Skechers U.S.A., Inc. SKX is riding high as its shoes are on trend worldwide. This Zacks Rank #1 (Strong Buy) is expecting sales to hit a new record high for the year in 2024.

Skechers makes a diverse range of lifestyle and performance footwear, apparel and accessories for men, women and children. It sells its collections in 180 countries through department and specialty stores and direct-to-consumers through Skechers e-commerce sites and about 5,200 company- and third party owned- physical retail stores.

Although headquartered in Southern California, it’s a truly global company, with more than half of its total sales from the international business.

A Record First Quarter

On Apr 25, 2024, Skechers reported its first quarter results and beat on the Zacks Consensus by $0.23. Earnings were $1.33 versus the consensus of $1.10.

It was the 6th consecutive earnings beat in a row.

Sales jumped 12.5% to a record $2.3 billion from $2 billion a year ago. Direct-to-consumer was up 17% while wholesale rose 10%.

International sales rose 15% while US domestic gained 8%. For the quarter, international sales represented 65% of total sales. All geographic regions were higher with growth rising 17% in Europe, the Middle East and Africa, 16% in Asia Pacific and 8% in the Americas.

Domestic wholesale, which had lagged in the fourth quarter, returned to growth, rising 8% year-over-year.

It’s celebrity branding is driving sales including signature capsules with Martha Stewart and Snoop Dogg. The comfort technology is also a catalyst as its Skechers Hands Free Slip-ins footwear has become the number one Skechers comfort technology product in most markets.

Gross margin increased 360 basis points to 52.5%, primarily due to lower costs per unit, driven by lower freight costs and higher average selling prices.

Inventory fell 10.8% to $1.36 billion, a decline of $164.8 million, from Dec 31, 2023.

Raised Full Year Guidance

After such a strong first quarter, it’s not surprising that Skechers raised its full year earnings and sales guidance.

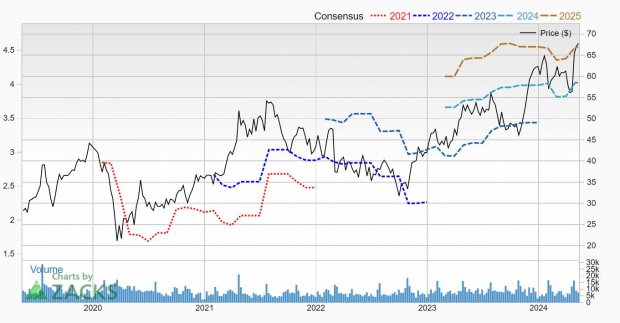

For earnings, it raised the earnings to between $3.95 and $4.10 per share, that’s up from the guidance it gave in Feb 2024 which was a range of $3.65 to $3.85.

As a result, the analysts raised their estimates for 2024. 6 estimates have been revised higher over the last month, pushing the Zacks Consensus up to $4.02.

That’s earnings growth of 15.2% as the company made $3.49 last year.

The analysts are bullish about the momentum sticking around too as 6 estimates were also revised higher for 2025 at the same time. The Zacks Consensus has jumped 13% to $4.55.

Image Source: Zacks Investment Research

Shares at New All-Time Highs

Shares of Skechers jumped after this latest earnings beat and continue to hit new all-time highs.

Image Source: Zacks Investment Research

Skechers is still attractively valued, with a forward P/E of just 16.9.

It’s also shareholder friendly. The company repurchased 1 million shares, for $60 million in the first quarter. As of Mar 31, 2024, it had $205.7 million remaining under the share repurchase program.

For investors looking for a retailer with sales momentum, Skechers should be on your short list.

[In full disclosure, Zacks Insider Trader currently owns shares of Skechers in its portfolio.]

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.