08 billion.

For further enlightenment:

As you delve into the realms of investing jungle, Fintel stands as a lighthouse guiding individual investors, traders, financial advisors, and small hedge funds on their financial odysseys.

Our galaxy spans the globe, encompassing the essential fabric of fundamentals, analyst reports, ownership narratives, fund sentiments, options sentiment, insider revelations, options flow, unusual trades, and a treasure trove of riches. Echoing through this symphony are our exclusive stock recommendations, powered by meticulous, backtested quantitative models for a journey towards amplified profits.

Click to Sip More Wisdom

This chronicle first graced Fintel’s halls, resonating with the echoes of financial wisdom.

As the curtains rise on this financial drama, it’s important to remember these are the sounds of the author’s viewpoint, not necessarily reflective of Nasdaq, Inc.