Broadcom Surprises with Strong Q4 Earnings and AI Revenue Surge

On Thursday afternoon, Broadcom (AVGO), a leading semiconductor company in the United States, reported its Q4 earnings results, surpassing analyst expectations by 2%.

Record Revenue and Dividend Increase Highlight Success

For fiscal year 2024, Broadcom achieved record revenue of $51.6 billion, a remarkable 44% increase from the previous year. This growth was largely driven by a 220% jump in AI-related revenue to $12.2 billion, alongside strong performances in its semiconductor and infrastructure software segments. Adjusted EBITDA rose 37% to $31.9 billion, while free cash flow reached $21.9 billion. To celebrate this success, the company announced an 11% increase in its quarterly dividend to $0.59 per share, marking the fourteenth consecutive annual dividend hike since 2011.

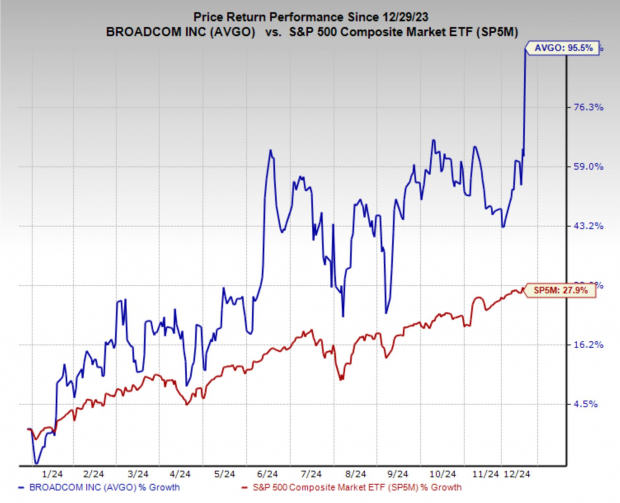

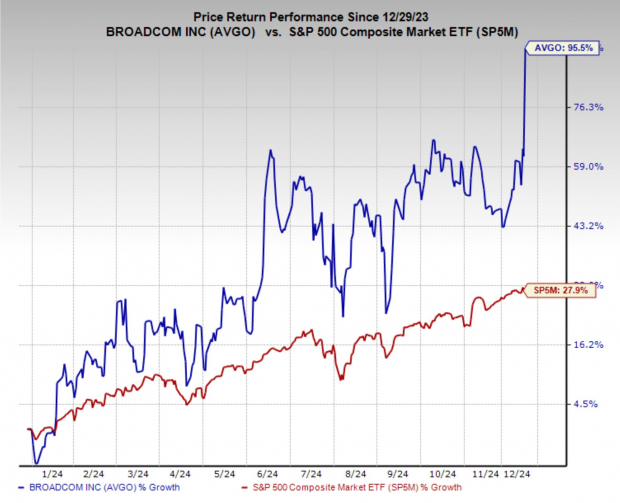

In 2023, Broadcom’s stock surged 95%, recently reaching all-time highs following this strong earnings report. Currently, the company holds a Zacks Rank #3 (Hold) rating, and analysts may soon revise their earnings forecasts upwards in light of these promising results. Continuous investments in AI infrastructure are a major driving force in the market, positioning AVGO as a key player in a complicated technology landscape.

Image Source: Zacks Investment Research

Custom AI Chips Driving Growth and New Partnerships

Recently, discussions have focused on the rise of custom silicon, which is becoming essential in AI technology, and Broadcom’s latest report reinforces this trend. Last week, Marvell (MRVL) also achieved new highs thanks to robust custom AI sales and a new partnership with Amazon (AMZN). Now, Broadcom has partnered with Apple (AAPL) to develop tailored AI solutions for their new server expansion.

The surge in artificial intelligence is increasing demand for custom-designed chips, known as Application-Specific Integrated Circuits (ASICs). These chips are specifically optimized for certain AI tasks, leading companies like Broadcom and Marvell to join Nvidia in creating these specialized solutions. Unlike general-purpose chips, ASICs are more efficient, cost-effective, and compact, making them ideal for specific AI applications even though they are less versatile for broader uses.

Stock Rally Reflects Strong Financial Performance

Broadcom’s robust quarterly performance and optimistic outlook have propelled its stock to all-time highs, with a notable single-day gain exceeding 22%. This surge follows a period of consolidation, during which investors awaited solid indicators of the company’s growth potential. The impressive increase in AI revenue and the expanding role in custom chip markets provided the necessary catalyst.

Looking at the long term, Broadcom shows a compelling outlook with projected earnings growth of 16.5% annually over the next three to five years. The company is strategically positioned to leverage rising investments in AI infrastructure and custom chip solutions. This quarter confirms Broadcom’s capability to capitalize on these trends, reinforcing its status as a vital player in the ever-evolving semiconductor industry.

Image Source: TradingView

Is Broadcom a Good Investment Right Now?

Given its remarkable performance and promising future, Broadcom appears to be an appealing choice for investors wanting to tap into the AI growth wave.

Nevertheless, with the stock climbing over 22% in just one session and hitting all-time highs, potential buyers might consider waiting for a price adjustment before entering the market. Long-term investors who believe in Broadcom’s leadership in custom AI chips and infrastructure may find chances to purchase shares over time, as the company is well-positioned for sustained growth in AI and data-based technologies.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is crucial to our economy, representing a multi-trillion dollar industry with many of the world’s largest companies.

Advanced technology is enabling clean energy solutions to potentially surpass traditional fossil fuels. Trillions of dollars are already being invested in clean energy projects, from solar to hydrogen fuel cells.

Emerging leaders in this field could become some of the most exciting stocks in your portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to see Zacks’ top picks for free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download “5 Stocks Set to Double.” Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Marvell Technology, Inc. (MRVL): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.