SPDR Portfolio S&P 400 Mid Cap ETF Shows Promising Analyst Targets

ETF Channel recently analyzed various exchange-traded funds (ETFs) and found intriguing insights regarding the SPDR Portfolio S&P 400 Mid Cap ETF (Symbol: SPMD). The average forward target price set by analysts for this ETF stands at $64.27 per unit.

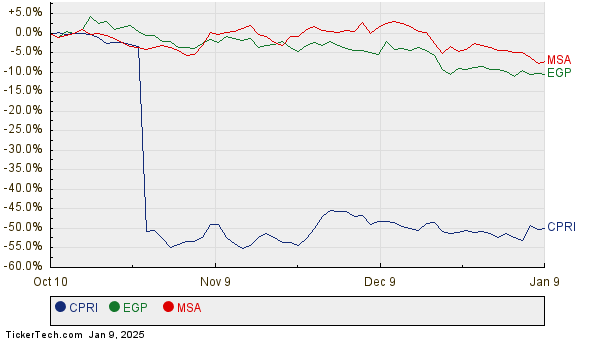

Currently, SPMD is trading at approximately $55.11 per unit, suggesting a potential upside of 16.62%. This potentially favorable outlook is based on the analyst target prices of some of its underlying holdings. Key companies such as Capri Holdings Ltd (Symbol: CPRI), EastGroup Properties Inc (Symbol: EGP), and MSA Safety Inc (Symbol: MSA) show significant upside potential. For instance, CPRI, which recently trades at $21.51 per share, has an average target of $27.50 per share, indicating a 27.85% upside potential. In a similar vein, EGP has a recent price of $158.71, with an analyst target price of $195.89 that represents a potential rise of 23.43%. Meanwhile, analysts project MSA to reach a target of $197.50 per share, which is 22.80% above its recent price of $160.83. Below is a twelve-month performance chart that highlights these stocks:

The following table summarizes the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 400 Mid Cap ETF | SPMD | $55.11 | $64.27 | 16.62% |

| Capri Holdings Ltd | CPRI | $21.51 | $27.50 | 27.85% |

| EastGroup Properties Inc | EGP | $158.71 | $195.89 | 23.43% |

| MSA Safety Inc | MSA | $160.83 | $197.50 | 22.80% |

As investors, it’s essential to consider whether these target prices are justified or if they may be overly optimistic. High targets can sometimes indicate confidence in future growth, but they might also lead to price downgrades if they don’t reflect recent developments in the respective industries. It would be prudent for investors to further research these matters.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Information:

• Affordable Energy Stocks

• SCL’s Next Dividend Date

• Institutional Holders of DIVB

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.