The Rise of Meta Platforms

A member of the beloved ‘Magnificent 7’, Meta Platforms META has rewarded shareholders handsomely, up an astounding 30% just in 2024. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with expectations moving considerably higher across the board.

Landing in the Zacks Internet – Software industry, currently ranked in the top 38% of all Zacks industries, reflects the company’s positive industry standing and robust earnings forecast.

Quarterly Performance and Financials

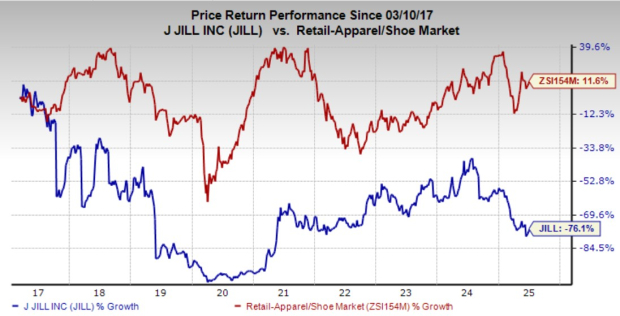

Since finding a bottom in early October of 2022, Meta shares have been on an absolute tear, adding nearly 420% on the back of robust quarterly results. Post-earnings positivity has consistently driven share prices higher, reflecting the favorable market sentiment towards the company.

Delving into the quarterly performance, Meta has delivered substantial earnings beats, exceeding the Zacks Consensus EPS estimate by an average of nearly 20% across its last four releases. Additionally, revenue growth has been impressive, with the company posting double-digit percentage Y/Y growth in three consecutive releases.

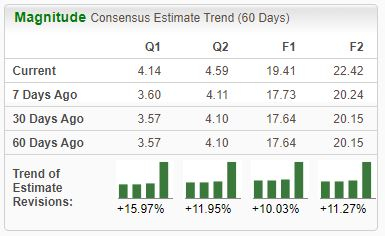

Considering the forecasted growth, the current 25.7X forward earnings multiple (F1) sits beneath five-year highs of 31.5X and compares favorably to the respective Zacks industry average of 38.1X. Consensus expectations for its current year suggest 30% earnings growth on 17% higher sales, with FY25 earnings and revenue forecasted to see growth of 15% and 13.6%, respectively. The stock also possesses a Style Score of ‘A’ for Growth.

Company Developments and Future Outlook

Income-focused investors seeking technology exposure could soon be interested as Meta unveiled its first-ever dividend following its latest print. In addition, the announcement of stock buybacks and the company’s operating margin moving significantly higher to 41% vs. 20% in the same period last year further solidifies its positive outlook.

Meta Platforms’ Stellar Position

Meta Platforms’ Zack Rank #1 (Strong Buy) establishes it as an outstanding stock for investors to consider.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028. It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since recommended, but our new top chip stock has much more room to boom.

See This Stock Now for Free >>