Walt Disney Company (DIS) reported a revenue breakdown from its Entertainment segment, contributing 45.2% to total revenues in Q2 fiscal 2025. Within this segment, Direct-to-Consumer (DTC) offerings, including Disney+ and Hulu, accounted for 57.3% of Entertainment revenues, with Disney+ boasting 126 million subscribers and Hulu having 54.7 million viewers.

Disney is set to launch “ESPN,” enhancing its DTC services, and plans to invest in local content internationally, aiming to boost user experience through personalization features. The company faces stiff competition from Netflix and Comcast, both of which have seen success in growing subscriber bases with diverse content strategies.

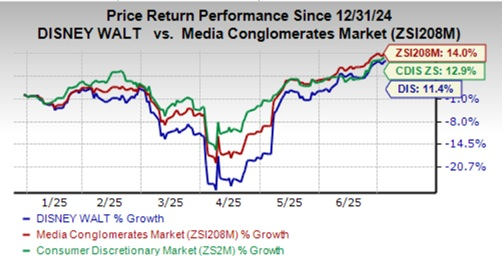

This year, DIS shares have risen by 11.4%, underperforming compared to sector averages. Currently, DIS trades at a trailing 12-month Price/Earnings ratio of 21.60, below the industry average of 24.40. The Zacks Consensus Estimate for Disney’s 2025 earnings is $5.78 per share, marking a 16.3% increase from the previous year.