Vanguard Value ETF Shows Analyst-Driven Potential for Growth

In a recent analysis at ETF Channel, we examined the underlying holdings of various ETFs in our coverage. For the Vanguard Value ETF (Symbol: VTV), the implied analyst target price based on its holdings stands at $189.71 per unit.

Current Value vs. Analyst Projections

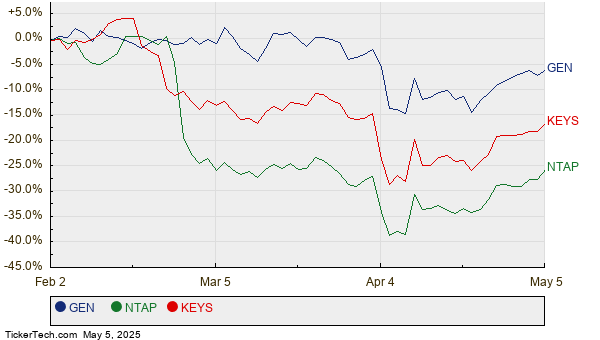

At a recent trading price of approximately $168.55 per unit, VTV indicates a potential upside of 12.55% according to the average analyst targets. Three underlying holdings with significant upside are Gen Digital Inc (Symbol: GEN), NetApp, Inc. (Symbol: NTAP), and Keysight Technologies Inc (Symbol: KEYS).

Individual Stock Analyses

Gen Digital Inc currently trades at $25.93 per share, with an average analyst target of $32.00, representing a 23.41% upside. Meanwhile, NetApp, Inc. is priced at $92.33; if it reaches the average target of $113.13, this reflects a 22.53% potential increase. Keysight Technologies Inc’s current price of $148.52 has a target of $181.40, offering a 22.14% upside as well.

Below is a twelve-month price history chart comparing the stock performance of GEN, NTAP, and KEYS:

Summary of Analyst Targets

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Value ETF | VTV | $168.55 | $189.71 | 12.55% |

| Gen Digital Inc | GEN | $25.93 | $32.00 | 23.41% |

| NetApp, Inc. | NTAP | $92.33 | $113.13 | 22.53% |

| Keysight Technologies Inc | KEYS | $148.52 | $181.40 | 22.14% |

Evaluating Analyst Optimism

Investors may wonder whether analysts are justified in these targets or if they are overly optimistic about future pricing. A high target relative to a stock’s current trading price could signal optimism but may also lead to price target adjustments if expectations were set by past performance. Investors are encouraged to conduct further research to assess these factors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of XBUY

• SAP Videos

• Funds Holding LUCY

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.