StoneCo Positioned to Capitalize on Brazil’s Payment Revolution

Company Insight: StoneCo Overview

Zacks Rank #1 (Strong Buy) Stock StoneCo (STNE) is a prominent fintech firm in Brazil, offering a comprehensive cloud-based platform for electronic payments across various channels, including storefronts, mobile, and online. The business can be divided into three key segments:

1. Payment Processing

As a leader in point-of-sale payment processing, STNE enables businesses to accept credit cards, debit cards, and digital wallet payments, similar to Block (XYZ) in the US.

2. Banking Services

Beyond payments, StoneCo supports small and medium-sized enterprises (SMEs) in banking, bill payments, and account management. By leveraging transaction data, STNE assesses creditworthiness to offer loans.

3. Software Tools

Similar to the Canadian giant Shopify (SHOP), StoneCo provides an array of products for effective e-commerce transactions, customer analysis, and management.

Growth Potential in Brazil’s Digital Payments Market

StoneCo presents an opportunity for investors to engage in Brazil’s growing payments market. As the ninth-largest economy globally, Brazil contributes over $2 trillion in annual GDP and is advancing towards a digital economy. Currently, only about 15% of Brazilian consumers utilize digital payments, indicating room for expansion. Statista forecasts a compound annual growth rate (CAGR) of roughly 29% in the Brazilian digital payment market from 2025 to 2029, potentially increasing market size from approximately $300 billion to $900 billion.

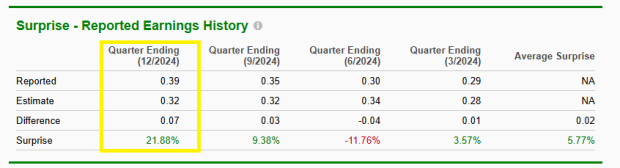

STNE: A Track Record of EPS Excellence

StoneCo has a history of exceeding EPS expectations from Wall Street. The company performed above Zacks Consensus Estimates in twelve out of the past thirteen quarters. Last quarter, despite challenging macro conditions, STNE surpassed expectations with a 21.88% positive EPS surprise, signaling growing business momentum.

Image Source: Zacks Investment Research

Attractive Valuation for Future Growth

Following a more than 15% increase in earnings, STNE shares remain relatively inexpensive, trading at a forward P/E ratio of approximately 8x EPS.

Image Source: Zacks Investment Research

Positive Technical Momentum

The technical outlook for STNE aligns with its robust fundamentals. Following the latest earnings results, shares surged past the 200-day moving average, marking a breakout from a multi-week consolidation phase.

Image Source: TradingView

Conclusion

With its extensive fintech offerings, consistent earnings performance, and favorable valuation, StoneCo presents a viable investment opportunity amidst Brazil’s digital payment transformation.

Zacks Highlights Top Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which soared more than +800% since our recommendation. NVIDIA continues to perform well, yet our new top chip stock has significant growth potential.

Enjoying strong earnings growth and an expanding clientele, this stock is poised to meet the surging demand in Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to rise from $452 billion in 2021 to $803 billion by 2028.

See this Stock Now for Free >>

For the latest tips from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Shopify Inc. (SHOP) : Free Stock Analysis Report

StoneCo Ltd. (STNE) : Free Stock Analysis Report

Block, Inc. (XYZ) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.