A Market Darling: ARM Holdings Striking Gold

Arm Holdings, a Zacks Rank #1 (Strong Buy), has been making waves in the semiconductor industry with its stellar performance. Benefiting from the robust semiconductor stock market, the British chip designer’s U.S. IPO last year marked the beginning of its upward trajectory. Recently hitting a new high, ARM stock is showcasing strong resilience and leadership in the market.

The Strength of Zacks Technology Services Industry

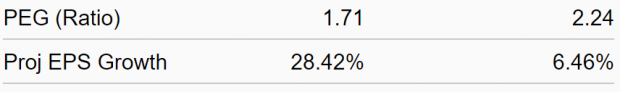

As part of the Zacks Technology Services industry group, ARM Holdings is positioned in the top 35% out of over 250 Zacks Ranked Industries. Historical research indicates that a stock’s industry grouping contributes significantly to its price appreciation. Being in the top 50% of Zacks Ranked Industries, such as ARM’s group, indicates a high probability of outperforming the market in the next 3 to 6 months.

Image Source: Zacks Investment Research

Investing in leading industry groups can offer a competitive edge, with industry performance significantly influencing stock returns. By focusing on top-ranked stocks within these industries, investors can enhance their stock-picking success.

Unlocking the Potential: Company Overview

Arm Holdings provides microprocessors, systems intellectual property, and graphics processing units for various markets, including automotive, consumer technologies, and the Internet of Things. With a global presence, the company has been a cornerstone of the semiconductor industry since its establishment in 1990 in the United Kingdom.

Companies involved in cutting-edge artificial intelligence technology have been in high demand, driving interest in chip producers. Notably, Nvidia’s significant investment in Arm Holdings underscores the industry’s recognition of ARM’s prowess. Despite a failed acquisition attempt by Nvidia in the past, Arm Holdings remains a beacon of innovation and strength in the market.

SoftBank’s privatization of Arm Holdings in 2016, followed by its return to the public market last year, speaks to ARM’s ability to weather storms and emerge stronger than ever.

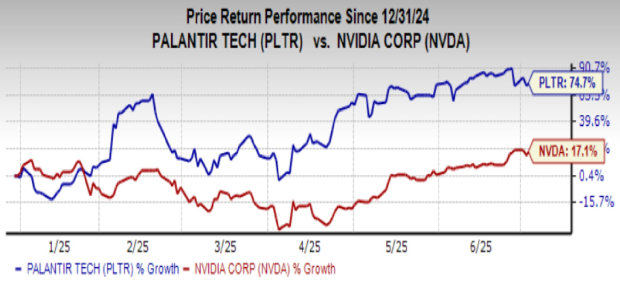

Financial Fortitude: Earnings and Projections

Following its Nasdaq debut in September 2023, Arm Holdings has consistently exceeded earnings estimates in recent quarters. With a 16% surprise in fiscal third-quarter earnings and revenues beating projections by 7.69%, the company has demonstrated a clear path to success.

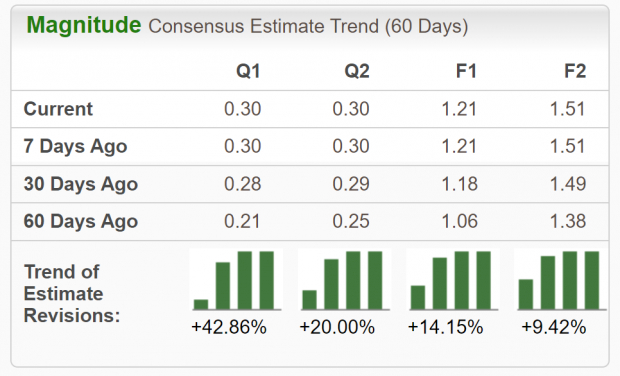

Analysts have been revising their earnings forecasts upwards, reflecting a positive outlook for ARM. With an estimated 24.8% growth in EPS and a projected revenue increase of 24.1% for the upcoming fiscal year, Arm Holdings is poised for continued success.

Image Source: Zacks Investment Research

Technical Brilliance: Riding the Wave

ARM shares have surged over 180% in the past five months, showcasing a remarkable upwards trend. The stock’s positive earnings estimates revisions and technical indicators point to a promising future.

Image Source: StockCharts

Notably, ARM’s 50-day moving average is on an upward trend, signaling a bullish momentum. With strong fundamentals and technical signals aligning, Arm Holdings is positioned for sustained outperformance.

Maintaining an upward trajectory in stock movement relies heavily on trends in earnings estimates. With Arm Holdings experiencing positive revisions and a track record of earnings beats, the stock is set to continue its bullish run in the foreseeable future.

In Conclusion: Promising Horizons Ahead

With a solid market position, a remarkable record of earnings surprises, and a strong technical setup, ARM Holdings presents an attractive investment opportunity. The company’s resilience and adaptability in the ever-evolving tech landscape make it a standout performer in the semiconductor industry.

Driven by a leading industry group and a history of beating expectations, ARM stock stands out as a compelling choice for investors. The combination of technical strength and robust fundamentals paints a bright picture for the future of Arm Holdings.

Don’t Miss Out: Zacks Top 10 Stocks for 2024

Get ahead of the curve with Zacks’ top picks for 2024. Handpicked by Zacks Director of Research, Sheraz Mian, these stocks have shown exceptional growth potential. Discover the top 10 stocks for 2024 and seize the opportunity to align your investment strategy with market leaders.

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The opinions expressed in this article reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.