Brookfield Infrastructure Corp announced on November 1, 2023, that its board of directors declared a quarterly dividend of $0.38 per share ($1.53 annualized). This is in line with its previous payout. Shareholders of record as of November 30, 2023, will receive the payment on December 29, 2023. Shares must be purchased before the ex-dividend date of November 29, 2023, to qualify for the dividend.

The Current Dividend Landscape

At the current share price of $30.62, the stock’s dividend yield stands at 5.00%. Looking back over the past five years, the average dividend yield has been 3.42%, with a low of 1.90% and a high of 6.19%. Based on this historical context, the current dividend yield of 5.00% is notably 2.37 standard deviations above the historical average, pointing to a relatively high return for investors.

Additionally, the company’s dividend payout ratio is 0.23, indicating a healthy balance between the portion of income paid out in dividends and the retained earnings for future growth. Furthermore, the 3-year dividend growth rate of 0.18% demonstrates the company’s commitment to consistent dividend increases over time.

Fund and Institutional Ownership

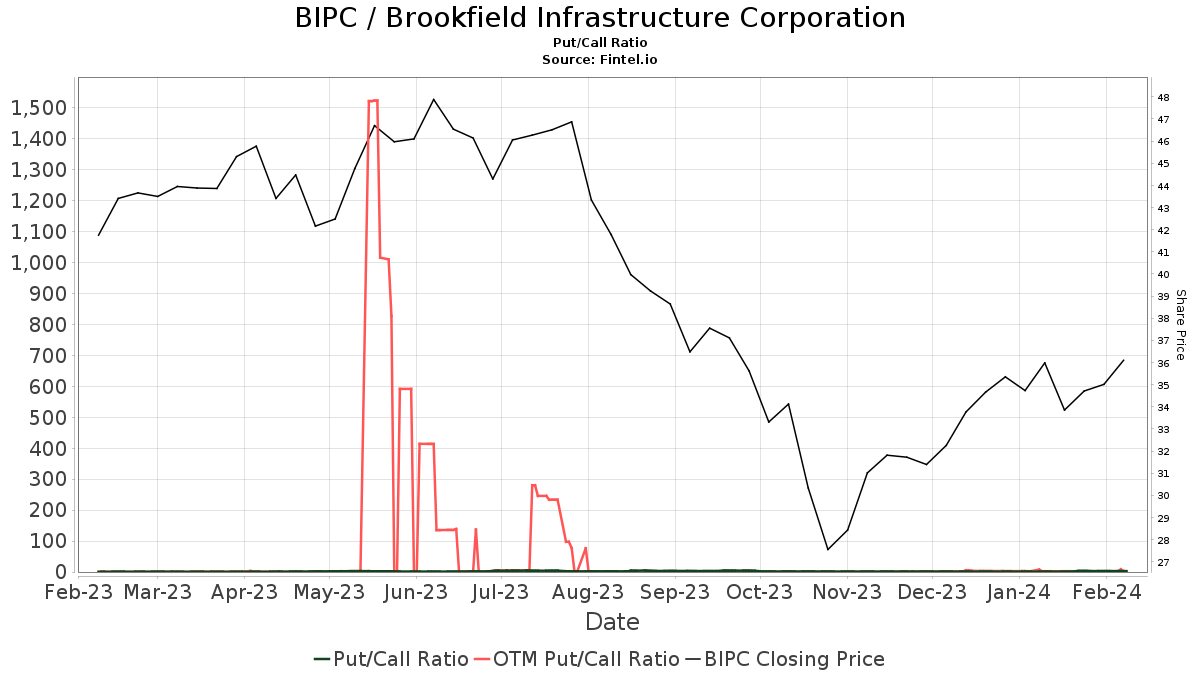

There are 497 funds or institutions reporting positions in Brookfield Infrastructure Corp, marking a slight decrease of 1.00% in the last quarter. The average portfolio weight of all funds dedicated to BIPC is 0.16%, reflecting a 1.19% decrease. Total shares owned by institutions increased by 1.78% in the last three months to 82,669K shares. The put/call ratio of BIPC is 1.29, indicating a bearish outlook in the market sentiment.

Notable Institutional Holdings

Brookfield Asset Management holds 13,013K shares, representing 9.72% ownership of the company, showing no change in the last quarter. Bank Of Montreal holds 3,647K shares, representing 2.72% ownership, which reflects a substantial 18.51% increase in its portfolio allocation in BIPC. On the other hand, Confluence Investment Management holds 2,528K shares, representing 1.89% ownership, and decreased its portfolio allocation in BIPC by 23.33% over the last quarter.

Brookfield Infrastructure – Providing Global Access to High-Quality Assets

Brookfield Infrastructure Corporation offers investors flexible access to its globally diversified portfolio of high-quality infrastructure assets. The company’s Class A shares are structured to provide an economic return equivalent to BIP units through a traditional corporate setup. Each BIPC Class A share offers the same distribution as a BIP unit and can be exchanged, at the shareholder’s option, for one BIP unit.

As investors analyze the latest dividend declaration and assess the overall market sentiment, understanding the historical context and institutional ownership could provide valuable insights for investment decisions.