The Rising Tide of Builder Sentiment

Builders are reveling in a newfound sense of optimism as confidence in the market for newly constructed single-family homes surged above the breakeven point in March. This crescendo marks the fourth consecutive monthly gain and hints at a robust tide of demand in the housing sector. Swirling around this buoyant sentiment is a whirlwind of factors – from a persistent shortage of existing inventory nudging buyers towards new constructions, to unwavering mortgage rates that languish below previous peaks witnessed last fall.

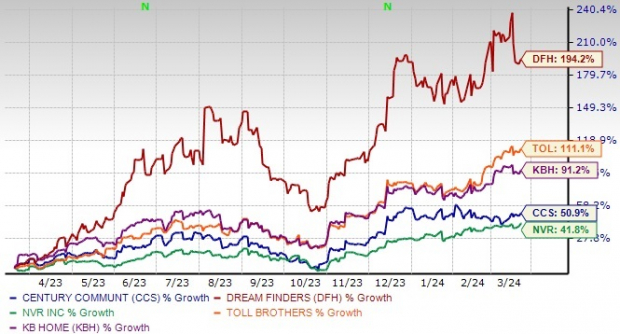

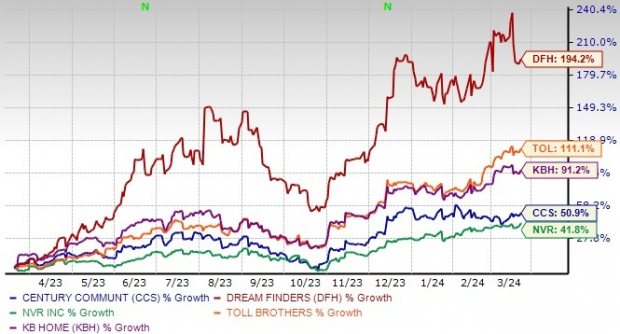

This escalating optimism has paved the way for notable players like Century Communities, Inc. CCS, Dream Finders Homes, Inc. DFH, NVR, Inc. NVR, Toll Brothers, Inc. TOL, and KB Home KBH to revel in the glow of their fundamental strength and the tailwinds propelling the market upwards.

Steering Through the Storm: Navigating Expected Rate Cuts and Rising Costs

The Federal Reserve looms on the horizon, anticipated to announce future rate cuts in the second half of 2024. As the winds of change whisper lower financing costs, there’s a siren call to lure in prospective buyers into the market. However, as the building activity surges, builders find themselves riding the waves of challenges brimming with rising material prices, particularly in the realm of lumber.

Despite mortgage rates dipping below 7%, builders are treading cautiously on reducing home prices to entice sales. In March, only 24% of builders reported price cuts – a decline from 36% in December 2023 – marking the lowest share since July 2023. The delicate dance of offering sales incentives remains steady, with 60% of builders extending some form of incentive in March, a trend that has endured between 58% and 62% since September.

As per Carl Harris, NAHB chairman, the clarion call of buyer demand remains strong, with a growing cohort of consumers primed to storm the market if mortgage rates continue their descent. Amidst this fertile ground, builders must navigate through choppy waters marked by a shortage of buildable lots, dearth in skilled labor, and newer restrictive codes – all adding to the burgeoning costs of construction.

The Crest of Top Homebuilding Stocks

Embarking on an odyssey to invigorate your portfolio amidst the surge in demand seems not just prudent but necessary. Armed with insights from the Zacks Stock Screener, five top high-fliers with a Zacks Rank #1 (Strong Buy) or 2 (Buy) beckon. The aegis of a top Zacks Rank signifies these stocks have basked in positive estimate revisions – a harbinger of accelerated price appreciation.

Image Source: Zacks Investment Research

CCS: Making its stand from the Greenwood Village, Colorado, tapestry, this homebuilder donning a Zacks Rank #1 has surged 50.9% over the past year.

CCS’ earnings per share (EPS) estimates for 2024 bloomed from $8.78 to $10.06 in the past 60 days. With earnings outshining the Zacks Consensus Estimate for the trailing four quarters by an average of 49.2%, 2024 promises a 24.4% year-over-year growth.

DFH: From the Jacksonville, FL shores emerges a Zacks Rank #1 gem, with DFH shares swelling by 194.2% in the prior year.

Dream Finders Homes’ EPS estimates for 2024 have ascended from $2.81 to $3.14 in the last 30 days. Having eclipsed the Zacks Consensus Estimate in every quarter by an average of 144.8%, 2024 beckons with a 12.5% year-over-year growth.

NVR: Headquartered in Reston, VA, this homebuilder carrying a Zacks Rank #1 has soared by 41.8% over the past year.

NVR’s EPS estimates for 2024 have ascended from $471.75 to $484.48 in the preceding 30 days. With earnings eclipsing the Zacks Consensus Estimate in every trailing quarter by an average of 8.1%, 2024 visions a 4.6% year-over-year growth.

TOL: Hailing from Horsham, PA, this Zacks Rank #1 behemoth has witnessed a meteoric rise of 111.1% over the past year.

TOL’s EPS estimates for 2024 ascended from $12.23 to $13.72 in the prior 30 days. With a stellar track record of surpassing the Zacks Consensus Estimate in every quarter by an average of 30.2%, 2024 forecasts an 11% year-over-year growth.

KBH: Nestled in Los Angeles, CA, this Zacks Rank #2 contender has ascended by 91.2% in the last year.

KBH’s EPS estimates for 2024 grew from $7.52 to $7.59 in the past 60 days. With earnings surpassing the Zacks Consensus Estimate whilst maintaining an average of 32.4% over the trailing four quarters, 2024 is poised for an 8% year-over-year growth.

Zacks Names #1 Semiconductor Stock

It’s merely 1/9,000th the size of NVIDIA which soared over +800% since its endorsement. While NVIDIA still holds its ground, this nascent chip stock harbors significant potential for exponential growth.

Promising robust earnings expansion and an ever-expanding consumer base, it stands at the vanguard of catering to the insatiable hunger for Artificial Intelligence, Machine Learning, and the Internet of Things. Forecasts predict global semiconductor manufacturing to swell from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock Now for Free >>

To peruse this article on Zacks.com, click here.

Views and opinions articulated are those of the writer and may not align with those of Nasdaq, Inc.