Broadcom Inc. (AVGO) reported Q2 fiscal 2025 earnings of $1.58 per share, surpassing expectations by 0.64%, with revenues of $15 billion also exceeding forecasts by 0.37%. However, shares fell by 6.2% over the past two trading sessions following the results. The company highlighted strong demand for AI semiconductor products, which boosted revenues by 46% year over year to $4.4 billion. Yet, it anticipates a weak outlook for the server storage, wireless, and industrial sectors in Q3, projecting revenues of $15.8 billion, reflecting only modest growth.

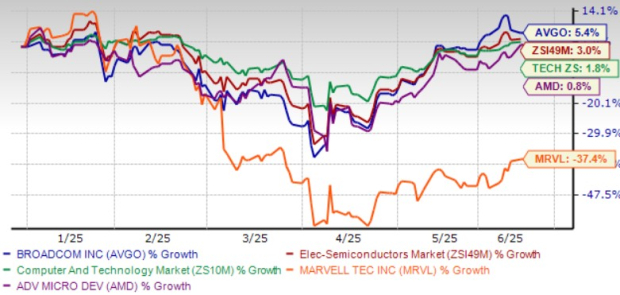

Year-to-date, Broadcom shares have increased by 5.2%, outperforming peers in the Zacks Electronics Semiconductors industry, which saw a 3% return. The company generated $6.55 billion in cash flow from operations, with a strong liquidity position that supports debt reduction and shareholder returns. Notably, their AI revenues for Q3 are expected to rise by 60% year over year to $5.1 billion, driven by robust demand for application-specific integrated circuits (ASICs).

The Zacks Consensus Estimate for AVGO’s fiscal 2025 earnings now stands at $6.63 per share, indicating a 36.14% increase from the previous year. For Q3, the earnings estimate is $1.68 per share, reflecting a year-over-year growth of 35.48%. As of the latest report, Broadcom is trading at a premium, with a forward price/sales ratio of 16.69, significantly higher than industry averages.