Analysts Predict Strong Upside for WisdomTree U.S. Quality Dividend Growth Fund ETF

We analyzed the holdings of various ETFs covered by ETF Channel and compared their current trading prices to the average 12-month target prices set by analysts. For the WisdomTree U.S. Quality Dividend Growth Fund ETF (Symbol: DGRW), the implied target price is $93.80 per unit.

Current Trading Position and Potential Gains

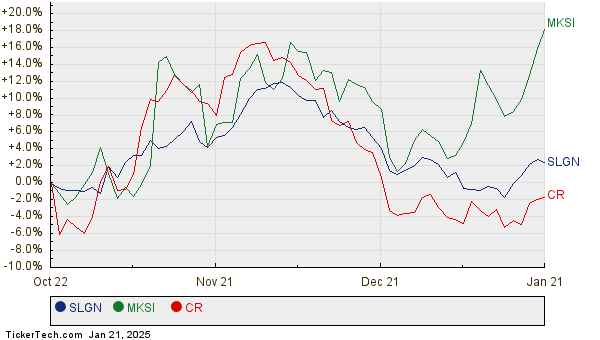

Currently, DGRW trades at approximately $82.44 per unit, suggesting a potential upside of 13.78% according to analyst targets. Several underlying stocks within DGRW show particularly significant upside potential. Silgan Holdings Inc (Symbol: SLGN) is trading at $52.61, with an average analyst target of $61.60, indicating a 17.09% increase. MKS Instruments Inc (Symbol: MKSI) is priced at $120.11, positioned for a 15.94% rise to a target of $139.25. Crane Co (Symbol: CR), currently at $156.00, has an analyst target of $180.60, representing a 15.77% upside. Below is a chart detailing the price movements of these three holdings over the past year:

Summary of Analyst Predictions

The following table summarizes the current analyst target prices for these holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. Quality Dividend Growth Fund ETF | DGRW | $82.44 | $93.80 | 13.78% |

| Silgan Holdings Inc | SLGN | $52.61 | $61.60 | 17.09% |

| MKS Instruments Inc | MKSI | $120.11 | $139.25 | 15.94% |

| Crane Co | CR | $156.00 | $180.60 | 15.77% |

Understanding Analyst Target Prices

Are analysts being realistic with these predictions? With a high target relative to the stock’s current price, there could be optimism about future performances, yet this can also lead to potential downgrades if targets are based on outdated information. Investors are urged to conduct further research to ascertain the validity of these predictions in light of recent developments in the industry and individual companies.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Cheap Dividend Stocks

• Institutional Holders of TSIB

• AA Market Cap History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.