Note: The following is an excerpt from this week’s Earnings Trends report. For full details, including historical data and future estimates, please click here>>>

Key Earnings Trends for Q4 2024

- Total S&P 500 earnings for Q4 2024 are projected to increase by +7.4% compared to Q4 2023, driven by a +4.8% rise in revenues.

- Once the negative impact of the Energy sector is excluded, Q4 earnings growth improves to +9.5%. However, excluding the contribution from the Tech sector, the growth rate drops to just +4.0%.

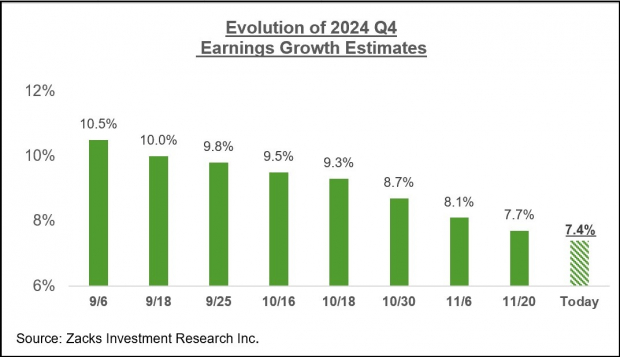

- Earnings estimates have gradually declined since the quarter began, with the current +7.4% growth estimate down from +9.8% at the start of October.

- The ‘Magnificent 7’ companies are expected to see a rise in Q4 earnings by +20.7% year-over-year, alongside a +12.3% increase in revenues. Without contributions from these firms, earnings for the remainder of the S&P 500 would only rise by +3.4% (compared to the overall +7.4%).

Technology Sector Fuels Growth

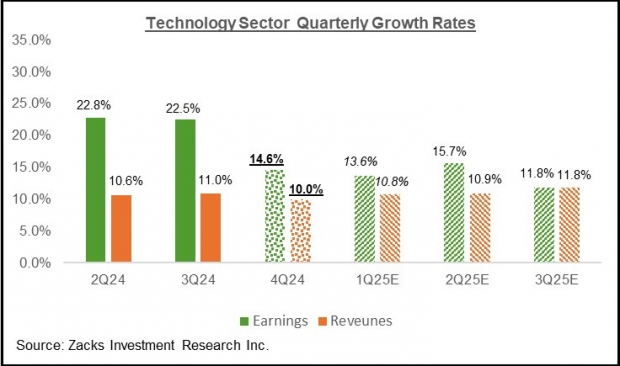

The Technology sector has consistently led earnings growth in recent quarters, a trend likely to persist into Q4 2024 and beyond. For this quarter, Tech earnings are anticipated to increase by +14.6% year-over-year, supported by +10% higher revenues, marking the sixth consecutive quarter of double-digit earnings growth.

This follows a significant +22.5% earnings growth in Q3 2024, with revenues up by +11%. The data suggests that Tech will continue on this upward trajectory in the upcoming quarters.

Image Source: Zacks Investment Research

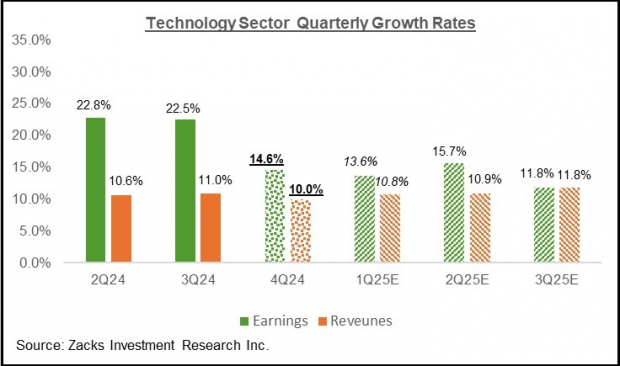

In addition to strong performance, the Tech sector has shown an improving earnings outlook. This is evident through favorable revisions for Q4 and the full year 2025.

Take, for instance, Nvidia NVDA and Meta Platforms META. The current earnings per share (EPS) estimate for Nvidia is 84 cents, an increase from 78 cents two months ago. Similarly, Meta’s Q4 EPS estimate has risen by +7.1% to $6.76 over the same timeframe.

Below is the aggregate revisions trend for the Tech sector as per the Zacks composite proxy.

Image Source: Zacks Investment Research

Looking at the Broader Earnings Picture

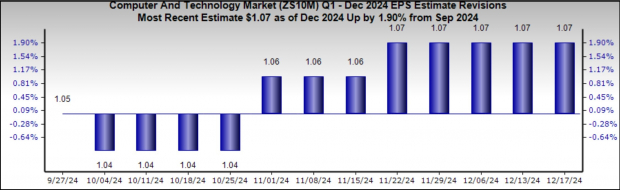

The following chart illustrates Q4 2024 expectations alongside actual performance from the previous four periods and estimates for the next three quarters.

Image Source: Zacks Investment Research

Though estimates for Q4 2024 have weakened since the quarter began, the rate and degree of downward revisions are less severe compared to the previous year’s Q3 period. This trend is evident in the subsequent chart detailing recent Q4 estimate fluctuations.

Image Source: Zacks Investment Research

The next chart provides an annual overview of earnings performance.

Image Source: Zacks Investment Research

As depicted, experts forecast double-digit earnings growth over the next two years, with a noticeable increase in the number of sectors contributing to this growth.

In 2025, the Tech sector is expected to experience a +17.4% earnings increase, following a +19.8% rise in 2024. Even without Tech’s influence, overall S&P 500 earnings are predicted to increase by +12.3% in 2025, with nine of the 16 Zacks sectors projected to see double-digit growth.

Explore the Future of Nuclear Energy

The demand for electricity is escalating rapidly, while the world moves towards reducing reliance on fossil fuels like oil and natural gas. Nuclear energy emerges as a viable alternative.

Recently, leaders from the US and 21 other countries pledged to TRIPLE global nuclear energy capacities. This ambitious shift could present substantial financial opportunities for stocks linked to nuclear energy – particularly for investors who act swiftly.

Our comprehensive report, Atomic Opportunity: Nuclear Energy’s Comeback, delves into the prominent players and technologies defining this trend, including three prominent stocks positioned to reap the greatest benefits.

Download your free copy of Atomic Opportunity: Nuclear Energy’s Comeback today.

Interested in the latest stock recommendations from Zacks Investment Research? You can currently download our report, 5 Stocks Set to Double, for free.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the complete article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.