The Great AI Divide: Strategies Amid Evolving Investment Landscapes

Editor’s Note: The rise of artificial intelligence represents a significant technological shift. This decade may well witness AI as a key driver of innovation, disruption, and generational wealth.

Since early 2022, we have tracked this transformation. Our analysis has included evaluating key players and identifying substantial investment trends within AI. Industry veteran Eric Fry has also emphasized that Artificial General Intelligence (AGI) is accelerating rapidly, which could fundamentally alter sectors ranging from finance to geopolitics.

In this issue, Eric shares insights on how investors can best prepare for this groundbreaking future.

Hello, Reader.

Discussion around technological shifts often brings to mind historical contexts. I once inquired why my grandfather left Illinois for Montana in the early 1900s.

My father explained, “Henry Ford destroyed all the farm jobs.” This forced my grandfather to seek work as a cowboy. While Ford did not personally dismantle farm jobs, his “Fordson Model F” tractor, launched in 1917, certainly changed the landscape.

Became the first mass-produced tractor, the Fordson quickly gained a 70% market share by 1922 and surged to an output of 700,000 units annually by 1928.

Artificial intelligence parallels Ford’s tractor in its potential to generate efficiencies while also displacing jobs. Such sweeping changes are challenging to comprehend and profit from, underscoring the need to “future-proof” our lives.

Moreover, it emphasizes the urgency of focusing on investment opportunities that AI presents.

The AGI Challenge: Navigating Opportunities and Risks

Artificial intelligence is bifurcating commerce into two categories: AI adopters and AI victims. Companies must quickly integrate AI technologies to survive; those that do not face obsolescence as AGI approaches.

Since alerting readers to the impending arrival of AGI last August, I disclosed several companies that I viewed as potential AI winners and losers. My assessments have proven to be accurate.

Today, let’s analyze one notable AI success story and one company that appears vulnerable.

A Toast to Success

Since my last update, Toast Inc. (TOST), a Boston-based firm, has experienced an impressive 80% stock increase.

Toast specializes in AI solutions across various restaurant operations, including online ordering and supply-chain management. The company has been honing its platform since 2011 to meet the unique technological needs of restaurants.

As a result, Toast’s software platform has become indispensable for many, especially for those who use online food delivery services.

Remarkably, Toast has maintained a 119% net revenue retention rate since 2015, indicating that it retains a high percentage of revenue from existing customers.

Essentially, Toast can now leverage one of the largest and most valuable datasets in the restaurant sector, enabling innovative AI applications. Its software provides actionable insights that help restaurants optimize costs and pricing in real time, critical in a competitive industry.

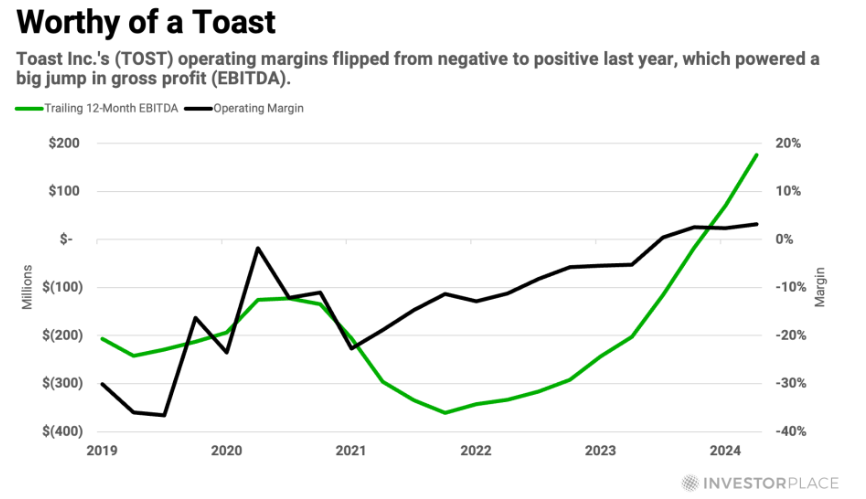

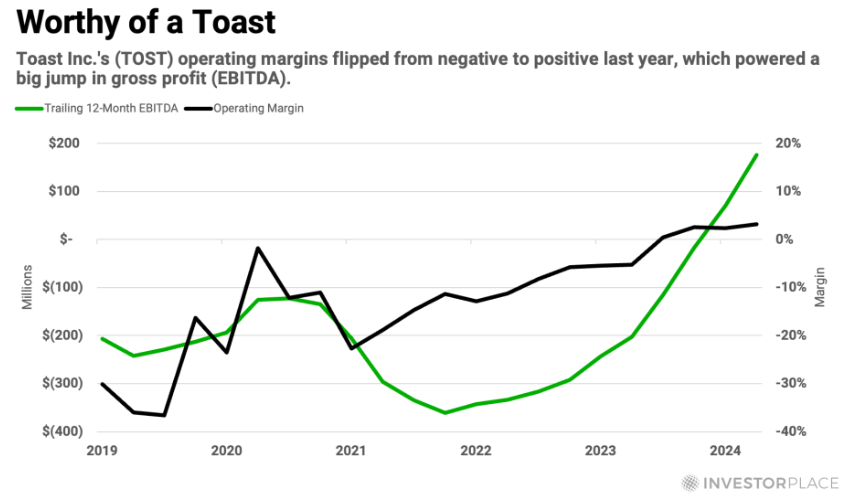

Toast’s operating margins have transitioned from negative to positive over the past nine months, indicating an upward trend in gross profits as well. Last week, the company reported record revenue and EBITDA for the first quarter, exceeding analyst expectations, leading to a 10% stock surge post-announcement.

Toast exemplifies a company that is effectively integrating AI into its operations and positioning itself for future success.

While AI technologies expand across various sectors, the number of successful “AI adopters” will rise, but so will the number of “AI victims.”

Identifying Risks: A Cautionary Tale

Companies that cannot adapt to AI technologies either lack the necessary expertise or have incompatible business models. Holding stocks of such companies poses risks for investors.

One example of a vulnerable company is Shutterstock Inc. (SSTK), which I flagged last August as being in a precarious position due to emerging AI technologies.

Once celebrated for its graphics library, Shutterstock now faces significant competitive threats from new AI tools. As a result, subscriber retention is decreasing, leading to reductions in gross margins and net income.

The company’s EPS was only $1.01 last year, missing expectations of $1.90. This year, EPS estimates have dropped from $3 to $2.10. Consequently, the stock has declined over 40% since I expressed my concerns.

Shutterstock is not alone in these challenges; investors must evaluate all potential investments with an eye on AI-related opportunities and risks.

To assist investors, I have compiled four new research reports focused on AI investments before AGI becomes a reality. Three reports recommend stocks for purchase, while one identifies stocks to steer clear of.

The time to prepare for AGI is limited, prompting me to issue a “Final Warning.” During my upcoming event, I will outline critical sectors to watch and provide essential stock recommendations.

- Insights on precious metals, energy, real estate, and biotech sector investment prospects.

- My top AGI-related stock pick that has already yielded a 46% gain.

- A list of stocks that should be avoided or sold before potential declines.

Investors can access critical insights to navigate these seismic changes and strategize effectively as AI continues to evolve.

The post The Great AI Divide: Position Yourself for a Seismic Power Shift appeared first on InvestorPlace.