Brent Oil Prices Fall Amid China’s Economic Concerns

By RoboForex Analytical Department

Brent crude oil prices dropped to 71.74 USD per barrel on Tuesday. This decline stems from disappointing stimulus measures in China. Investors are worried about the country’s economic recovery, as weak inflation and sluggish energy demand contribute to negative market sentiment.

The strength of the US dollar is adding to the pressure on oil prices. A strong dollar makes commodities priced in dollars, like oil, less appealing to investors. However, the geopolitical situation, a typical factor affecting oil price fluctuations, is currently stable. Improved conditions in the Middle East have eased some of the risk premiums that were previously factored into Brent prices.

Investors are now focused on the monthly OPEC report due later today, which should shed light on the current supply-demand situation in the oil market. This report could significantly sway market opinions as they evaluate global oil demand expectations for 2025.

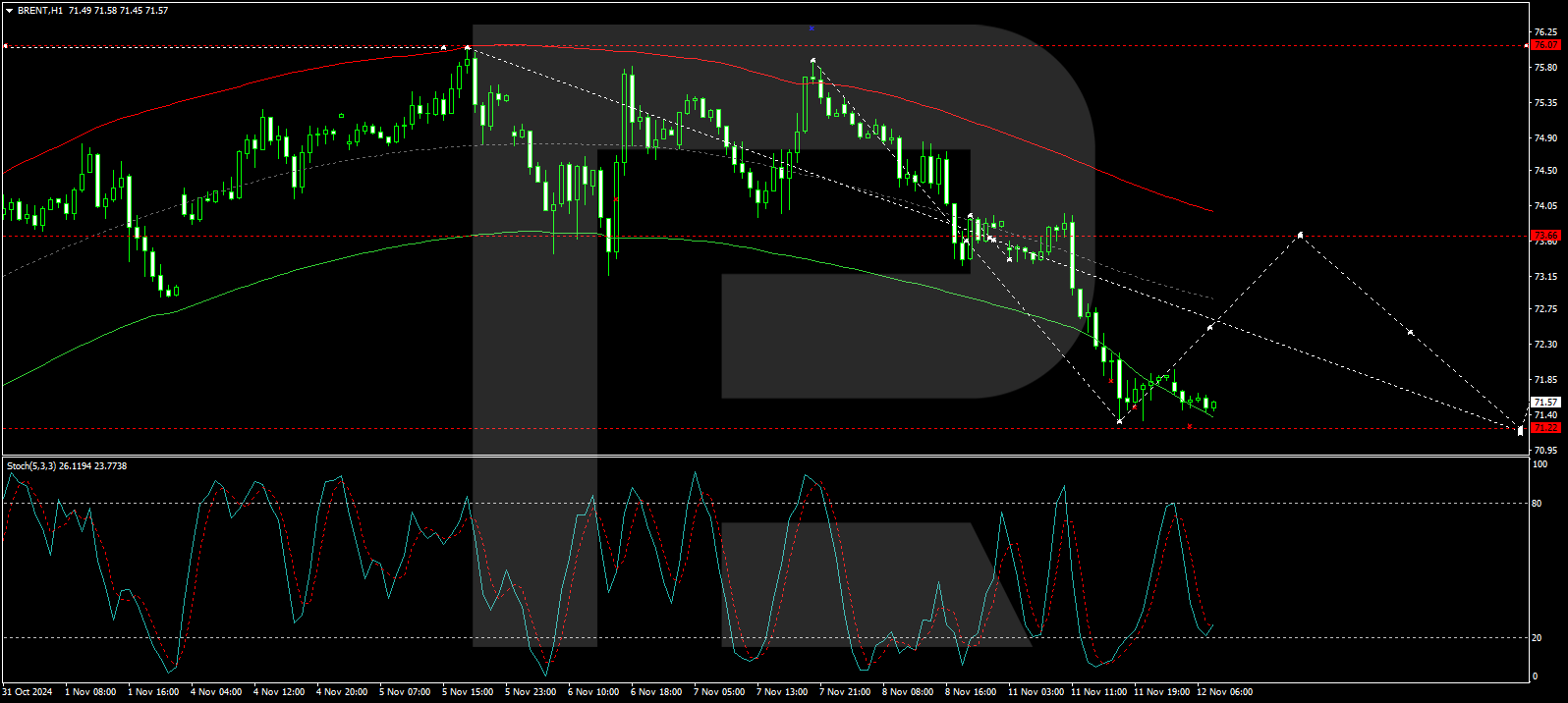

Technical Outlook for Brent

On the four-hour (H4) chart for Brent crude, prices are forming a broad range between 73.66 and 71.33. A potential rise to 73.66 is expected today. After reaching this point, a downward movement to 71.22 could follow. There remains a possibility for a growth wave that could extend to 76.00 and eventually to 80.80. This scenario is supported by the MACD indicator, which shows a downward trend.

On the one-hour (H1) chart, Brent prices have also shown a consolidation range around 73.66 and have moved down to 71.33, which serves as the local target. A corrective rise towards 73.66 could occur today, but another decline to 71.22 is viable afterward. The downward momentum seems to be waning, supported by the Stochastic oscillator, which is pointing downward.

Disclaimer

Any projections in this article are solely the author’s opinion and should not be viewed as trading advice. RoboForex is not liable for any trading outcomes based on the trading recommendations or reviews in this article.

This article is from an unpaid external contributor. It does not reflect Benzinga’s reporting standards and has not been verified for content or accuracy.

Market News and Data brought to you by Benzinga APIs