Bruker Corporation Unveils First High-Resolution 1.3 GHz NMR Spectrometer at Joint Conference

At the Joint ENC-ISMAR Conference 2025, Bruker Corporation (BRKR) has introduced the world’s first high-resolution 1.3 GHz Nuclear Magnetic Resonance (“NMR”) spectrometer. This innovative spectrometer features a pioneering superconducting, persistent standard-bore 54 mm NMR magnet, boasting a remarkable field strength of 30.5 Tesla (T). It also utilizes a cutting-edge ReBCO high-temperature superconductor (HTS) insert, enabling even higher magnetic field generation.

This significant advancement marks a new era for ultra-high field NMR research, delivering unprecedented resolution and dispersion capabilities.

Bruker’s Stock Movement Post-Announcement

Following this announcement, Bruker’s shares surged by 6.1%, closing at $38.70. The launch of the 1.3 GHz spectrometer underscores the company’s dedication to cutting-edge innovation. The GHz-class NMR technology is expected to further enhance researchers’ understanding of complex biomolecular systems and contribute substantially to advanced materials science, particularly for compounds containing quadrupolar and low-gamma nuclei. As a result, market sentiment around BRKR stock is likely to stay positive in light of this news.

Bruker holds a market capitalization of $5.53 billion. According to the Zacks Consensus Estimate, the company’s earnings per share (EPS) for 2025 is projected to grow by 11.6%. Furthermore, Bruker has a history of exceeding earnings expectations, with an average beat of 3.7% over the last four quarters.

Importance of the New 1.3 GHz Spectrometer

The newly introduced 1.3 GHz NMR spectrometer offers unmatched resolution and sensitivity, allowing scientists to explore complex biomolecular systems and advanced materials in greater detail. This innovative magnet expands on Bruker’s LTS-HTS hybrid magnet architecture. Notably, it retains the physical dimensions and cryogen consumption levels found in Bruker’s previous 1.2 GHz magnets, with only a modest increase in stray field radius.

Image Source: Zacks Investment Research

Testing for applications at the 1.3 GHz proton frequency employed five distinct NMR probe configurations, including a 3 mm TXI liquids room-temperature probe, a 5 mm TXO liquids CryoProbe, and various solid-state magic-angle spinning (MAS) probes. These validations confirmed the spectrometer’s capabilities, showing high-resolution liquid and solid NMR spectra at 1.3 GHz, showcasing remarkable sensitivity and potential for molecular and materials research breakthroughs.

Industry Outlook for Bruker

According to a research report, the global NMR spectroscopy market was valued at $760.7 million in 2023 and is anticipated to expand at a compound annual growth rate of 5.1% through 2030. Growth is driven by increased funding and investment in biomedical research utilizing NMR spectroscopy, as well as the rising demand for affordable generic medications.

Recent Developments at Bruker

Additionally, Bruker has introduced a state-of-the-art Fourier 80 multinuclear benchtop FT-NMR spectrometer, dubbed the ‘Multi-Talent’ configuration. This advanced system signifies a substantial advancement in permanent magnet-based FT-NMR technology, designed to provide enhanced versatility in benchtop FT-NMR multinuclear analyses tailored for academic and industrial researchers.

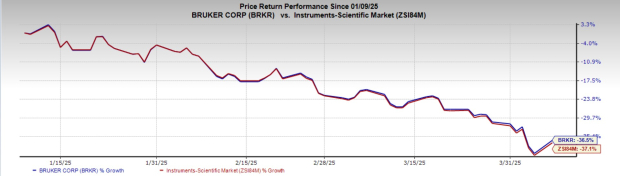

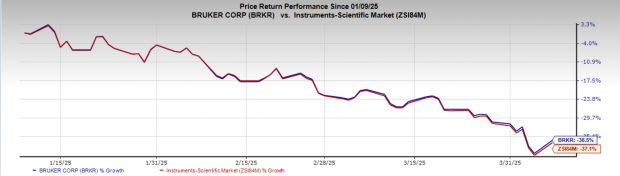

Bruker’s Stock Performance Overview

Over the last three months, shares of Bruker have declined by 36.5%, in comparison to a 37.1% drop in the broader industry.

Zacks Rank and Notable Comparisons

Currently, Bruker holds a Zacks Rank of #3 (Hold).

Within the medical sector, better-ranked stocks include Hims & Hers Health (HIMS), Boston Scientific (BSX), and Abbott (ABT), each rated as a Zacks Rank #2 (Buy). For a comprehensive list of Zacks’ top picks, refer to this link.

Hims & Hers Health maintains a constant 2025 EPS estimate of 63 cents amid a significant 90.9% rise in share price over the past year, while the industry saw a 13.6% decrease. Its earnings yield stands at 2.4%, surpassing the industry’s negative 7.9% yield. The company has exceeded earnings expectations in two of the last four quarters.

Boston Scientific has risen by 33.3% over the past year, with 2025 EPS estimates holding steady at $2.85. The company consistently beats earnings estimates, achieving an average surprise of 8.3% across the last four quarters.

Abbott’s 2025 EPS estimates remain unchanged at $5.15, with an 11% increase in shares compared to the industry’s nominal growth. The company’s earnings yield is 3.9%, contrasting with industry rates, while Abbott has surpassed earnings expectations in three of four recent quarters.

Explore Zacks Recommendations for Strategic Investments

We’re not kidding.

Several years ago, we surprised our members by offering them a 30-day access to all our stock picks for only $1. There’s no obligation to spend anything more.

Many have benefitted from this offer, while some hesitated thinking there must be a catch. Yes, there is a reason. We seek to introduce you to our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, etc., which successfully closed 256 positions with double- and triple-digit gains in 2024 alone.

Abbott Laboratories (ABT) : Free Stock Analysis Report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Bruker Corporation (BRKR) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.