Investors often seek guidance from Wall Street analysts before making investment decisions. The brokerage recommendations can sway a stock’s price. But do these suggestions hold real significance?

Before delving into the reliability of brokerage recommendations and how to leverage them, let’s inspect what Wall Street experts have to say about Energy Transfer LP (ET).

Understanding the Brokerage Recommendation for ET

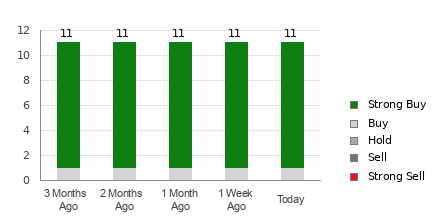

Energy Transfer LP currently holds an average brokerage recommendation (ABR) of 1.23, indicating a Strong Buy to Buy sentiment based on inputs from 13 brokerage firms.

Of these 13 recommendations, 11 advocate for Strong Buy, while one recommends Buy, cumulatively representing 84.6% and 7.7% of all suggestions, respectively.

Brokerage Recommendation Trends for ET

Check price target & stock forecast for Energy Transfer LP here>>>

While the ABR supports investing in Energy Transfer LP, relying solely on this data might not be prudent. Studies reveal that brokerage recommendations often fall short in predicting a stock’s price potential.

Brokerage analysts predominantly exhibit a strong positive bias, influenced by their firms’ vested interests in the stocks they cover. This predisposition leads them to issue more favorable ratings, undermining their efficacy as a guide for investors.

Zacks Rank, on the other hand, offers a quantifiable model based on earnings estimate revisions with a proven track record for projecting stock price movements, providing a broader framework for investment decisions.

Comparing ABR and Zacks Rank

ABR and Zacks Rank may share a 1-5 scale, but they are distinct measures. ABR hinges solely on brokerage recommendations, whereas Zacks Rank employs a quantitative model based on earnings estimate revisions, offering a more reliable indicator for investors.

Analysts’ recommendations are often overly optimistic, contrasting sharply with the Zacks Rank, which correlates closely with actual stock price movements. The Zacks Rank is also more timely and reflective of current conditions.

Furthermore, Zacks Rank includes all stocks with current-year earnings estimates, ensuring a balanced assessment across the market.

Insight into ET’s Investment Potential

Despite the current ABR for Energy Transfer LP, which suggests a favorable stance, investors should consider other factors. The Zacks Consensus Estimate shows a 1% increase over the past month, indicating growing optimism among analysts.

Considering the recent trend in earnings estimates and other related factors, Energy Transfer LP obtains a Zacks Rank #2 (Buy), pointing to potential near-term appreciation.

Therefore, while the ABR portrays a positive outlook for Energy Transfer LP, investors should weigh this data against other indicators before making investment decisions.

Energy Transfer LP (ET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.