Co-authored with “Hidden Opportunities.”

Value investing entails buying undervalued businesses when the market shuns them, and holding onto them for the long haul. It’s an approach that has underpinned some of Warren Buffett’s most significant and profitable investments. These investments were made when others were fleeing, making them the ultimate contrarian bets of Buffett’s legendary career.

Warren Buffett has recounted during the 2008 financial crisis, when everyone else was abandoning the stock market, he secured shares in Bank of America (BAC) and Goldman Sachs (GS), which subsequently became reliable sources of passive income for years. Such timely and shrewd investment decisions underscore Buffett’s sage advice of not succumbing to market panic.

“In the 58 years we’ve been running Berkshire, I would say there’s been a great increase in the number of people doing dumb things, and they do big dumb things,” he said. The reason they do it is because, to some extent, they can get money from people so much easier than when we started.” –

Warren Buffett.

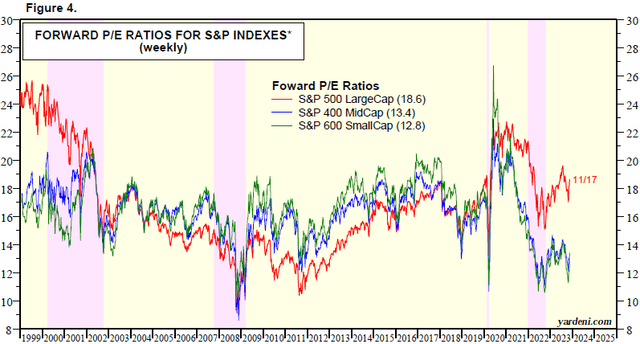

Despite the recovery of the markets post-2008, there remains a dichotomy with a select few companies witnessing dizzying valuations, while the remainder of the index continues to house undervalued opportunities, ripe for the picking.

Amidst this backdrop, let’s delve into two overlooked and battered picks, standing outside the limelight of the top-tier stocks.

Pick #1: BTI – Yield 9.7%

Businesses, much like individuals, sometimes don’t fit the neat contours of accounting. Take the case of Google’s $12.5 billion purchase of Motorola Mobility in 2011, later selling it for a loss. Despite the apparent flop, Google retained a trove of mobile patents generating significant cash flows, ultimately proving the investment’s worth.

Similarly, Google’s $50 million acquisition of Android in 2005 belies its subsequent ascent to a market share of 72% and a substantial revenue stream from the Google Play Store. Such examples underscore Buffett’s frequent dismissal of book value as an immaterial metric.

Enter British American Tobacco p.l.c. (BTI, BTAFF), commonly known as BAT, currently making headlines for announcing a £25 billion impairment charge related to its U.S. brands. While such write-downs may seem ominous, they present a pragmatic alignment of a brand’s value with its potential sell-off price.

The economic value of income-generating assets like brands may transcend conventional book value adjustments, often tethered closely to their ability to generate cash flow rather than market valuations. Notably, combustible tobacco remains a stable, profit-churning business, sustaining robust cash flows.

Significant Benefit from Impairment

An impairment, primarily a paper loss, doesn’t portend the disposal of assets at throwaway prices; rather, these brands are poised to yield substantial free cash flow in the foreseeable future. Furthermore, such impairments often carry a silver lining being tax-deductible.

Besides, BAT’s 29% stake in ITC, with a conservative book value of £1.9 billion, has burgeoned to over £16 billion. A potential disposal could potentially offset the impairment and substantially reduce the company’s net debt.

FY 2023 Guidance Remains Intact

BAT unequivocally affirms its FY 2023 guidance, envisioning modest growth, propelled by burgeoning non-combustible segments and its foothold in emerging markets. Such is the market’s fixation on the U.S. operations that the U.S. government recently deferred the menthol ban, underscoring the company’s resilience across diverse geographies.

In essence, for investors, these overlooked opportunities aren’t ‘Diamonds in the Rough’ but rather ‘Diamonds in the Buff,’ belying their obscured status with robust fundamentals that warrant a relook.

Unlocking Unseen Value in the Market

Amidst headwinds and skepticism in the market, opportunities often hide in plain sight. In these times of ever-present worry, hunting out undervalued treasures is akin to miners prospecting for nuggets of gold. British American Tobacco (BTI) and Royce Value Trust (RVT) are two such hidden gems, presenting compelling investment prospects for the astute income-seeker.

Pick #1: BTI – Yield 9.7%

British American Tobacco (BAT), the global giant in tobacco, faces an interesting conundrum. Driven by health-awareness campaigns and stark regulatory changes, there is evident decay in the combustible business in developed nations; however, this decay is not an immediate threat. Instead, it is the extended opportunity window for the growth and expansion of non-combustibles within the company.

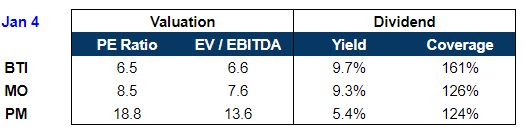

BAT currently trades at an extremely low valuation on forward earnings while sporting a large 9.7% yield. Among tobacco peers, BAT maintains the lowest 62% dividend payout ratio, indicating adequate safety to the income stream and strong prospects for continued dividend growth in the coming years.

Accounting regulations require companies to carry out regular impairment tests, and BAT’s current announcement presents significant tax offsets without any change to the cash flow generation from its legacy brands or affecting the dividend safety. The steep irrational sell-off presents an attractive opportunity to load up on this 9.7% yield.

Pick #2: RVT – Yield 7.5%*

In the current economic climate, Small Cap stocks seem to be unfairly undervalued. The record pace of rate hikes by the Federal Reserve and persistent recession forecasts by Wall Street has led to a significant disconnect between the valuations of Small Cap versus Large Cap stocks.

The SmallCap sector is currently trading at valuations well below their historic levels, appearing to be priced as though the recession were already here. Bargain buyers and income investors see huge potential in the SmallCap sector and await valuation improvement, which may result from rate cuts or better earnings announcements from SmallCap firms.

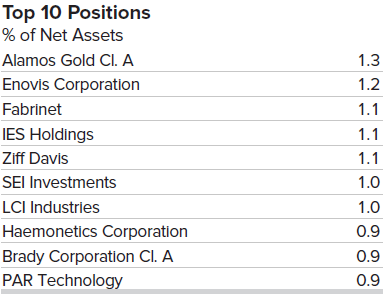

Royce Value Trust (RVT) is a time-tested closed-end fund, run by managers who pay meticulous attention to small-company balance sheets. 60% of the fund’s assets are invested across industrials, financials, and information technology, with a portfolio of 488 holdings from the small-cap segment of the market.

RVT was born in 1986, an era with high inflation, unemployment, and a weak economic outlook, making it one of the few funds that have demonstrated long-term portfolio resilience and shareholder returns through a wide range of economic challenges. Comparing the performance of RVT and the S&P 500 since January 2001, the fund is well-positioned to repeat this in the coming years.

RVT has a variable distribution policy whereby its quarterly payment is adjusted based on the NAV at the end of the trailing four quarters. In the nine months of FY 2023, RVT’s distributions were composed of 0.5% income, 15.3% short-term gains, 84.2% long-term gains, and 0% ROC.

Not only is RVT composed of undervalued companies from an undervalued sector, but the fund itself trades at a large 12% discount to NAV, making every invested dollar automatically work harder to secure returns.

Conclusion

In the world of investing, some opportunities beg to be seized, and these rarely come at peak price points. Understanding the nuances in the market and recognizing undervalued investments is essential to build a resilient portfolio.

“Some people should not own stocks at all because they just get too upset with price fluctuations. If you’re gonna do dumb things because your stock goes down, you shouldn’t own a stock at all.” – Warren Buffett.

The markets clearly show a disconnected recovery where the bulk of it remains undervalued with respect to its underlying earnings. BTI and RVT present two such deeply discounted picks that we are buying to collect steady dividends through the market’s irrational phase.

At High Dividend Opportunities, we have been steady buyers of passive income, and our “model portfolio” of +45 picks currently yields ~9.7%. They provide a reliable income stream as we patiently await market normalization during this unbalanced recovery. Take swift action and capitalize on these bargains before they vanish!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.