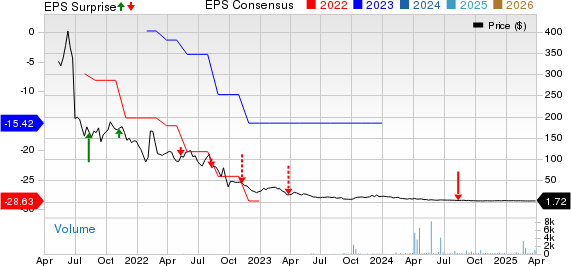

Better Choice Company Inc. Shows Financial Gains Amid Stock Decline

Shares of Better Choice Company Inc. (BTTR) fell by 9.4% following the company’s earnings report for the quarter ending December 31, 2024. In contrast, the S&P 500 index experienced a smaller decline of 1.9% during the same period. Over the last month, BTTR’s stock yielded a 12.4% increase, while the S&P 500 saw a 4.3% decrease, indicating significant volatility and deviations from the overall market trend.

See the Zacks Earnings Calendar to stay ahead of market-making news.

For the fourth quarter of 2024, Better Choice reported a net loss per share of $0.50, demonstrating a significant 97% improvement from the prior year.

The Financial Results: Revenue and Losses

The company experienced a 26% rise in revenue year-over-year, reaching $7.2 million. Losses also narrowed notably, with the net loss decreasing 90% to $1.6 million. Adjusted EBITDA for the quarter stood at a negative $0.7 million, reflecting improvements in cost management and operational efficiencies. Gross margin significantly expanded by 2,705 basis points to 36%, fueled by increased sales volumes and better terms with manufacturing partners.

Key Performance Metrics Show Improvement

The company has shifted focus towards higher-margin digital sales, with a reported 32% year-over-year growth in sales through Amazon and Chewy. This quarter marked the fourth consecutive increase in gross margin, supported by enhanced operational leverage and cost strategies. Inventory was lowered by over 40% year-over-year without sacrificing service levels, which remained above 95%. Additionally, a gain of $6.2 million from debt extinguishment improved the balance sheet, increasing working capital from $2.5 million to $7.9 million compared to the previous year.

Management’s Insight on Strategic Advancements

CEO Kent Cunningham described 2024 as a pivotal year for Better Choice. He highlighted substantial growth in essential e-commerce platforms, successful promotional events like Black Friday, and expanding market presence in the Asia-Pacific region, particularly with the launch of Halo on Chewy Canada. CFO Nina Martinez supported these views, emphasizing sustainable gross margin growth, careful marketing investments, and an asset-light manufacturing strategy as pivotal in improving profitability.

Understanding the Key Drivers of Performance

Improved financial performance stemmed from strategic withdrawals from unprofitable channels, a focus on high-profit e-commerce partnerships, stringent cost controls, and scaling operations in international markets. Gains in gross margins were supported through disciplined spending and an optimized product portfolio, particularly with plant-based offerings. The reduction of debt and settlements with suppliers also contributed to lowering losses and fortifying the balance sheet.

Full-Year Performance Overview

For the full year 2024, Better Choice saw a reduced net loss of $0.2 million compared to a significant $22.8 million loss in 2023. Loss per share improved dramatically, dropping to 10 cents from $32.29, while the adjusted EBITDA was reported at a negative $1.9 million. Yearly revenues decreased by 9% to $35 million due to strategic exits from non-core, less profitable areas. Nevertheless, revenue from primary digital channels rose by 8%, and international sales increased by 18% year-over-year.

Recent Developments and Future Prospects

After the year’s end, Better Choice finalized an agreement to sell its Halo Asia business for $6.5 million in cash at closing, along with a 3% royalty on future sales over five years, ensuring a minimum of $1.7 million. Furthermore, the company agreed in principle to a 5.5% royalty on sales of the Halo Elevate brand in Asia. The board has also approved a strategy to distribute up to 55% of the annual royalties from Halo to shareholders as of December 31.

Additionally, Better Choice anticipates completing its acquisition of SRx Health Solutions in April. This deal, approved by the shareholders of both firms, is expected to establish a leading global health and wellness platform, offering synergies and new growth opportunities for both pet and human health products.

Highlighted Stock Picks for Future Growth

From thousands of stocks analyzed, five Zacks experts selected their favorites projected to soar by 100% or more in the upcoming months. Among them, Director of Research Sheraz Mian has identified one particular company with considerable upside potential.

This company focuses on millennial and Gen Z demographics, having generated nearly $1 billion in revenue last quarter. A recent pullback presents a timely investment opportunity. While not every pick guarantees success, this one could surpass previous high-performing stocks, such as Nano-X Imaging, which rose 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Better Choice Company Inc. (BTTR): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.