Investment Opportunity in the South

MercadoLibre MELI is a major player in the South American e-commerce sphere, reigning as a market leader in Brazil, Argentina, Colombia, Chile, Ecuador, Costa Rica, Peru, Mexico, and Uruguay based on unique visitors and page views.

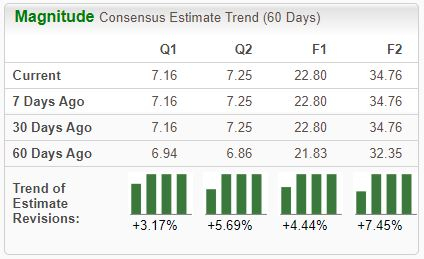

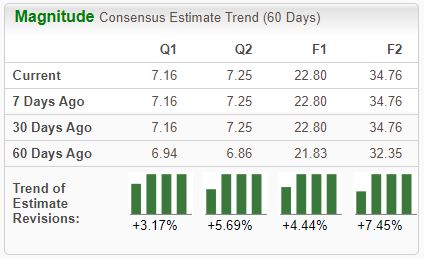

It currently holds a Zacks Rank #1 (Strong Buy), with analysts elevating their projections across all timeframes.

Furthermore, the company is part of the Zacks Internet – Commerce industry, presently ranked in the top 28% of all Zacks industries. In addition to the improved earnings outlook and favorable industry status, let’s delve into other aspects of the company.

Image Source: Zacks Investment Research

Market Momentum

MELI shares have surged in the last three months, gaining more than 25% in value and surpassing the S&P 500. Following its latest quarterly release, the stock received a substantial boost, with buyers showing significant interest.

Image Source: Zacks Investment Research

Strong Financials

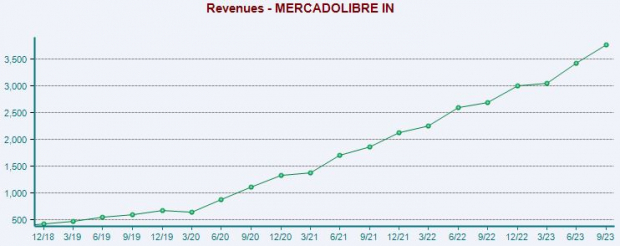

During the recent release, MELI outperformed expectations with a 22.4% beat relative to the Zacks Consensus EPS Estimate and reported revenue 5% ahead of expectations, reflecting growth rates of 180% and 70%, respectively.

In addition, the company posted a quarterly record of $685 million in income from operations. Consumer activity on the platform remains robust, with total items sold growing by an impressive 26% from the year-ago period.

Image Source: Zacks Investment Research

Growth Potential

Shares currently trade at a 4.4X forward price-to-sales (F1), a fraction of the 10.3X five-year median and highs of 22.1X in 2020. While the multiple is indeed rich, the company’s high-growth nature explains this, with earnings projected to soar 140% in its current year on 36% higher sales.

The stock sports a Style Score of “D” for Value.

Image Source: Zacks Investment Research

Keep an eye out for MercadoLibre’s upcoming release expected on February 22nd, with the Zacks Consensus EPS Estimate of $7.16 reflecting a 120% year-over-year growth. The consensus revenue estimate stands at $4.1 billion, suggesting a 40% improvement year-over-year.

Investor Perspective

Investors can harness the power of the Zacks Rank to discover potential winners. The top 5% of all stocks receive the highly coveted Zacks Rank #1 (Strong Buy). These stocks are projected to outperform the market compared to any other rank.

Therefore, MercadoLibre MELI presents an excellent stock for investors to consider, given its Zack Rank #1 (Strong Buy).

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street’s radar, presenting a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.