Cardinal Health Overview

Cardinal Health is a multinational powerhouse in healthcare services and products, firmly anchored in the United States. As a vital conduit in the pharmaceutical and medical supply chain, it caters to an array of healthcare institutions, pharmacies, and manufacturers. Its extensive array of services includes pharmaceutical distribution, medical product manufacturing, and solutions that optimize the efficiency and effectiveness of healthcare delivery. Annually, the company garners an incredible $200 billion in sales.

Strategic Acquisition and Earnings Projections

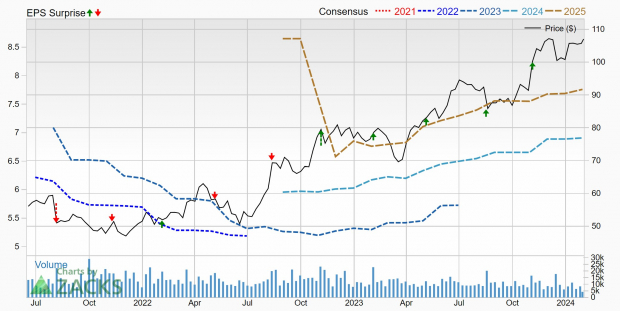

Benefiting from a Zacks Rank #1 (Strong Buy), the company has been riding on upward-trending earnings revisions and forecasts impressive EPS growth in the upcoming years. The acquisition of healthcare analytics company Specialty Networks, valued at $1.2 billion, not only underscores Cardinal Health’s strategic prowess but also led to a breakout in its stock value, accentuated by a compelling technical chart pattern.

Earnings estimates have been on a steady incline over the past two years, elevating Cardinal Health to the zenith of the Zacks Rank on several occasions. During this period, the stock has yielded an exceptional return of 123%. The sales projection for the current year stands at an estimated 10.3% year-over-year growth to reach $226 billion. Looking forward, the next year is expected to witness an 8.2% surge, touching $245 billion—an impressive growth rate for a company of such magnitude. Moreover, the earnings estimates during these intervals indicate a striking increase of 19.3% and 12.3% year-over-year, respectively. Over the subsequent 3-5 years, the EPS is foreseen to burgeon at an average annual rate of 15.3%, a testament to its forward-looking, reasonable relative valuation.

Stock Valuation and Technical Prowess

Cardinal Health is presently trading at a one-year forward earnings multiple of 15.5x, exhibiting a notable discount compared to the industry average of 18.8x. While this figure surpasses its 10-year median of 13.1x, the strong EPS growth projections place Cardinal Health at a fair value, evidenced by a PEG Ratio of 1x. This indicates a balanced proposition for investors—acquiring a fair valued company that is poised to escalate profits at an enviable 15% annually. Additionally, Cardinal Health offers an attractive dividend yield of 1.9%.

Following the announcement of the acquisition, Cardinal Health’s stock broke out from a 3-month bull flag, propelling its share price to attain unprecedented heights. This breakout symbolizes robust momentum driving the buying trend. Sustaining a price above the breakout level of $106 augurs well for Cardinal Health’s continued ascent.

Positive Market Positioning

Cardinal Health presently offers investors an opportunity to acquire one of the most pivotal components of the US healthcare infrastructure at a very reasonable valuation. Particularly during a period where US monetary policy is undergoing significant shifts, healthcare entities such as Cardinal Health can often deliver returns that outperform the market during uncertain times.

Given the myriad bullish catalysts at play, Cardinal Health emerges as a compelling consideration for any investor.