Analysts Predict 13.88% Upside for Invesco EQWL ETF

We analyzed the underlying holdings of exchange-traded funds (ETFs) in our coverage at ETF Channel. By comparing the trading price of each holding with the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the ETF. For the Invesco S&P 100 Equal Weight ETF (Symbol: EQWL), the implied target price based on its underlying holdings stands at $115.86 per unit.

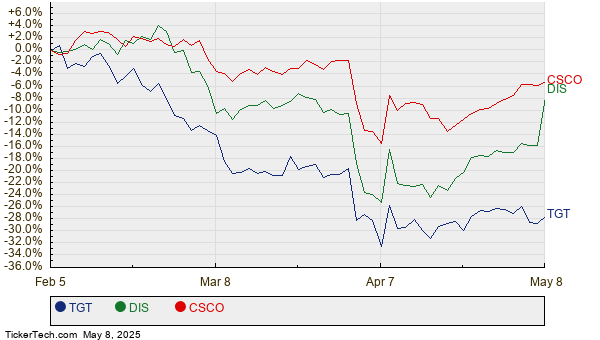

Currently, EQWL is trading at approximately $101.74 per unit. This indicates an expected upside of 13.88% according to analysts, based on their target prices for the ETF’s holdings. Notably, three of EQWL’s underlying stocks show significant potential for growth relative to their analyst targets: Target Corp (Symbol: TGT), Walt Disney Co. (Symbol: DIS), and Cisco Systems Inc. (Symbol: CSCO). For instance, TGT is trading at $95.49 per share, but its average analyst target is $131.47, representing a 37.68% upside. Similarly, DIS has a recent price of $102.09, with an average target of $124.42—indicating 21.88% upside. Analysts expect CSCO to rise from its current price of $59.57 to a target of $69.67, marking a 16.95% increase.

Below is a twelve-month price history chart comparing the stock performance of TGT, DIS, and CSCO:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 100 Equal Weight ETF | EQWL | $101.74 | $115.86 | 13.88% |

| Target Corp | TGT | $95.49 | $131.47 | 37.68% |

| Walt Disney Co. | DIS | $102.09 | $124.42 | 21.88% |

| Cisco Systems Inc | CSCO | $59.57 | $69.67 | 16.95% |

Are analysts justified in their target prices, or are they too optimistic about potential stock performance over the next year? This raises questions about whether analysts have a valid basis for their projections or if they are responding to outdated company and industry trends. A high target price in comparison to a stock’s trading price may indicate future optimism. However, it could also signal that a price correction is necessary if those targets are inaccurate. Investors should conduct additional research to navigate these challenges.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding ZOM

• Funds Holding TWND

• CVX Dividend Growth Rate

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.