Brookdale Senior Living Inc., commonly known as BKD, recently found itself in turbulent waters as its shares spiraled down by 13.1% following the release of its fourth-quarter 2023 financial results on Feb 20, 2024. The cause of this investor distress? A widening loss that went beyond expectations, spurred by an increase in general and administrative expenses as well as facility operating lease costs. These challenges were, however, somewhat offset by the company’s enhanced resident fee revenues, interest income, and occupancy rates.

Behind the Numbers

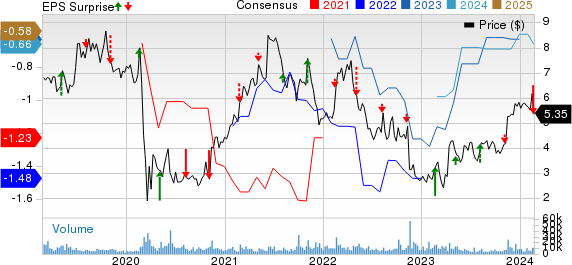

During the fourth quarter, Brookdale Senior reported an adjusted loss of 40 cents per share, significantly wider than the Zacks Consensus Estimate of a 19 cents per share loss and the 13 cents per share loss recorded during the same quarter the previous year.

On the revenue front, the company witnessed a 7.7% year-over-year increase to $754.5 million, driven by growth in resident and management fee revenues.

A Glimpse into Operations

Resident fees saw a solid uptick, reaching $716.6 million, an 8.9% increase from the previous year. This surge was fueled by improved Revenue Per Occupied Unit (RevPOR) and occupancy rates, albeit dampened by the divestiture of 20 communities.

RevPOR showed an impressive 8.1% surge year over year, while the weighted average occupancy experienced a 130 basis points increase, thanks to BKD’s strategic initiatives aimed at reviving occupancy levels. Meanwhile, Revenue Per Available Unit (RevPAR) climbed by 10% in the fourth quarter, with management fees also growing by 4.7% year over year.

Financial Standing

As of December 31, 2023, Brookdale Senior had $278 million in cash and cash equivalents, marking a 30.3% drop from the previous year-end. The company’s total assets amounted to $5.6 billion, witnessing a 6.1% decrease compared to 2022.

Long-term debt, excluding the current portion, stood at $3.7 billion, a 3.4% decline from the previous year, while the current portion of long-term debt was $41.5 million. Total equity took a dip as well, plummeting by 30.6% from the previous year-end figure to $405.2 million.

Future Projections

Looking ahead, Brookdale Senior anticipates a 6.25-6.75% year-over-year growth in RevPAR for the first quarter of 2024. Adjusted EBITDA is expected to fall within the range of $90 million to $95 million, representing a 4.4% improvement from the corresponding figure in the prior-year quarter.

In terms of the full year 2024, the company estimates non-development capital expenditures, net of anticipated lessor reimbursements, to be around $180 million.

In the Industry Landscape

Within the medical sector, notable players such as Inspire Medical Systems, Inc., The Cigna Group, and Tenet Healthcare Corporation have all surpassed the Zacks Consensus Estimate with their fourth-quarter 2023 results, showcasing a strong performance contrast to the challenges faced by Brookdale Senior.

Quarterly Earnings Report Insights in the Health Services Sector

A Blossoming Quarterly Triumph

This quarter rang in with a melody of success for Inspire Medical Systems, Inc. (INSP) and Cigna Group (CI). INSP reported a loss of 4 cents per share, a notable turnaround from the previous quarter. Their revenues soared to $192.5 million, a remarkable 39.6% surge year over year. The U.S. revenues of $189.4 million paint a vivid picture of growth, showcasing a 41% increase from the year prior.

U.S. Market Expansion Fueling Growth

Not resting on their laurels, INSP expanded its horizons by activating 78 new U.S. centers in the quarter. This surge brought the total count of U.S. medical centers offering Inspire therapy to a grand total of 1,180. Moreover, the creation of 13 new U.S. sales territories pushes INSP’s total to 287, paving the way for future expansion.

Innovative Revenue Streams

While U.S. revenues stole the spotlight, revenues from outside the United States clocked in at $3.1 million, declining by 16% year over year. Despite this dip, gross profit took center stage, climbing by 42.1% to hit $164.5 million. The impressive expansion didn’t stop there, with the gross margin increasing to 85.4%, marking a significant gain.

Trailblazing Financial Performance

On a different note, Cigna Group showcased resounding success with a fourth-quarter adjusted EPS figure of $6.79, surpassing estimates by 4.1%. Their adjusted revenues of $51.2 billion also stood out, marking a 4.8% increase year over year. The company’s medical customer base surged to 19.8 million, boasting a 9.9% uptick from the previous year.

Diverse Revenue Streams

The Evernorth Health Services unit of Cigna showcased substantial growth, generating adjusted revenues of $40.5 billion, a notable 12% increase year over year. On the pretax front, adjusted operating income also painted a rosy picture, rising by 10% year over year to hit $1.9 billion in the fourth quarter.

Impressive Performance Continues

Tenet Healthcare Corporation reported an adjusted EPS of $2.68, impressively surpassing the Zacks Consensus Estimate by 69.6%. Their net operating revenues reached $5.4 billion in the fourth quarter, marking a 7.8% improvement year over year. Adjusted net income also saw a substantial rise, climbing by 32.9% compared to the previous year.

A Growing Legacy

The hospital operations and services segment of Tenet Healthcare saw net operating revenues up by 6% to hit $4.3 billion, showcasing a steady rise. The Ambulatory Care unit also joined the winning streak, reporting net operating revenues of $1.1 billion, marking a significant 15.4% year-over-year increase in the fourth quarter.

Turning the Corner

This quarter’s performances are a testament to the resilience and innovation demonstrated in the health services sector. As INSP and CI lead the charge in revenue growth and market expansion, the sector is poised for significant developments in the coming quarters. The reports paint a vivid picture of opportunities and challenges that lie ahead, guiding investors on an eventful journey through the financial landscape.