When considering investment opportunities, Wall Street analysts’ recommendations hold significant weight, influencing the decisions made by investors. However, the reliability of brokerage recommendations and how to leverage them to one’s advantage is often a topic of debate. Let’s delve into the world of brokerage recommendations and understand what experts have to say about ServiceNow (NOW) before making any investment decisions.

ServiceNow’s Brokerage Recommendations

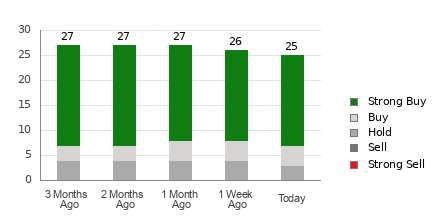

ServiceNow currently holds an average brokerage recommendation (ABR) of 1.18, falling between Strong Buy and Buy, based on the ratings of 33 brokerage firms. Of these recommendations, 87.9% are Strong Buy and 6.1% are Buy, contributing to the overall ABR.

Understanding Brokerage Recommendations Trends for NOW

Check price target & stock forecast for ServiceNow here>>>

While the ABR suggests buying ServiceNow, relying solely on this information may not be prudent. Studies have shown that brokerage recommendations have limited success in guiding investors to select stocks with the highest potential for price appreciation.

Analysts’ positive bias due to the vested interest of brokerage firms often skews their ratings, resulting in more favorable recommendations. As a result, these recommendations may not always align with the true potential of a stock, warranting additional analysis or tools for predicting stock price movements.

The Role of Zacks Rank in Making Informed Investment Decisions

The Zacks Rank, a proprietary stock rating tool, categorizes stocks from Strong Buy to Strong Sell and is an effective indicator of a stock’s potential performance. Validating the ABR with the Zacks Rank can aid in making profitable investment decisions.

Comparing ABR and Zacks Rank

Despite both appearing on a scale from 1 to 5, ABR and Zacks Rank are distinct measures. ABR uses brokerage recommendations, while the Zacks Rank relies on a quantitative model driven by earnings estimate revisions.

Empirical research has shown a strong correlation between near-term stock price movements and trends in earnings estimate revisions, validating the reliability of the Zacks Rank in predicting future stock prices.

Moreover, the Zacks Rank’s proportionate application across all stocks for which brokerage analysts provide earnings estimates ensures a balanced assessment at all times.

Additionally, the Zacks Rank maintains timeliness, as it quickly reflects brokerage analysts’ earnings estimate revisions, providing up-to-date insights into future stock prices.

Assessing the Investment Potential of ServiceNow

With a 1.1% decline in the Zacks Consensus Estimate for the current year to $10.46, analysts’ growing pessimism over ServiceNow’s earnings prospects has led to a Zacks Rank #4 (Sell) for the company. This convergence in EPS estimate revisions warrants caution for potential investors.

Considering the recent consensus estimate change and the Zacks Rank, it’s essential for investors to approach ServiceNow’s Buy-equivalent ABR with discernment.

Zacks Names #1 Semiconductor Stock

Feeling overshadowed by NVIDIA, which rose over 800% since a recommendation, there’s a new top chip stock poised for explosive growth. With strong earnings and a growing customer base, it’s positioned to capitalize on the voracious appetite for Artificial Intelligence, Machine Learning, and Internet of Things. Anticipated growth in global semiconductor manufacturing further enhances its potential.

See This Stock Now for Free >>

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.