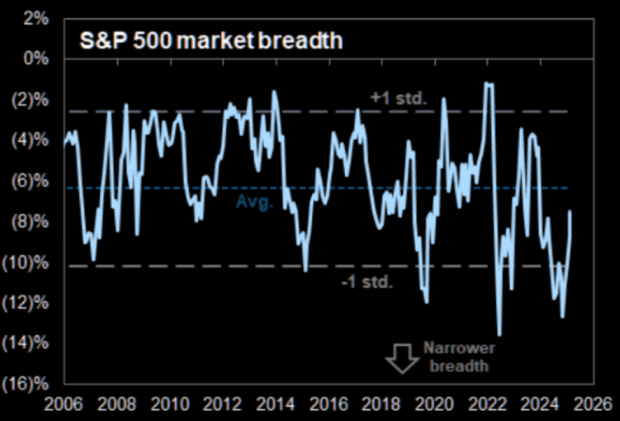

Recent data indicates a bullish shift in the U.S. stock market. As of early February, the S&P 500’s market breadth has expanded after reaching its narrowest levels since April. This upward trend is supported by an increase in tech stocks, which rallied significantly after record short positions were established by investors last week.

Additionally, trucking spot rates have risen by $0.61/mile over the past four months, a robust indicator of economic strength, and AI capital expenditure (CAPEX) spending is projected to surge from $390 billion in 2025 to $515 billion in 2026, now constituting over 2% of GDP. This combined with favorable market seasonality trends suggests that bullish momentum is regaining control.

Experts, including Jeffrey Hirsch, suggest that the lows of February are likely in, barring any unexpected events. The latest trends point towards a strengthened economic outlook propelled by significant investments in AI and positive market breadth.