Investing in Dividend Stocks: Coca-Cola, ExxonMobil, and York Water

Flying cars? Vacationing in space? The future is bound to look different in decades to come, especially when you consider that Blockbuster Video was a go-to destination 30 years ago. However, some aspects of investing remain unchanged, particularly the value of dividends. Investors focused on enhancing their financial stability through dividend-paying stocks are making prudent choices. For those aiming for consistent passive income over time, now is an excellent opportunity to acquire shares in the well-established dividend stocks: Coca-Cola (NYSE: KO), ExxonMobil (NYSE: XOM), and York Water (NASDAQ: YORW).

Where to invest $1,000 right now? Our analyst team recently identified their top 10 stocks to buy. Learn More »

Savor the Opportunity with Coca-Cola

Coca-Cola has a rich history dating back nearly 140 years, proving the beverage’s lasting popularity. While consumer preferences have shifted toward healthier options, Coca-Cola has adapted its product line accordingly. This adaptability suggests that the company will continue to innovate in response to future changes in consumer taste.

While there’s no guarantee that dividends will persist indefinitely, Coca-Cola’s status as a Dividend King is significant. The company has consistently raised its dividend for over 60 years. With a substantial position in Berkshire Hathaway and a forward dividend yield of 2.9%, Coca-Cola is a strong candidate for long-term investors.

Explore Potential with ExxonMobil

Despite the rise of renewable energy sources, the reality is that fossil fuels will remain a crucial part of the energy sector for the foreseeable future. Investors looking to add passive income should consider ExxonMobil Stock, which currently boasts a forward yield of 3.6%.

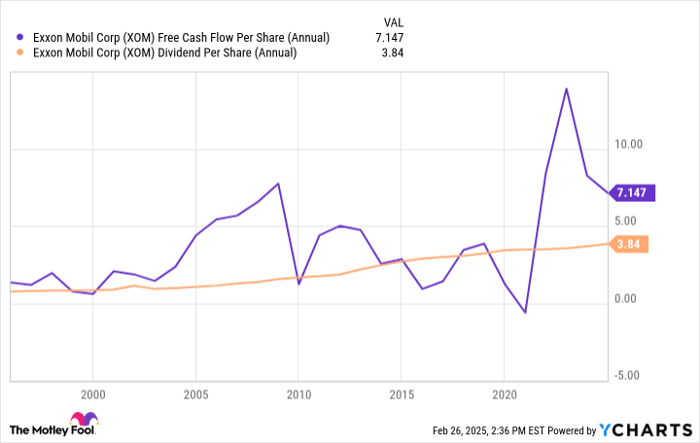

With a remarkable history of 42 consecutive years of dividend increases, ExxonMobil has rewarded its shareholders with dividends for over a century. The company, spanning the energy value chain, generates strong free cash flow despite energy market fluctuations. Notably, it has effectively sourced dividend payments during the past 30 years.

XOM Free Cash Flow Per Share (Annual) data by YCharts.

Interestingly, ExxonMobil forecasts a staggering $165 billion in excess cash after dividend payments from 2025 to 2030. This financial buffer enables the company to pursue growth opportunities that could enhance its ability to sustain dividend payments for years to come.

Steady Returns with York Water

High-yield dividend stocks often attract investors, but companies with solid business models also hold significant appeal. York Water, a utility provider in Pennsylvania since 1816, exemplifies this reliability through consistent dividend payouts.

Risk-averse investors tend to favor utilities like York Water, which offers a forward yield of 2.6%. Operating in regulated markets, York Water enjoys predictable cash flows, supported by rates approved by the Pennsylvania Public Utility Commission. This predictable revenue stream allows the company to effectively manage capital expenditures and dividends.

YORW EPS Diluted (Annual) data by YCharts.

York Water has adopted a cautious approach to dividend distribution since 2010, growing its diluted earnings per share faster than its dividend. The company has maintained a conservative average payout ratio of 58.3% from 2015 to 2023, further demonstrating its commitment to sustainable dividends.

Which Dividend Stock Suits Your Needs?

Coca-Cola stands out as a consumer staples powerhouse worthy of exploration for those seeking dividend opportunities. Investors interested in the energy sector should closely examine ExxonMobil Stock. Conversely, for those prioritizing minimal risk, York Water represents a viable investment.

No matter which stock you choose, Coca-Cola, ExxonMobil, and York Water are poised to reward their shareholders for the foreseeable future.

Don’t Miss This Potential Investment Opportunity

Have you ever felt like you missed out on buying top-performing stocks? Now’s the time to reconsider.

Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies they believe are on the verge of significant growth. If you worry you’ve missed your chance to invest, seize the moment before it’s too late. Consider these compelling returns:

- Nvidia: An investment of $1,000 in 2009 could have yielded $323,920!*

- Apple: An investment of $1,000 in 2008 would now be worth $45,851!*

- Netflix: An investment of $1,000 in 2004 is now worth $528,808!*

Currently, we are providing “Double Down” alerts for three exceptional companies. Opportunities like this don’t come often.

Continue »

*Stock Advisor returns as of February 28, 2025

Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.