Amazon (AMZN) Surges Past Previous Highs, Signaling Strong Growth Ahead

Over the past three months, AMZN stock has jumped 20%, not only surpassing its 2021 highs but also outperforming many of its major tech competitors, known as the Magnificent 7.

Investors are responding positively as Amazon transitions into a mature company with significant earnings growth. The online retail and cloud giant is heavily investing to capture a substantial portion of the quickly growing artificial intelligence market, even challenging Nvidia in the AI chip arena.

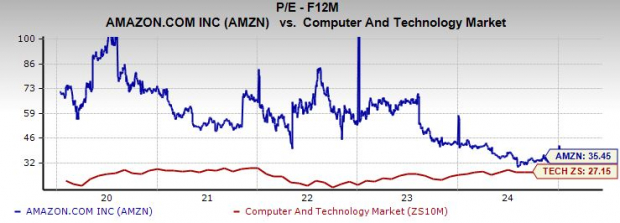

Trading at all-time highs, Amazon’s current valuation is among its lowest on record due to increasing earnings.

Potential buyers may find the current price attractive since Amazon appears priced low after several underwhelming years by its own standards.

Reasons to Consider Amazon Stock in 2025

Currently, Amazon commands nearly 40% of the U.S. e-commerce market, dwarfing Walmart’s 7% share. Additionally, Amazon Web Services (AWS) dominates the global cloud infrastructure market with a 31% stake, outpacing Microsoft’s 20% and Alphabet’s 12%.

Amazon Prime is also expanding its reach in streaming, positioning itself to better compete with Netflix. Revenues from its high-margin AWS and advertising divisions, along with a focus on efficiency, are propelling Amazon’s earnings growth.

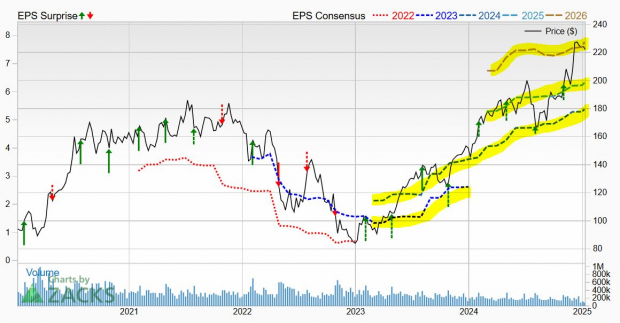

Image Source: Zacks Investment Research

From FY20 to FY23, Amazon’s revenue increased by around $200 billion, culminating in a remarkable $574.79 billion in 2023.

In a significant turnaround, AMZN moved from a loss of -$0.27 per share in 2022 to a profit of +$2.90 per share in 2023, reviving its impressive earnings growth following last year’s setback.

The earnings outlook for FY24 has jumped 50% in the last year, while projections for FY25 are over 30% higher. Recent estimates from Zacks show Amazon’s earnings per share (EPS) figures significantly exceeding the consensus, giving AMZN a Zacks Rank #1 (Strong Buy).

On average, Amazon has surpassed bottom line estimates by 25% over the past four quarters.

Image Source: Zacks Investment Research

Predictions indicate Amazon’s earnings will grow by 82% in 2024 and 20% in FY25, reaching $6.32 per share. Additionally, sales are expected to rise 11% in both FY24 and FY25, reaching approximately $706.50 billion, which is a $130 billion increase compared to FY23.

As Amazon transitions into a more mature tech entity, it anticipates a stable growth of low double digits over the next four years, down from its previous rapid expansion. However, it’s crucial to keep in mind that maintaining large annual percentage increases becomes challenging as the company’s base grows.

Why Amazon is a Top AI Investment

Amazon plans to invest over $100 billion in data centers and related initiatives to boost its AI capabilities. Recently, the company announced an additional $4 billion investment in AI firm Anthropic, doubling its commitment.

This new funding will help Anthropic enhance its Claude AI assistant, positioning Amazon to compete against leading AI services such as ChatGPT.

In December, Amazon unveiled plans for an “Ultracluster,” an extensive AI supercomputer comprised of thousands of its proprietary Trainium chips. These chips are designed specifically for AI training and analysis, aiming to provide high performance at lower costs.

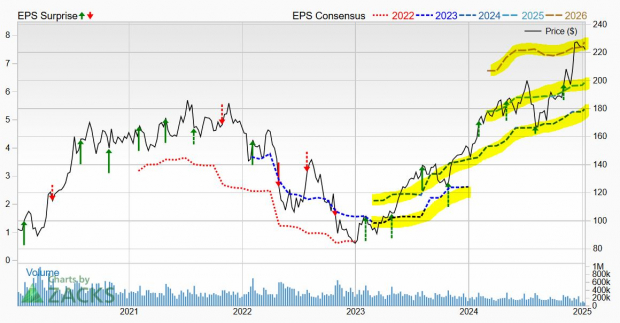

Image Source: Zacks Investment Research

Large tech companies, including Apple (AAPL) and Databricks, are now utilizing Amazon’s latest chips. The tech giant aims to strengthen its position in the AI chip market, directly competing with Nvidia (NVDA).

According to Amazon, its new Trainium2-based Amazon EC2 Trn2 instances are especially tailored for generative AI, claiming to be the most powerful instances for developing and deploying AI models, achieving up to four times their predecessors’ performance while lowering training costs by 50%.

Now is the Time for Both Traders and Long-Term Investors to Eye Amazon

Over the past 20 years, Amazon’s stock has risen an astonishing 10,000%, far surpassing the tech sector’s 800% increase. In the last decade, AMZN climbed 1,400%, outpacing other major firms like Apple, Meta, Microsoft, and Alphabet. However, its 135% rise over the past five years puts it on par with the tech industry.

Image Source: Zacks Investment Research

Recently, Amazon’s stock has jumped significantly, increasing 20% compared to the tech sector’s 6% rise over the same period. This surge has led Amazon to reach new all-time highs, firmly breaking above its 2021 records.

Currently, Amazon is trading slightly below its 21-day moving average and near neutral RSI levels.

In terms of valuation, Amazon’s price is over 90% below its peak and more than 50% discounted compared to its 10-year average of 35.5X forward earnings. Its price-to-earnings-to-growth (PEG) ratio suggests a 30% value compared to the wider tech sector.

Image Source: Zacks Investment Research

Amazon’s investments in AI, efforts to integrate advanced technologies across its operations, and competition in the AI chip market solidify its standing as a leading long-term investment in the AI space.

Wall Street’s consensus indicates strong support for Amazon, with 46 out of 50 brokerage ratings recommending it as a “Strong Buy.”

Get Comprehensive Access for Only $1

We’re serious.

In a surprising move, we offered our members 30-day access to all our stock picks for just $1. No further obligations were necessary.

Many took advantage of this offer, while others suspected there was a catch. The reason behind this is simple: we want you to familiarize yourself with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and many more, which yielded 228 double- and triple-digit gains in 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.