BTIG Initiates ‘Buy’ on Amentum Holdings as Fund Sentiment Surges

On April 15, 2025, BTIG began coverage of Amentum Holdings (LSE:0AD9) with a Buy recommendation.

Fund Sentiment Overview

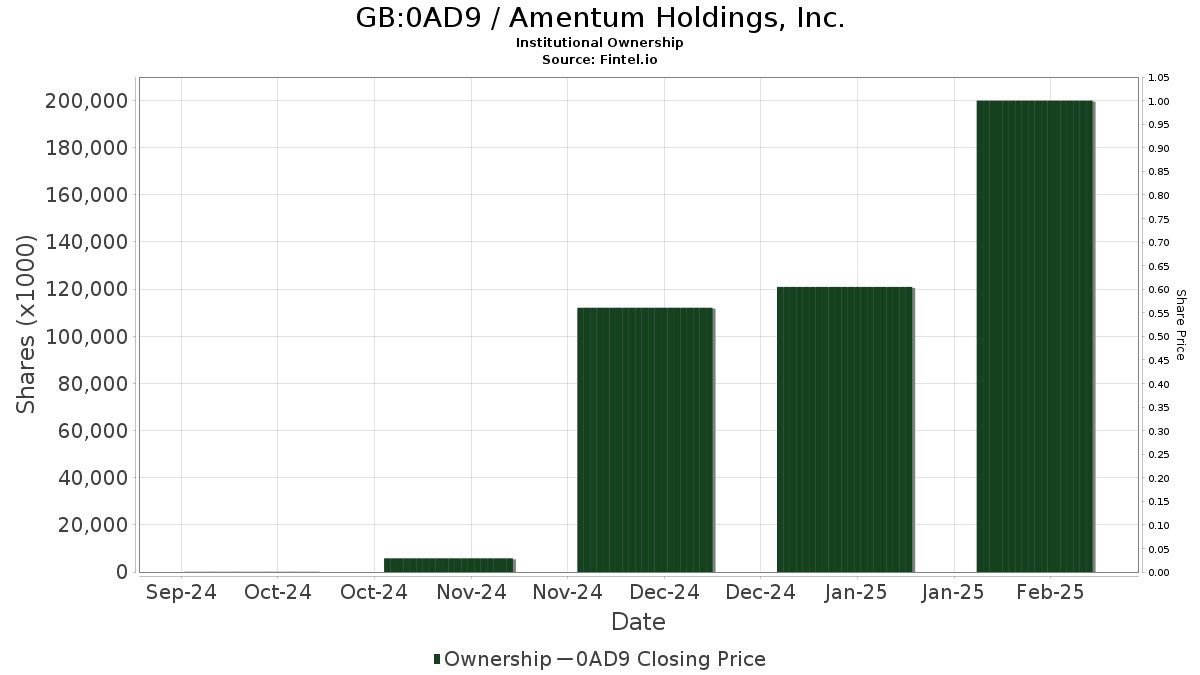

A total of 942 funds and institutions currently report positions in Amentum Holdings. This marks an increase of 42 owners or 4.67% in just the last quarter. The average portfolio weight dedicated to 0AD9 among all funds is 0.13%, which has seen a substantial increase of 61.43%. In the past three months, the total shares owned by institutions grew by 78.14%, reaching 211,135K shares.

Shareholder Activity

American Securities is the largest shareholder, holding 43,894K shares, which constitutes 18.04% ownership of Amentum Holdings.

Kovitz Investment Group Partners owns 14,787K shares, representing 6.08% ownership. Notably, the firm’s recent filing shows a significant increase from the prior 135K shares, marking a remarkable growth of 99.09%. Kovitz also raised its portfolio allocation in 0AD9 by 3,275.99% during the last quarter.

Invesco holds 13,856K shares, equivalent to 5.70% ownership. This is up from 7,801K shares in its previous filing, reflecting a 43.70% increase, although the firm reduced its portfolio allocation in 0AD9 by 89.98% over the last quarter.

The IJR – iShares Core S&P Small-Cap ETF maintains 7,997K shares, amounting to 3.29% ownership.

Primecap Management owns 6,414K shares, representing 2.64% ownership. This figure reflects an increase from 5,271K shares previously, representing a 17.82% lift. However, the firm also reduced its portfolio allocation in 0AD9 by 16.42% in the last quarter.

Fintel is known for its extensive research capabilities, serving individual investors, traders, financial advisors, and small hedge funds.

Its comprehensive data includes fundamentals, analyst reports, ownership statistics, fund sentiment, options analysis, insider trading, options flow, unusual options trades, and more. Fintel’s exclusive Stock picks utilize advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.