Analysts Project Strong Upside for iShares Core S&P U.S. Growth ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs. We compared trading prices with the average analyst 12-month forward target prices, leading to a calculated weighted average implied analyst target price for the iShares Core S&P U.S. Growth ETF (Symbol: IUSG) of $163.66 per unit.

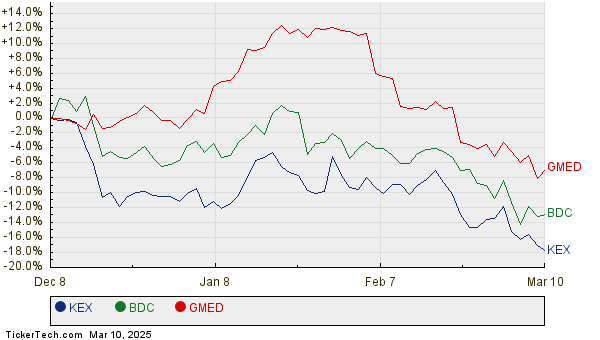

Currently, IUSG trades at approximately $132.34 per unit. This indicates analysts foresee a 23.67% upside for the ETF based on the average analyst targets for its holdings. Notably, three of IUSG’s underlying holdings show significant potential for growth relative to their target prices: Kirby Corp. (Symbol: KEX), Belden Inc. (Symbol: BDC), and Globus Medical Inc. (Symbol: GMED). KEX recently traded at $97.13 per share, while the average analyst target is 39.50% higher at $135.50 per share. BDC shows a 27.50% upside from its recent share price of $104.47, targeting an average of $133.20. Lastly, analysts expect GMED to reach a target price of $98.69 per share, reflecting a 27.49% increase from its recent price of $77.41. Below is a twelve-month price history chart comparing the stock performance of KEX, BDC, and GMED:

Below is a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core S&P U.S. Growth ETF | IUSG | $132.34 | $163.66 | 23.67% |

| Kirby Corp. | KEX | $97.13 | $135.50 | 39.50% |

| Belden Inc. | BDC | $104.47 | $133.20 | 27.50% |

| Globus Medical Inc. | GMED | $77.41 | $98.69 | 27.49% |

The optimism present in these price targets raises several questions. Are analysts justified in predicting these future prices, or are they overly optimistic? Understanding the rationale behind these targets is essential, especially in light of recent company and industry developments. A high target price relative to a stock’s trading price might reveal optimism about future performance but can also signal potential downgrades if the targets reflect outdated expectations. These considerations warrant thorough research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• OCGN Options Chain

• Funds Holding COAL

• AZO 13F Filers

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.