“`html

Broadcom Shares Surge 15% Amid Buyback and Product Announcements

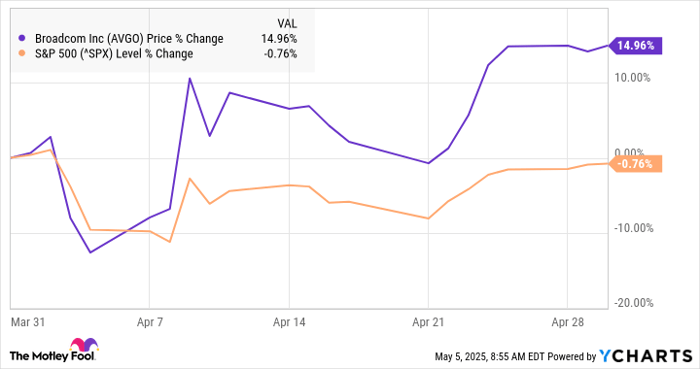

Shares of Broadcom (NASDAQ: AVGO) outperformed the broader market last month, driven by a strategic buyback announcement, encouraging analyst recommendations, and the launch of a new product.

According to data from S&P Global Market Intelligence, the stock concluded the month with a 15% gain.

As illustrated in the chart below, Broadcom’s stock received a boost from the share buyback announcement at the onset of April. It then tracked alongside the S&P 500 for the rest of the month, displaying greater upward movement.

AVGO data by YCharts

Broadcom’s Resilient Performance

Following the announcement of tariffs by President Trump, Broadcom shares, like many others in the stock market, faced a downturn. However, on April 7, the company surprised investors with a $10 billion share repurchase program, which, while only about 1% of the company’s market capitalization, demonstrated management’s confidence amidst trade war uncertainties. This announcement led to a 5.4% jump in Broadcom’s stock, even as the overall market struggled.

On April 9, the stock surged by 19% following news of a 90-day pause on most tariffs that Trump had previously enacted. As a cyclical stock closely linked to global economic conditions, Broadcom proved resilient in such scenarios.

As April progressed, the company announced advancements in its Symantec cybersecurity segment with the launch of Incident Protection, an AI-based tool aimed at predicting cyberattacker behavior. This innovation contributed positively to market sentiment.

At the end of the month, Broadcom benefited from news that trade tensions between the U.S. and China might ease. On April 30, Seaport Research began coverage of the stock with a “buy” rating, highlighting Broadcom’s strong position to cater to hyperscalers interested in designing their own chips, especially in light of its leadership in custom ASIC chips, now seen as alternatives to some Nvidia GPUs.

Image source: Getty Images.

Outlook for Broadcom

Broadcom is set to report its next earnings results in June, but it seems poised to leverage the momentum in AI while navigating market fluctuations effectively. This positioning is bolstered by the company’s diversification across networking chips, infrastructure products, virtualization software, and cybersecurity.

Should You Invest in Broadcom Now?

Before considering an investment in Broadcom, note the following:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks to buy currently, with Broadcom notably absent from the list. This selection aims at achieving substantial returns in the coming years.

Consider how Netflix performed after making this list on December 17, 2004; investing $1,000 at that time would now be worth $623,685!* Similarly, Nvidia, recommended on April 15, 2005, has seen an investment of $1,000 turn into $701,781!*

Notably, Stock Advisor has recorded a total average return of 906%—a significant outperformance compared to 164% for the S&P 500.

*Stock Advisor returns as of May 5, 2025.

Jeremy Bowman has positions in Broadcom and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`