When it comes to deciding whether to buy, sell, or hold a stock, many investors look to analyst recommendations for insight. The media often amplifies the influence of brokerage-firm-employed analysts’ rating changes on a stock’s price. But, before diving into the reliability of brokerage recommendations and strategies for leveraging them, let’s explore what the Wall Street heavyweights are saying about Lululemon (LULU).

The Brokerage Outlook for LULU

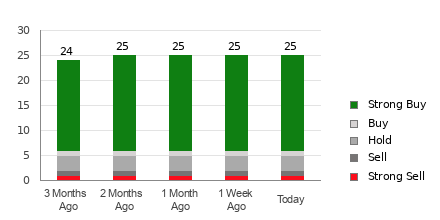

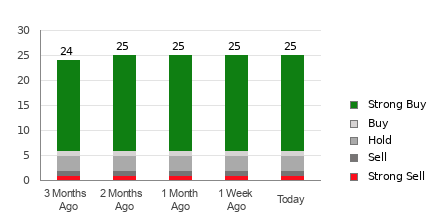

Lululemon currently boasts an average brokerage recommendation (ABR) of 1.62 on a scale of 1 to 5, where 1 reflects a Strong Buy and 5 indicates a Strong Sell. This figure stems from the actual recommendations (Buy, Hold, Sell, etc.) submitted by 26 brokerage firms. Essentially, an ABR of 1.62 positions Lululemon between a Strong Buy and a Buy.

Of the 26 recommendations that form the ABR, 17 are Strong Buy and three are Buy, collectively representing 65.4% and 11.5% of all recommendations, respectively. A glance at the brokerage recommendation trends for LULU may shed more light on this.

Check price target & stock forecast for Lululemon here>>>

While the ABR calls for buying Lululemon, it’s crucial to recognize that relying solely on this data for investment decisions may not be prudent. Several studies have highlighted the limited success of brokerage recommendations in identifying stocks with the best potential for price appreciation.

Why is this so? It appears that analysts at brokerage firms, driven by their interests in a stock, tend to portray it with an overly positive bias. According to research findings, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation, suggesting a tendency to paint an overly optimistic picture. This misalignment between the interests of brokerage institutions and those of retail investors delivers little clarity on a stock’s likely future price trajectory. Consequently, it’s advisable to use this information to validate your independent analysis or a proven effective tool for predicting stock price movements.

Sorting Through the Metrics

One such reliable tool is the Zacks Rank, a proprietary stock rating mechanism with a robust externally audited track record. This tool classifies stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is a potent gauge of a stock’s likely price performance in the near term. Therefore, juxtaposing the ABR with the Zacks Rank could yield a judicious investment decision.

It’s imperative to note that while both the ABR and Zacks Rank are represented on a scale from 1 to 5, they are fundamentally distinct metrics. The former is computed solely based on broker recommendations and is typically displayed as a decimal (e.g., 1.28). In contrast, the Zacks Rank is a quantitative model designed to harness the power of earnings estimate revisions and is showcased in whole numbers from 1 to 5.

Analysts employed by brokerage firms have demonstrated an inclination for overly positive recommendations due to their employers’ vested interests, thereby often leading investors astray. Conversely, the core of the Zacks Rank revolves around earnings estimate revisions, with empirical research demonstrating a strong correlation between trends in these revisions and near-term stock price movements.

The Right Tool for the Job

There is another critical divergence between the ABR and Zacks Rank – timeliness. While the ABR may not always reflect the most up-to-date information, the Zacks Rank swiftly incorporates brokerage analysts’ revised earnings estimates, embodying the tool’s ongoing relevance in signaling future price movements.

Considering Lululemon’s earnings estimate revisions, the Zacks Consensus Estimate for the current year has surged by 0.4% over the past month to $12.47. The growing optimism among analysts about the company’s earnings prospects, evident in their strong consensus in revising EPS estimates upwards, presents a compelling reason for the stock to soar in the imminent future. This pivot has culminated in a Zacks Rank #2 (Buy) for Lululemon, broadening the investment landscape for the company.

Thus, the Buy-equivalent ABR for Lululemon holds promise as a valuable guide for investors in navigating the stock market terrain.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.