It’s common for investors to turn to the recommendations of Wall Street analysts before making decisions about buying, selling, or holding a stock. But before you place all your bets on these recommendations, it’s important to understand the reliability of these suggestions and how to leverage them in your favor. Let’s take a closer look at what these financial titans are saying about Celsius Holdings Inc. (CELH).

Celsius Holdings Inc.’s Average Brokerage Recommendation

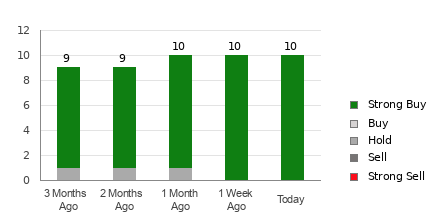

Currently, Celsius Holdings Inc. holds an average brokerage recommendation (ABR) of 1.29 on a scale of 1 to 5 (Strong Buy to Strong Sell) based on the actual recommendations of 14 brokerage firms. With 12 out of the 14 recommendations being Strong Buy, accounting for 85.7% of all recommendations, the positive sentiment surrounding CELH is evident.

Brokerage Recommendation Trends for CELH

While the ABR suggests a strong buying sentiment for Celsius Holdings Inc., it’s essential to note that making investment decisions solely based on these recommendations may not be prudent. Studies have shown that brokerage recommendations have limited success in identifying stocks with the most potential for price appreciation.

Why is that? Research indicates that analysts at brokerage firms tend to rate stocks with a significantly positive bias, heavily influenced by their institutions’ stakes in the stocks they cover. This disparity of interest undermines the recommendations’ insight into a stock’s future price movement, making it crucial to validate such information with your independent analysis or an effective stock prediction tool.

Zacks Rank Should Not Be Confused With ABR

It’s important to highlight the distinction between the Zacks Rank and ABR despite both being rated on a scale from 1 to 5. While ABR is based solely on brokerage recommendations, typically displayed in decimals, the Zacks Rank is a quantifiable model driven by earnings estimate revisions, displayed in whole numbers.

Historically, analysts at brokerage firms have been known to exhibit exceedingly optimistic recommendations due to their employers’ interests, hindering rather than aiding investors. On the other hand, the Zacks Rank leverages earnings estimate revisions, displaying a strong correlation with near-term stock price movements.

Moreover, the Zacks Rank applies its various grades proportionately across all stocks for which brokerage analysts provide earnings estimates, ensuring a balanced assessment across the market.

Is CELH Worth Investing In?

Considering Celsius Holdings Inc.’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has remained steady at $0.75 over the past month. Analysts’ consistent views on the company’s earnings prospects have led to a Zacks Rank #3 (Hold) for CELH.

It might be advisable to approach the Buy-equivalent ABR for Celsius Holdings Inc. with caution, especially when juxtaposed with the Zacks Rank assessment.