In 2023 Toll Brothers TOL was named the world’s most admired homebuilder by Fortune Magazine for a third consecutive year, solidifying its position as the leading builder of luxury homes in the United States. The million-dollar homebuilder has been a mainstay on Fortune Magazine’s most admired companies list for eight years running, signaling continued profitability and growth for discerning investors.

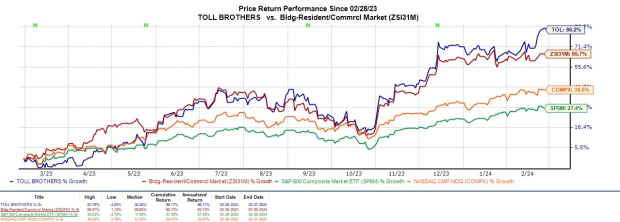

Toll Brothers’ stock currently boasts a Zacks Rank #1 (Strong Buy) and earns the prestigious title of Bull of the Day after surpassing fiscal first quarter expectations with finesse.

Image Source: Zacks Investment Research

Million-Dollar Home Sales

Driving Toll Brothers’ robust Q1 results were 1,927 homes delivered at an average price of approximately $1 million, leading to sales of $1.94 billion. This exceeded Q1 sales estimates by 4% and marked a 9% increase from the comparative quarter.

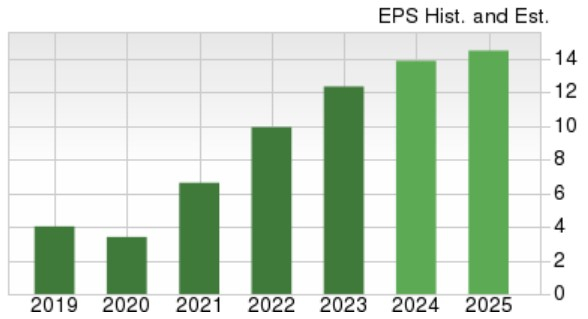

The company’s distinctive architecture and premium locations in highly coveted areas nationwide have been key drivers of success, resulting in increased profitability. First quarter net income surged by 25% to $239.6 million and $2.25 per share, reflecting a 32% EPS growth that outperformed expectations by a remarkable 27%. Toll Brothers has consistently outperformed the Zacks EPS Consensus for 16 consecutive quarters, with an average earnings surprise of 30.16% in the last four quarterly reports.

Image Source: Zacks Investment Research

Gross Margin Improvement

Toll Brothers’ trailing twelve-month (TTM) Gross Margin percentage stands at an impressive 26.92%, surpassing the Zacks Building Products-Home Builders Industry average of 21.78%. Noteworthy is the increase in home sales gross margin to 27.6% last quarter from 25.6% in Q1 2023, highlighting the company’s profitability and growth trajectory.

Image Source: Zacks Investment Research

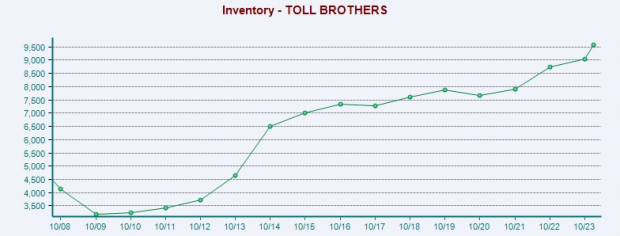

Spec Homes & On-Going Demand

Illustrating robust demand, Toll Brothers signed 2,042 net contracts worth $2.06 billion in the first quarter, marking a 40% increase in units and a 42% rise in dollar value. Additionally, the inventory dollar value of Speculative Homes increased by 6% in Q1 to $9.58 billion, signaling sustained interest in the market.

Image Source: Zacks Investment Research

Checking the Boxes

Aside from its Strong Buy rating, Toll Brothers stock holds an overall “A” VGM Zacks Style Scores grade, reflecting a blend of Value, Growth, and Momentum. Upward momentum is evident as fiscal 2024 and FY25 EPS estimates have increased by 7% and 4% respectively over the past week, indicating positive market sentiment and growth potential.

Image Source: Zacks Investment Research

Post its Q1 report, Toll Brothers’ annual earnings are projected to escalate by 6% this year to $13.15 per share. Although fiscal 2025 EPS is anticipated to remain stable, TOL shares are trading at a highly attractive forward earnings multiple of just 8.5X, particularly considering the strong price performance and substantial bottom-line growth in recent times.

Image Source: Zacks Investment Research

Takeaway

Toll Brothers continues to shine as a dominant force in the homebuilding industry, attracting investors seeking stability and growth. As the spring home-buying season approaches, now presents an opportune time to invest in Toll Brothers stock, especially with the Zacks Building Products-Home Builders Industry ranking in the top 11% among over 250 Zacks industries.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has skyrocketed over 800% since our recommendation. While NVIDIA remains strong, our top chip stock offers substantial room for growth, catering to the burgeoning demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to surge from $452 billion in 2021 to $803 billion by 2028. Explore this stock opportunity for free now.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days for free.

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Read this article on Zacks.com by clicking here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.