Many investors look to Wall Street analysts for guidance when making decisions about stocks. The impact of brokerage-firm recommendations on stock prices is well-documented. However, it’s crucial to examine these recommendations with a discerning eye, especially before diving into an investment with Netflix (NFLX).

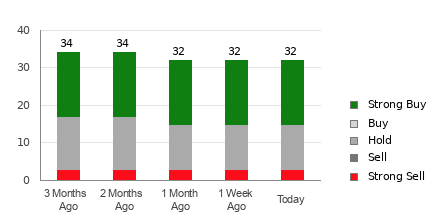

The current average brokerage recommendation (ABR) for Netflix stands at 1.96 on a scale of 1 to 5, indicating a consensus between Strong Buy and Buy, based on evaluations from 40 brokerage firms. Among these, 55% represent Strong Buy, and 2.5% are Buy recommendations. While these numbers suggest a generally favorable outlook, it’s vital to consider whether such advice should be the sole foundation for investment decisions.

Are Brokerage Recommendations Trustworthy?

Multiple studies have cast doubt on the practical effectiveness of brokerage recommendations in identifying stocks with significant upward potential in value. Analysts at these firms may exhibit a clear bias in favor of stocks they cover, often resulting in an overabundance of bullish ratings.

It’s not uncommon for brokerage firms to assign five “Strong Buy” for every “Strong Sell” recommendation, highlighting the disparity in their assessments. Such conflict of interest may mislead retail investors seeking clarity on a stock’s trajectory, warranting the need for alternative tools or independent analysis.

Regarding Netflix, the ABR may indeed advocate for a positive stance. However, its reliability as a sole yardstick for investment decisions is open to debate.

Introducing Zacks Rank and Its Predominance

One such alternative is Zacks Rank, a stock rating mechanism renowned for its externally verified track record. The system categorizes stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), offering investors a reliable gauge of a stock’s potential performance in the near term.

It’s essential to differentiate between the ABR and Zacks Rank, with the former driven solely by brokerage recommendations and the latter leaning on quantitative models and earnings estimate revisions. Research has shown that the latter’s resonance with near-term stock price movements outweighs the former.

The Weight of Earnings Estimates and Netflix’s Prospects

Amidst this, the Zacks Consensus Estimate indicates a 5.5% surge over the past month, forecasting a figure of $16.93 for Netflix in the current year. The upward revision of EPS estimates signals robust optimism among analysts about the company’s earnings outlook, a promising indicator for potential price escalation in the near future.

With the Zacks Rank #1 (Strong Buy) conferred upon Netflix, supported by a notable consensus estimate variance and other relevant factors, the stock appears poised for an upswing. Given the substantial changes in consensus estimates, the Buy-equivalent ABR for Netflix could indeed offer valuable insights to prospective investors.

Amidst the evolving landscape of recommendations and evaluations, it’s prudent for investors to leverage tools like Zacks Rank as a means of augmented scrutiny, ensuring informed and advantageous investment decisions in the realm of stock trading.

The author’s views and opinions expressed in this article are personal and do not necessarily reflect those of Nasdaq, Inc.