Analysts Predict Bright Future for First Trust US Equity Opportunities ETF

In an analysis of ETFs, the First Trust US Equity Opportunities ETF (Symbol: FPX) shows promising potential, according to current analyst forecasts.

By examining individual holdings within the ETF, we calculated an implied analyst target price for FPX at $131.09 per unit. Currently, FPX is trading at about $119.51 per unit, indicating a potential upside of 9.69% based on average analyst expectations for its underlying stocks.

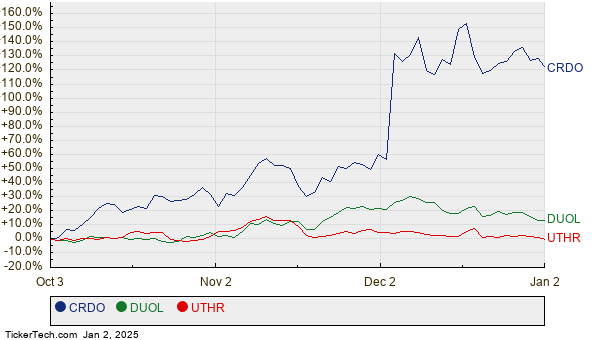

Several holdings stand out with considerable upside potential. For instance, Credo Technology Group Holding Ltd (Symbol: CRDO) currently trades at $67.21 per share, while analysts predict a target of $75.30, suggesting an upside of 12.04%. Similarly, Duolingo Inc (Symbol: DUOL) is priced at $324.23, with a target price of $359.90, reflecting an 11.00% increase. United Therapeutics Corp (Symbol: UTHR) also shows promise, with a target of $391.15 compared to its recent price of $352.84, allowing for a 10.86% increase. Below is a comparative chart displaying the price history of CRDO, DUOL, and UTHR:

The table below summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust US Equity Opportunities ETF | FPX | $119.51 | $131.09 | 9.69% |

| Credo Technology Group Holding Ltd | CRDO | $67.21 | $75.30 | 12.04% |

| Duolingo Inc | DUOL | $324.23 | $359.90 | 11.00% |

| United Therapeutics Corp | UTHR | $352.84 | $391.15 | 10.86% |

Investors might wonder whether analysts are justified in their target outlooks or if they are being overly optimistic. Evaluating stock performance and recent industry developments is essential. High target prices can reflect optimism, but they may also lead to future downgrades if they do not align with the market reality. Investors are encouraged to conduct further research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Stocks with Recent Secondaries That Hedge Funds Are Selling

• CNSI Insider Buying

• Top Ten Hedge Funds Holding WBIN

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.