As the market rides the bullish wave, it’s prime time to delve into the Bull Call Spread Screener.

A Bull Call Spread serves as an options strategy employed by traders anticipating a surge in the price of an underlying stock in the near future.

Understanding the Bull Call Spread

In this maneuver, a trader procures a call option and simultaneously offloads a further out-of-the-money call option, adhering to specific conditions:

- Both call options must pertain to the same underlying stock

- Both call options must share the same expiration date

- Both call options must feature the same number of options

The initial position generates a net debit given that the strike price of the sold call exceeds that of the bought call.

Similar to a traditional long call, the Bull Call Spread reaps profits as the underlying stock’s value ascends.

However, the distinguishing factor lies in the fact that the upside potential is constrained by the short call.

The short call aids in offsetting some costs but at the expense of capping profits.

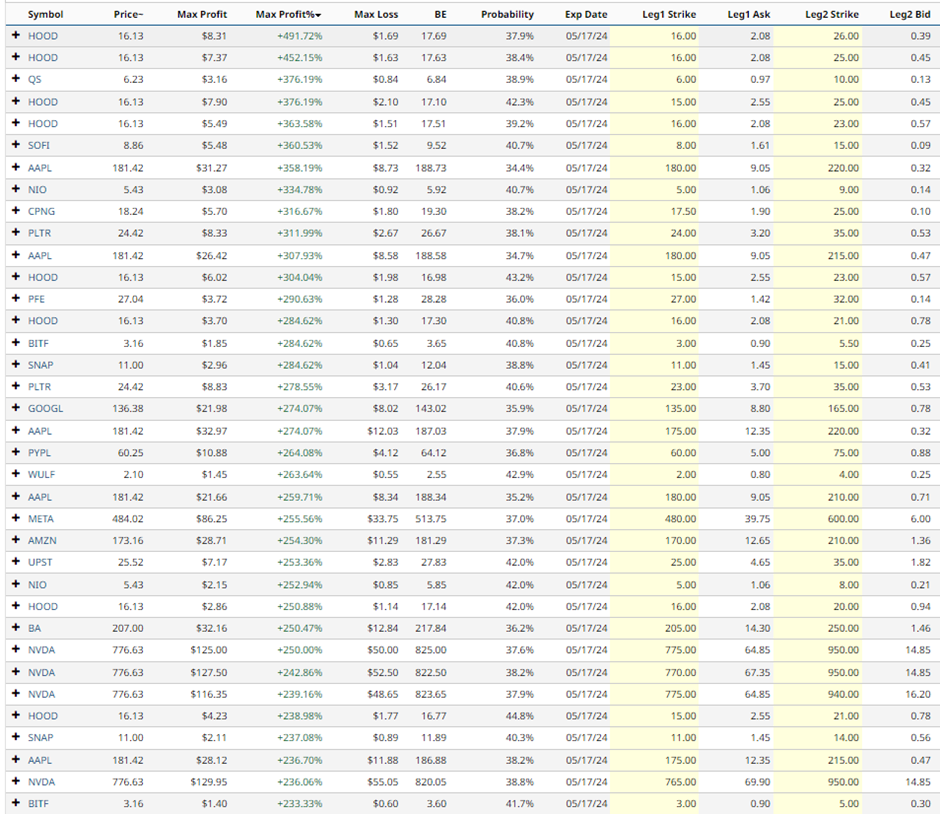

Exploring Barchart’s Bull Call Spread Screener Results

Let’s delve into the insights provided by Barchart’s Bull Call Spread Screener for February 29th:

Noteworthy Iron Condor trades are detected on stocks like HOOD, SOFI, AAPL, NIO, PLTR, and PFE through the scanner’s analysis.

To refine our search, let’s filter for bull call spreads on stocks boasting a Buy rating and a Market Cap exceeding 40 billion:

Examining Trade Examples

WMT Bull Call Spread Overview

Let’s scrutinize the primary listing – a bull call spread linked to Walmart (WMT).

The trade entails acquiring the May expiry $61.67 strike call and vending the $70 strike call.

This spread’s purchase price hovers around $1.06 or $106 per contract, signifying the maximum potential loss as well.

Mitigating Potential Losses

Bull call spreads represent trades with defining risk parameters, offering built-in risk management.

The maximum conceivable loss for the WMT scenario stands at $106, whereas the Citigroup call spread is capped at $161.

Consider implementing a stop loss at 25-30% of the maximum loss for each trade while monitoring key support levels and moving averages diligently.

Kindly take heed that options trading carries inherent risks, with the potential for investors to lose the entirety of their investment.

This article serves educational purposes only and does not provide trading advice. Remember to conduct thorough research and consult your financial advisor before making any investment decisions.