Market Beatdown

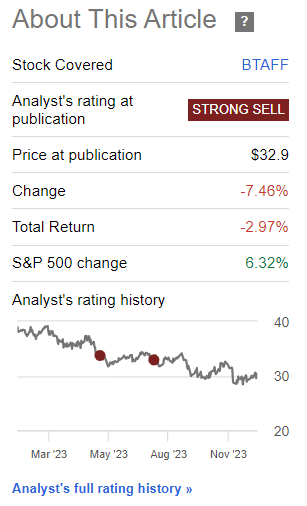

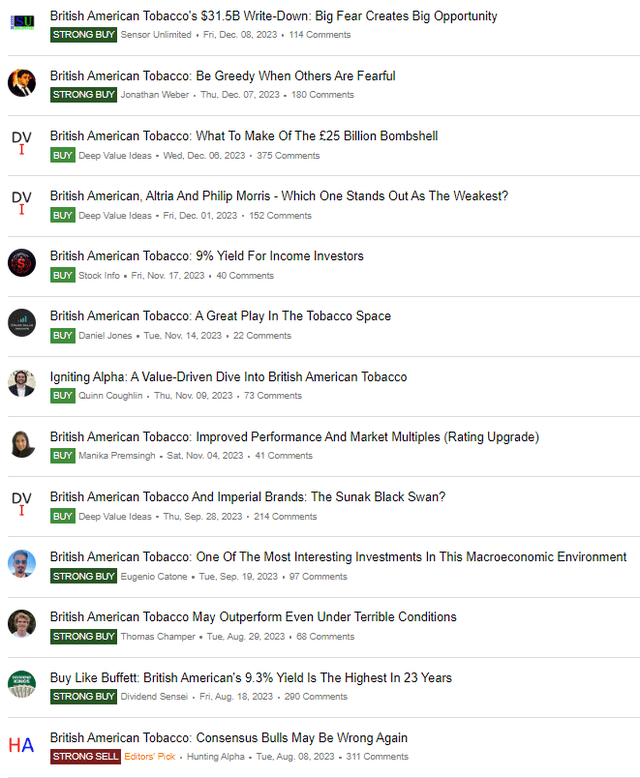

For two consecutive times, the only bear on Seeking Alpha on British American Tobacco (NYSE:BTI) (OTCPK:BTAFF), has issued a ‘Strong Sell’ rating on the stock. The stock has generated -2.97% in total shareholder return compared to the S&P 500 (SPY) (SPX), which has gained +6.32% in the same period. This implies an alpha of +9.29% for the Strong Sell view compared to a long position in the market index.

The results show that this analyst has had the right call yet again as everyone else has been overwhelmingly bullish on the stock.

Revised Stance

After the stock underperformed and fell as expected, the analyst has moderated the bearish bias. Instead of a ‘Strong Sell’, BTI is now declared a ‘Sell’.

The analyst remains bearish due to the ongoing disappointments in the US Combustibles, slow-moving regulatory bodies, and a poor diversification strategy.

Continued Struggles in US Combustibles

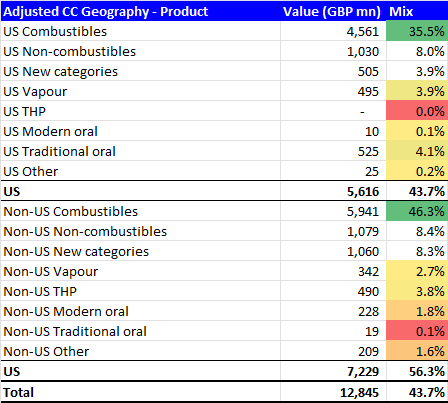

US Combustibles make up almost 36% of the overall revenue mix. In the H2 FY23 Pre-Close update, the company took a £25 billion ($31.5 billion) impairment charge on acquired US combustible brands as they cut down the useful life assumptions on these assets.

“Mainly relates to some of our acquired U.S. combustibles brands, as we now assess their carrying value and useful economic lives over an estimated period of 30 years.” – CEO Tadeu Marroco in the H2 FY23 Pre-Close Concall

Following this was a revenue guidance update pointing towards the lower end of the previous range.

“Due to the continued weakness of U.S. combustibles, we now expect to deliver group organic revenue growth at the low end of our 3 to 5% guidance range” – CEO Tadeu Marroco in the H2 FY23 Pre-Close Concall, Author’s bolded highlights

From a market share perspective, BTI’s combustibles value share dropped 40bps in H2 FY23. This was only partially offset by stronger performance in non-US combustibles, indicating the overall loss of market share in their primary market of combustibles.

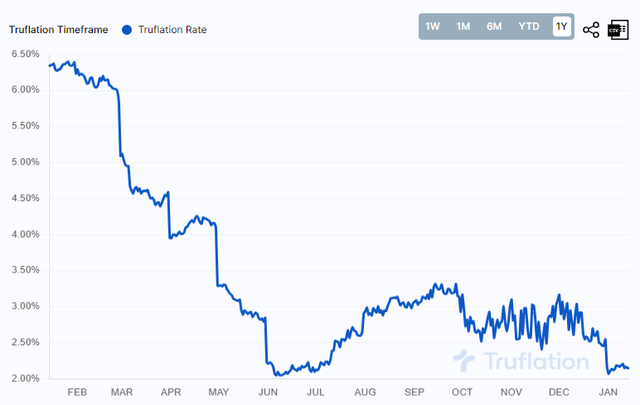

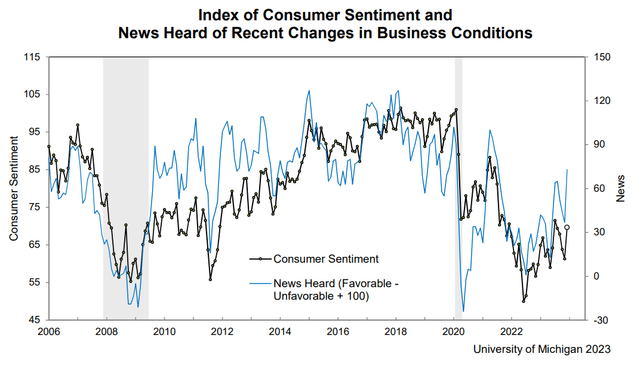

The company attributed the poor performance of US combustibles to inflation and other macro drivers such as high interest rates and consumer confidence.

The company insisted that once macroeconomics improve, the scenario will change, but the analyst remains skeptical about these claims.

The data shows that the consumer confidence is rebounding strongly, raising doubts about the macroeconomic reasons for underwhelming performance. The company’s indicated that the illicit disposable e-cigarette category is cannibalizing regular combustibles, adding another layer of complexity to the issue.

BTI Faces Regulatory Headwinds and Diversification Woes

BTI’s Struggle for Market Share

Revelations from the H2 FY23 Pre-Close Concall shed light on the challenges facing BTI. Macro-related headwinds and substitution effects have exerted pressures on the combustibles market, impacting BTI’s market share. Even amidst efforts to return their U.S. Combustibles business to consistent value growth, the company faces an uphill battle. The outlook for the U.S. combustibles market appears bleak. CEO Tadeu Marroco’s longer-term optimism seems out of touch with the reality of a declining industry.

BTI at the Mercy of Regulatory Bodies

BTI’s reliance on vapour e-cigarettes, particularly in the US, has become precarious due to the supply of illicit products. The company’s fate is entwined with the regulatory decisions of the US Food & Drug Administration (FDA). However, industry experts express skepticism regarding the FDA’s potential to offer significant support.

Moreover, the impending ban on menthol cigarettes in the US poses further challenges for BTI, with the company expressing frustration at the regulatory stance. Recent discussions about the potential banning of flavored e-cigarettes by the World Health Organization (WHO) threaten to derail BTI’s diversification strategy, adding to the company’s regulatory woes.

BTI’s Flawed Diversification Strategy

BTI’s heavy reliance on the declining combustibles market, coupled with a diversification strategy into related, yet equally embattled, products reflects a shortsighted approach. The company’s persistence in swimming against the regulatory currents raises questions about its long-term sustainability. A strategic realignment could be vital for BTI’s future prospects.

The Indian cigarette market leader ITC serves as an illustrative example of successful diversification, decreasing its reliance on cigarettes and expanding into growth areas without the constant struggle against stringent regulations. BTI’s failure to replicate such a strategy has further diminished investor confidence. Alternatively, prioritizing the combustibles segment and enhancing shareholder value through increased capital returns might have been a more prudent approach in light of declining returns on invested capital.

Evaluating Valuation and Future Prospects

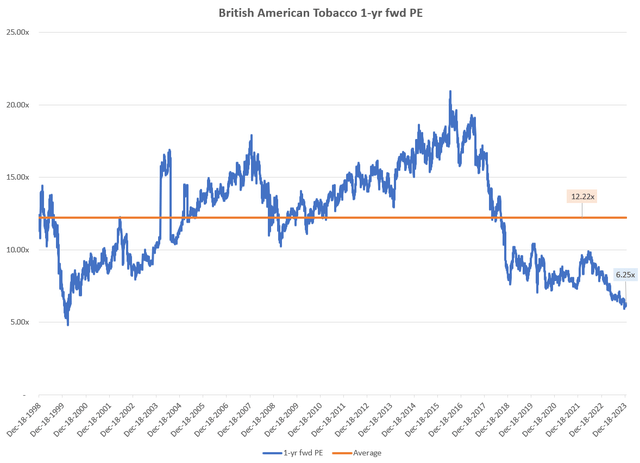

Trading at a 6.25x 1-yr fwd PE, BTI’s substantial discount to the longer-term 1-yr fwd PE multiple raises concerns. Despite the persistent underperformance and negative total shareholder return, the stock continues to pose a conundrum for prospective buyers. The evident value trap status of BTI suggests a lack of compelling reasons for purchase without a significant shift in circumstances.

Key Risks and Monitorables

BTI’s resurgence necessitates meaningful support from regulatory bodies to curb illicit e-cigarette sales and alleviate the impact of restrictive bans. A shift in regulatory policies may hold the key to unlocking potential opportunities for BTI and reshaping its future trajectory.

The Bitter Truth Behind British American Tobacco’s Longing for Victory

British American Tobacco (BTI) has been facing an uphill battle, with pessimism looming over the company’s stock. The past performance when pitted against the S&P 500 index shows a negative total shareholder return of -2.97%, while the S&P 500 managed to score a commendable +6.32% during the same period, demonstrating an alpha of +9.29%. This suggests a clear lag in BTI’s performance compared to the broader market.

The Bearish Perspective

The company’s traditional stronghold in combustibles, particularly within the US, has seen a series of letdowns, forcing downward revisions in guidance by management. This situation has adversely impacted BTI’s value share within the market. The illicit flow of e-cigarettes poses as another major obstacle for BTI’s New Categories, subjecting the company to the sluggish pace and misalignment of regulators, hindering the establishment of favorable operating conditions.

Amidst this struggle, BTI’s attempt to diversify into other nicotine-based products seems to be steering the company into a relentless tussle against resistant regulatory bodies at every turn. In contrast, the success story of Indian cigarette maker ITC stands out as a glaring example of tactful diversification within the nicotine product sector.

The Value Trap Conundrum

The grim picture portrayed in the last analysis has persisted, affirming the prolonged ensnarement of value, with little hope for a shift in the prevailing selling inertia. The only remote possibility for a deviation from this path would hinge on a miraculous alignment of regulatory authorities to support BTI’s interests. Consequently, the current rating for the stock remains a resolute ‘Sell’, albeit a slight alteration from the previous ‘Strong Sell’, given the onslaught of adverse events and headwinds affecting BTI’s shares.

For investors who seek stability in dividends, the focus on total shareholder return stands paramount, affecting overall net worth. Nevertheless, alternative options such as Annaly (NLY) and SCHD (SCHD) seem to offer more promising avenues for dividend-focused plays.

Unlocking the Ratings Code

To decode the intricate web of ratings provided by Hunting Alpha, a ‘Strong Buy’ indicates an anticipated outperformance of the S&P 500 on a total shareholder return basis, accompanied by a higher-than-usual level of confidence. A ‘Buy’ rating signals an expected outperformance of the S&P 500 on a total shareholder return basis. Meanwhile, a ‘Neutral/Hold’ rating forecasts the company’s performance to be in line with the S&P 500. Conversely, a ‘Sell’ rating denotes an expected underperformance of the S&P 500, whereas a ‘Strong Sell’ projects a heightened level of underperformance against the S&P 500, once again coupled with higher-than-usual confidence.

These ratings are cast within a time horizon that primarily spans multiple quarters to around a year, although they are not set in stone. The author will provide updates on any alterations in perspective through a pinned comment on the article, while also reserving the option to publish a new article elucidating the rationale behind the shift in viewpoint.

It is essential to note that some of the securities discussed in this article may not trade on major U.S. exchanges, thereby exposing investors to associated risks.