Introduction to Brokerage Recommendations

While market rumors often cause stocks to sway, investors typically depend on the recommendations of brokerage firm analysts when making stock decisions. These recommendations tend to influence stock prices, but the real question is: Are they truly significant?

Before delving into the reliability of brokerage recommendations and how investors can tactically leverage them, let’s take a look at the opinion of Wall Street bigwigs regarding Adma Biologics (ADMA).

Brokerage Recommendations for Adma Biologics

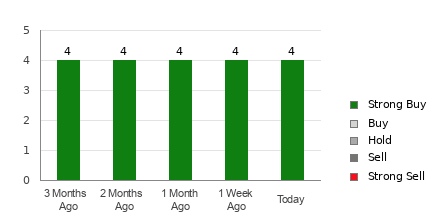

Adma Biologics currently boasts an average brokerage recommendation (ABR) of 1.00, indicating a Strong Buy, derived from the ratings of four brokerage firms. All four recommendations are Strong Buy, representing 100% of all recommendations.

Check price target & stock forecast for Adma Biologics here>>>

However, it may not be prudent for investors to base their decisions solely on the ABR. Studies have highlighted the limited success of brokerage recommendations in predicting stocks with the best potential for price increases.

Why, you ask? It turns out that due to their vested interest in the stocks they cover, brokerage firms tend to exhibit a strong positive bias in their ratings. Research suggests that for every “Strong Sell” recommendation, they assign five “Strong Buy” recommendations, underscoring a misalignment of interests with retail investors and offering scant insight into a stock’s future price movement. It’s prudent to view brokerage recommendations as a complement to your personal analysis or a proven tool for predicting stock price movements.

Comparing ABR with Zacks Rank

Zacks Rank, our internally verified stock rating tool, groups stocks into five categories, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), effectively signaling a stock’s anticipated price performance in the near term. Hence, endorsing the ABR by validating it against the Zacks Rank could be an astute strategy for making an informed investment decision.

Distinction between ABR and Zacks Rank

Though ABR and Zacks Rank both employ a 1-5 range, they are distinct metrics. ABR is based solely on brokerage recommendations and typically displayed with decimals (e.g., 1.28), while the Zacks Rank is a quantitative model leveraging earnings estimate revisions and presented in whole numbers from 1 to 5.

Analysts associated with brokerage firms have historically showcased excessive optimism in their recommendations due to their employers’ vested interests, often providing more favorable ratings than can be justified by their research. In contrast, the Zacks Rank centers on earnings estimate revisions, demonstrating a strong correlation between trends in earnings estimates and short-term stock price movements.

Future Investment Considerations

In terms of earnings estimate revisions for Adma Biologics, the Zacks Consensus Estimate for the current year has soared by 36.7% over the past month to -$0.02. This growing optimism among analysts, illustrated by a strong consensus in revising EPS estimates upwards, could underpin a potential near-term upswing in the stock.

Given the drastic change in the consensus estimate and three other factors linked to earnings estimates, Adma Biologics has secured a Zacks Rank #2 (Buy). Interested in exploring more Zacks Rank #1 (Strong Buy) stocks? You can peruse the complete list here >>>>

Ergo, the Strong Buy-equivalent ABR for Adma Biologics could be a valuable compass for investors.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.