The Steady Revolution Behind Vertiv’s Growth

Vertiv Holdings Co (VRT) has emerged as a silent giant in the world of AI-boosted growth, outshining even the likes of Nvidia. While not as flashy, Vertiv’s focus on power, cooling, and IT infrastructure is the backbone of the digital revolution. With technological advancements demanding a constant stream of data, Vertiv stands poised to thrive for generations to come.

Diving into Vertiv’s Portfolio and Services

Vertiv’s array of solutions spans power, cooling, and IT infrastructure essential for data centers, communication networks, and various facilities. From critical power to thermal management, the company’s products cater to a diverse clientele, including enterprises and small businesses across sectors like healthcare, telecom, and retail.

Expanding Horizons and Strategic Acquisitions

Vertiv’s recent acquisition of CoolTera highlights its commitment to supporting AI deployment at scale. Teaming up with industry giant Nvidia (NVDA) further solidifies its position in tackling future data center challenges. The company’s global manufacturing plants are ramping up production to meet growing demands, showcasing a forward-looking expansion strategy.

Predicting Growth Trajectory

After a successful SPAC debut in early 2020, Vertiv has recorded impressive revenue growth rates, with projections indicating a continued upward trajectory. With organic orders rising and a substantial backlog, CEO Giordano Albertazzi anticipates a bright future driven by AI’s escalating data center requisites.

Financial Projections and Market Performance

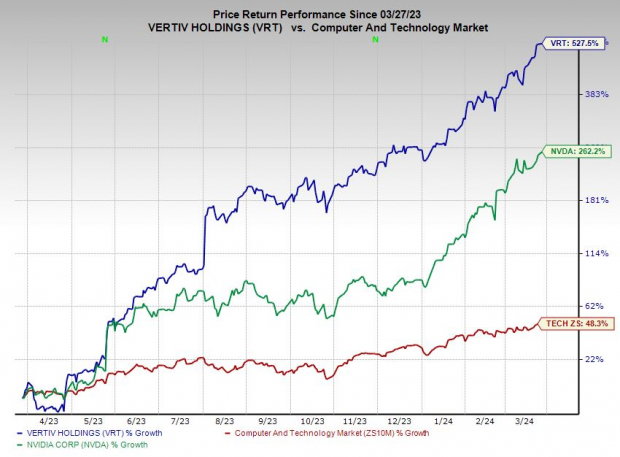

Vertiv’s robust financial outlook positions it favorably among investors. The company’s earnings estimates have surged significantly, earning it a Zacks Rank #1 (Strong Buy). Vertiv’s stellar performance in the market, surpassing key benchmarks like the S&P 500 and Nvidia, underscores its potential for continued success.

Cautious Optimism Amidst Market Volatility

While Vertiv’s meteoric rise may give some investors pause, its consistent growth and strategic positioning within the data infrastructure landscape offer a sense of stability in turbulent times. With prudent consideration for market dynamics, Vertiv remains a beacon of innovation and resilience in an ever-evolving industry.

Unlocking the Potential: Vertiv Holdings Co. – A Gem in the Making for Long-Term Investors

Uncovering Hidden Gems

Many times, the best investment opportunities are like rare jewels hidden in plain sight, waiting to be discovered by those with the patience and foresight to understand their true value. Vertiv Holdings Co. is one such gem that has quietly been gaining strength and traction in the market, positioning itself as a lucrative option for savvy investors looking beyond short-term fluctuations.

Diving into the Numbers

Vertiv is currently trading at a discount relative to its industry peers in the Computers – IT Services sector, boasting a forward 12-month earnings ratio of 33.2X compared to the industry average of 36.1X. This translates to solid value for investors, especially considering that Vertiv has seen a remarkable 325% surge over the last three years while its industry peers managed a modest 12% growth.

Vertiv’s PEG ratio, a key metric that accounts for the company’s long-term earnings growth prospects, stands at 1.2. This figure represents a significant 60% discount compared to its industry average, a 36% discount relative to the Zacks Tech sector, and an 8% markdown compared to tech giant Nvidia. These numbers paint a compelling picture of Vertiv’s potential for sustained growth and value appreciation.

Opportunities on the Horizon

With Wall Street showing a bullish sentiment towards Vertiv, as evidenced by nine out of the ten brokerage recommendations from Zacks rating the stock as “Strong Buys,” it is clear that the company is poised for further success. Investors looking to capitalize on the exponential growth of data utilization and the dawn of the AI era should consider Vertiv as a strategic addition to their portfolios.

Conclusion

In the dynamic landscape of the stock market, recognizing the latent potential of emerging players like Vertiv Holdings Co. can be a game-changer for discerning investors. While short-term fluctuations and market noise may obscure these opportunities, a closer examination of the fundamental strengths and growth prospects of companies like Vertiv can reveal a path to long-term wealth creation and value appreciation.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.