Amazon Surpasses Walmart in Fourth Quarter Retail Sales

Ladies and gentlemen, the retail industry has a new leader: In the fourth quarter of 2024, Amazon (NASDAQ: AMZN) reported net sales of $188 billion. In contrast, Walmart (NYSE: WMT) generated $181 billion, marking the first time Walmart’s revenue fell below that of Amazon.

Despite this shift, Walmart still claims the highest annual revenue for the year. The company reported a year-over-year revenue increase of 5%, bringing its total to $681 billion, while Amazon’s full-year net sales stood at $638 billion.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nevertheless, given Amazon’s current growth rate—which is approximately twice that of Walmart—it appears likely that Amazon could surpass Walmart in annual sales by 2025.

This article will explore how Amazon secured the retail crown and its strategies for maintaining its position in future years.

Key Drivers of Amazon’s Growth

While many associate Amazon primarily with its website sales, it is essential to recognize that substantial growth is occurring beyond this segment.

Firstly, Amazon generates revenue not just from its own sales but also through facilitating third-party sales. In the fourth quarter, this third-party business provided a significant revenue stream of $47 billion, representing a 9% year-over-year increase and helping Amazon surge ahead of Walmart.

Moreover, Amazon’s advertising business is among its fastest-growing sectors. With Q4 advertising revenue reaching $17 billion—a rise of 18%—this area has considerable potential for expansion. The company’s established digital platform has greatly contributed to this growth.

Additionally, the Amazon Web Services (AWS) cloud-computing segment continues to yield impressive financial results. Following a growth rate of just 13% in Q4 of 2023, AWS recorded 19% growth in the latest quarter, generating over $100 billion in revenue for 2024.

All these thriving segments reinforce Amazon’s position in retail, explaining its strong stock performance. Investors can anticipate promising returns as Amazon continues to grow.

Walmart: Still a Player in Retail

Although Walmart may not currently lead the retail sector, investors should not dismiss it. The company remains a robust entity despite being overshadowed by Amazon.

Similar to Amazon, Walmart is expanding its digital-advertising business, which saw a 27% increase to $4.4 billion in revenue during 2024. Its recent acquisition of smart-TV manufacturer Vizio exemplifies Walmart’s strategy to bolster advertising revenue moving forward.

Vizio generates revenue through its smart-TV operating system’s advertising, which aligns well with Walmart’s advertising initiatives and its extensive consumer data. Given the narrow profit margins common in retail, a higher-margin revenue stream from digital advertising could significantly improve overall profitability.

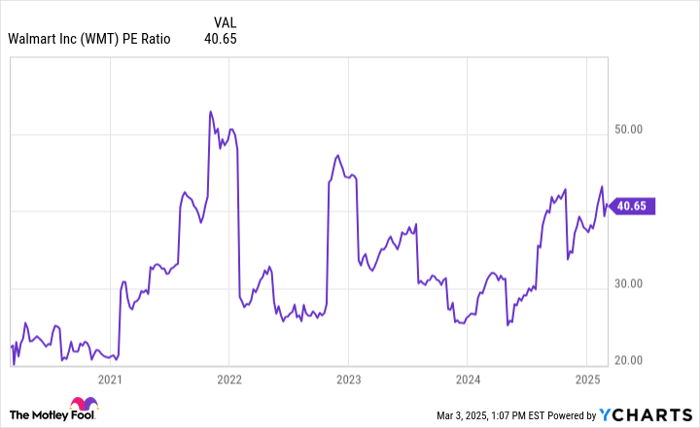

However, investors should note Walmart’s modest outlook for 2025, with management projecting only 4% sales growth and 5% profit growth. This conservative forecast may restrain share price growth, particularly as Walmart’s stock currently trades at a high price-to-earnings (P/E) valuation, as illustrated below.

WMT PE Ratio data by YCharts.

In summary, Walmart Stock may be a viable investment if priced appropriately, but current performance indicates Amazon Stock is the more favorable option. With its superior growth, Amazon has now eclipsed Walmart in scale, and this upward trajectory seems likely to continue, suggesting strong potential for future gains.

Pursue New Investment Opportunities

Have you ever felt you missed out on premier investment opportunities? If so, this could be your chance.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies they believe are on the verge of significant growth. If you feel you’ve missed your investment chance, now is the optimal time to act before you lose out again. The data supports these recommendations:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $304,161!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,694!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $534,395!*

Currently, we are issuing “Double Down” alerts for three remarkable companies that could present lucrative opportunities.

Continue »

*Stock Advisor returns as of March 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.