“`html

On September 17, 2023, the Federal Reserve cut the benchmark lending rate by 25 basis points to a range of 4-4.25% during its Federal Open Market Committee (FOMC) meeting. This marks the first interest rate cut of the year, with projections indicating two more cuts within 2023 and additional cuts in 2026 and 2027.

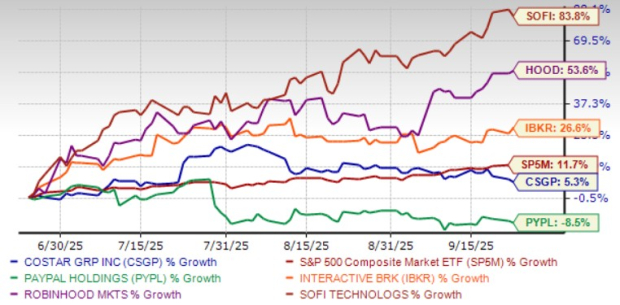

The fintech sector is expected to benefit from this low-interest-rate environment, with companies like CoStar Group Inc. (CSGP), PayPal Holdings Inc. (PYPL), SoFi Technologies Inc. (SOFI), Interactive Brokers Group Inc. (IBKR), and Robinhood Markets Inc. (HOOD) showing strong growth potential. CoStar Group anticipates a revenue growth of 18.1% for the current year, while Robinhood expects a growth rate of 35.4%.

These companies carry favorable Zacks Ranks, indicating strong buy or buy prospects, and are leveraging innovations in AI and technology to enhance their market presence and improve financial performance in a favorable economic landscape.

“`