Intuit’s Strong Quarter and AI Push Drive Stock to New Highs

Intuit Inc. (INTU) reached all-time highs following a strong earnings report on May 22, thanks to its growing artificial intelligence initiatives.

The company finally broke free from a trading range that has persisted since late 2021. Wall Street is optimistic that Intuit’s AI enhancements and diverse product offerings will sustain double-digit sales and earnings growth.

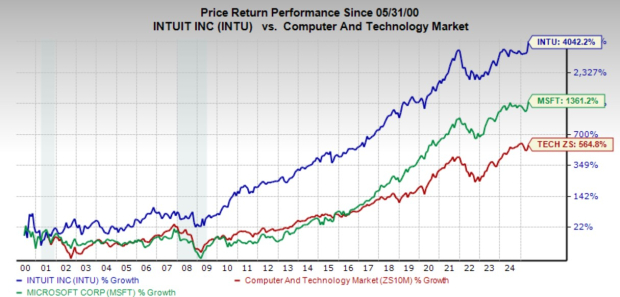

INTU has significantly outperformed the Tech sector and software giants like Microsoft over the last two decades.

This recent surge and breakthrough signal a renewed interest from Wall Street for Intuit’s potential near-term upside and ongoing long-term success.

Intuit’s Transformation as an AI Leader

Intuit holds a major position in a vital part of the economy, driven by the inevitability of taxes. Its consistent enhancements to TurboTax have solidified its status as a tech leader.

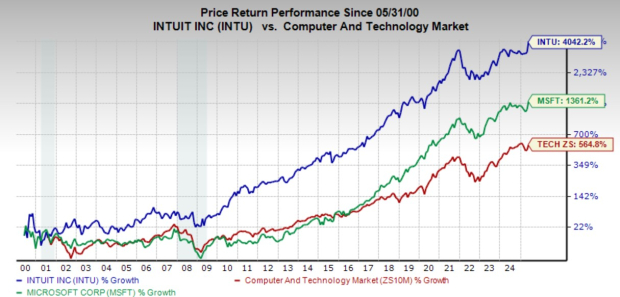

The company achieves impressive top-line growth comparable to major tech names like Microsoft, Apple, and Alphabet.

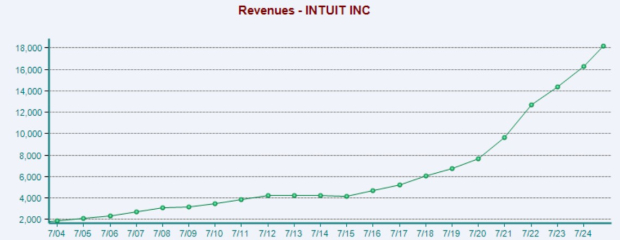

Over the past decade, INTU averaged 16% revenue growth and approximately 15% GAAP earnings growth.

Image Source: Zacks Investment Research

Intuit has diversified its software offerings beyond TurboTax, including Credit Karma, QuickBooks, and Mailchimp, creating a comprehensive solution for finance and marketing.

The company serves around 100 million customers and is fully committed to leveraging artificial intelligence to fend off emerging competition.

Image Source: Zacks Investment Research

Last summer, Intuit announced a workforce restructuring, eliminating 1,800 jobs (10% of its team) while hiring an equal number in engineering and customer-facing positions to emphasize AI integration.

Intuit’s Strong Financial Performance and Future Projections

For the third quarter of fiscal 2025, Intuit reported a 15% increase in revenue, resulting in an 18% rise in adjusted earnings and a 19% increase in GAAP EPS.

The Consumer Group revenue grew by 11%, Global Business Solutions Group sales increased by 19%, and Credit Karma revenue surged 31%.

TurboTax Live, an AI-assisted tax preparation service, saw a 47% revenue growth to $2 billion, comprising 40% of the entire Consumer Group revenue.

Image Source: Zacks Investment Research

This growth reflects a shift toward hybrid tax solutions that leverage AI for efficiency while providing personalized human guidance. This model attracts users seeking convenience over traditional services.

AI-driven innovations have energized growth across Intuit’s offerings. CEO Sasan Goodarzi highlighted the company’s commitment to redefining the role of AI in helping consumers and businesses.

Intuit anticipates 15% revenue growth for FY25, increasing its previous guidance from 12%, and expects sales to reach $20.96 billion by FY26.

Adjusted earnings are forecasted to rise by 18% in fiscal 2025 and by 14% the following year. This strong earnings outlook has earned Intuit a Zacks Rank #1 (Strong Buy) as it has exceeded earnings estimates in 19 of the last 20 quarters.

Intuit’s Stock Performance and Future Outlook for Investors

Market Recap and Company Resilience

Intuit’s stock suffered significant losses in 2022, similar to many growth-focused tech stocks, as rising interest rates pressured valuations. Investors expressed concerns over potential AI disruptions in the tax sector.

However, Intuit has shifted the narrative around AI, and analysts are willing to pay a premium due to its consistent earnings growth in a stable economic segment.

Image Source: Zacks Investment Research

Long-Term Performance Highlights

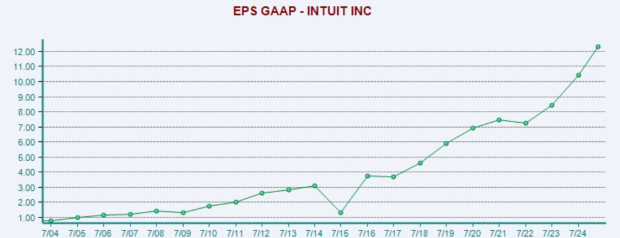

Over the past 20 years, Intuit’s stock increased by over 3,300%, significantly outperforming the tech sector’s 725% growth and Microsoft’s (MSFT) 1,600%. The stock surged by 80% in the last three years and gained 20% in 2025, following a post-earnings release rise.

Recently, Intuit broke through its 2021 high, overcoming previous resistance points throughout 2024.

A cautionary note: The stock appears somewhat overheated by relative strength index (RSI) standards, reflecting broader trends among stocks that have rebounded sharply since April’s market lows.

Image Source: Zacks Investment Research

Valuation and Investment Strategy

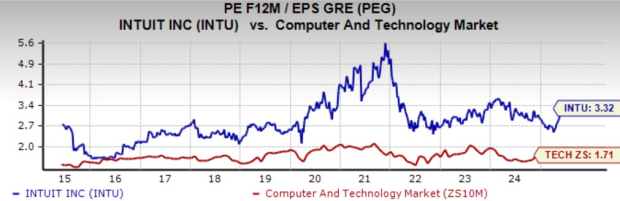

Intuit’s robust earnings outlook allows it to trade at a 40% discount to its previous highs, featuring a price-to-earnings-to-growth (PEG) ratio of 3.3. This valuation metric is noteworthy, especially as the stock recently set a new record.

Traders and long-term investors may prefer to wait for a price pullback before purchasing INTU stock. Precise market timing is challenging, and historically, stocks that break out of consolidation phases can continue to rise longer than anticipated.

Analyst Insights: Semiconductor Stock Recommendations

A leading semiconductor stock is suggested, significantly smaller than NVIDIA, which rose over 800% after a previous recommendation. This new stock is positioned to benefit from growing demands in AI, machine learning, and IoT, with global semiconductor manufacturing expected to grow from $452 billion in 2021 to $803 billion by 2028.

This article originally published on Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.