The present macro environment across global equity markets presents a glaringly inconsistent investment scenario for 2024 and beyond. The pervasive speculation in the US stock market raises concerns, while long-neglected economies emerge as having exceptional value and promising growth opportunities.

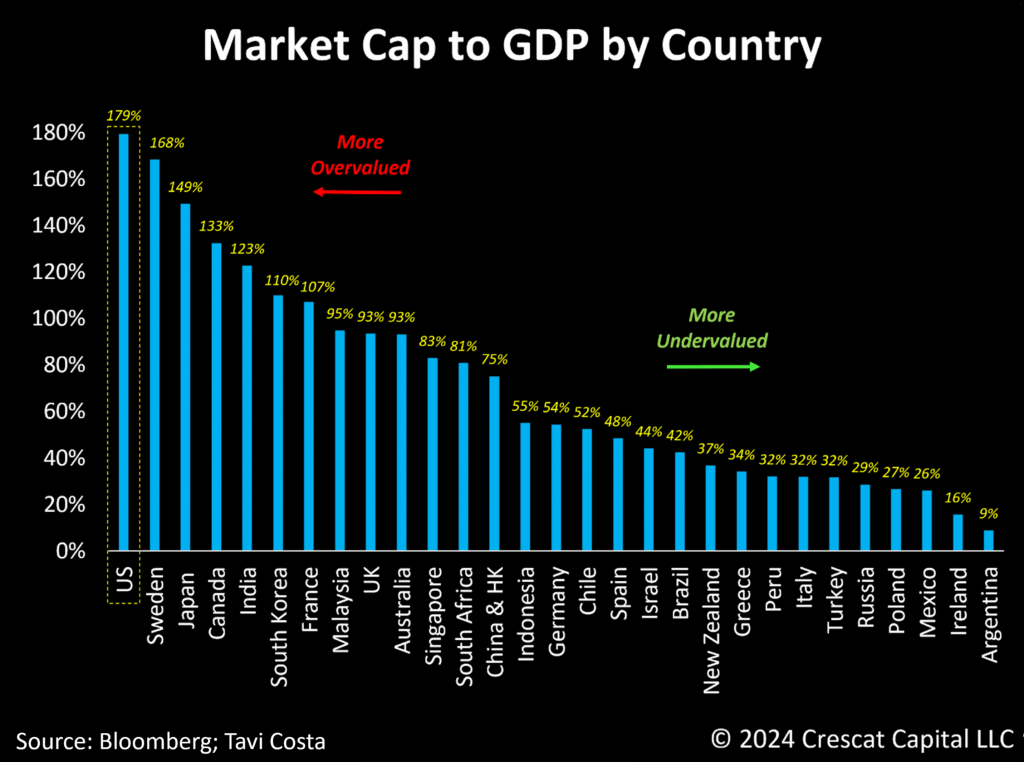

When applying Warren Buffett’s preferred valuation indicator, it becomes evident that US stocks not only reside at historically expensive levels but also are the most overvalued among 28 of the world’s largest economies. In our perspective, investors buying US equities are currently taking unjustified risks amid dangerously inflated valuations.

Simultaneously, we find economies with notably low valuations that also have substantial exposure to broad commodities with a favorable supply and demand outlook. South America, in this context, stands out as a resource-rich region with incredibly undervalued markets, especially compared to the US.

We would much rather own growing businesses at low single-digit P/E multiples than hyped-up US mega-cap technology stocks, such as the Magnificent 7, which at the mean are trading at an exuberant 48 times annual trailing profits with questionable potential to sustain their past growth rates.

The Shift in AI and Implications

Today’s sharp divergence in valuation metrics globally highlights the potential for investors to unearth compelling opportunities in undervalued regions and industries. This challenges the prevailing trend characterized by crowded optimism in US technology companies, which currently constitute over one-third of the overall equity market – a level of dominance not witnessed since the peak of the tech bubble.

More intriguingly, the recent advancements in artificial intelligence could paradoxically have highly positive implications for emerging markets that have long grappled with a low-quality labor force.

With the evolution of entrepreneurship, the internet has enabled individuals to start businesses without the need for a physical location, significantly lowering barriers to entry for new enterprises. Tools like ChatGPT, even in their early stages, act as true capability enablers. Now, individuals can not only launch businesses from their dorm rooms but also access high-quality personal assistants, programmers, mathematicians, writers, historians, biologists, and more at virtually no cost.

When extrapolating this phenomenon globally, less developed economies gain access to the same tools, leveling the playing field in terms of labor quality. The United States has historically benefited tremendously from having top-tier school systems and attracting students and workers from around the world. However, these transformative changes suggest that the gap in company valuations between developed and less developed economies will likely shrink significantly. The market, in our view, is underestimating these changes, especially at a time when the valuation of a US company has never been more expensive relative to an emerging market.

This idea can be extended further to posit that these new tools generate highly innovative and disruptive technologies that will also narrow the valuation gap between larger and smaller companies. Concurrently, today’s market exhibits an unprecedented level of dominance by mega-cap technology stocks, which in our view is completely unsustainable.

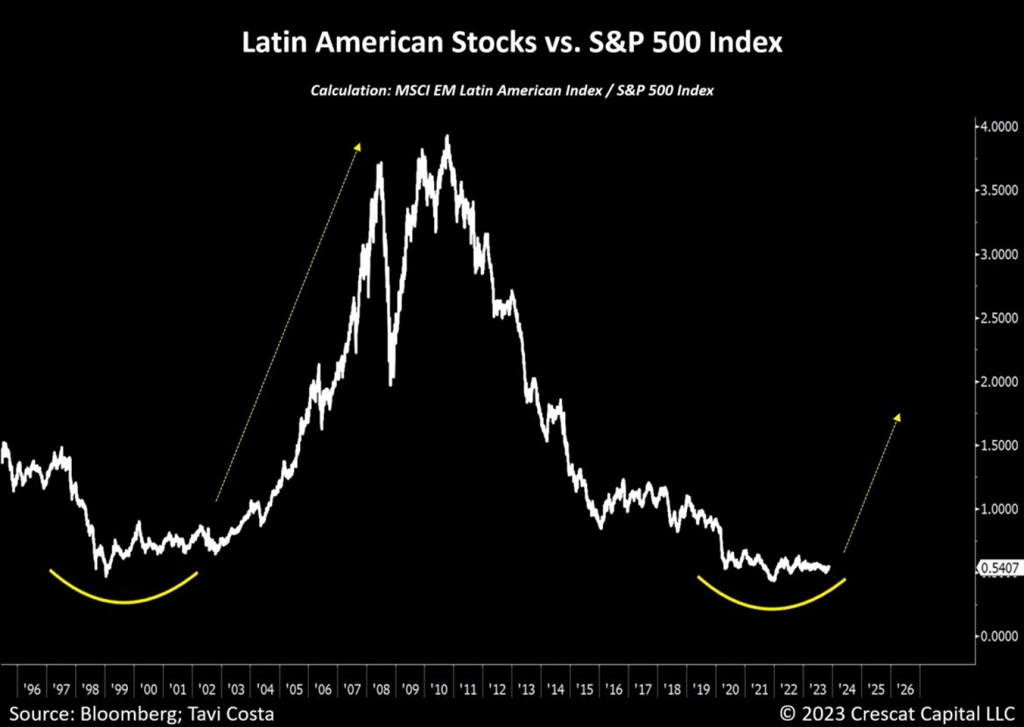

An alternative representation of the opportunity to buy undervalued Latin American businesses and short overpriced US stocks is depicted in this chart. The relative performance between these two regions is currently re-testing the levels we experienced in the early 2000s, a time that marked a major bottom for emerging versus developed markets. We believe the current investment landscape is remarkably similar to that period, and potentially even more compelling now.

Given our conviction in this thesis, our Global Macro Fund currently has a 37% weight in South American companies, mostly through mining businesses. Furthermore, we pair that exposure with a substantial short position in US markets through a diversified basket of thematic ideas: mega-cap growth ceiling, ESG re-think, private equity mismatch, and mispriced cost of capital. These are all research-driven themes that are strongly supported by our fundamental quant models.

The Dawn of a New Investment Cycle

We believe that November 2021 marked the inception of a new investment cycle, distinguished by a crucial shift in market correlations across different asset classes. During this period, businesses operating at unsustainable valuations faced a moment of reckoning, and the global fixed-income market underwent a complete collapse. Safe-haven currencies, such as the Japanese Yen, notably faltered. Additionally, the transition from growth to value stocks was initiated, benefiting commodity-related firms, while resource-rich emerging markets notably outperformed their developed counterparts. Outside of mega-cap technology companies, these market trends have persisted and are likely to intensify in the years ahead.

The next decade is likely to be influenced by a set of significant factors. These include the deepening challenges associated with deglobalization, a critical shift for businesses to prioritize securing their logistics rather than focusing solely on cost-efficiency, rising social and political pressure favoring populist leaders in response to widespread global wealth disparities, anticipated widespread labor strikes as workers seek better compensation in light of corporate profits, and forthcoming issues arising from a prolonged period of underinvestment in natural resource industries that is yet to impact the supply of critical materials.

The convergence of these long-term macro trends is profound and leads us to anticipate that inflation will surpass its historical averages over the last 30 years. Consequently, we expect the cost of capital to rise significantly and sustainably in the decade ahead. The potential for such an environment sets the stage for profound changes in the price behavior of financial markets. As the overall cost of issuing debt and equity becomes more cumbersome, it is highly improbable that volatility will remain as subdued as it currently is. As a result, we believe a return to a more disciplined approach is inevitable, prompting companies to shift their focus back towards profitability. With these shifts unfolding, investors are likely to reward improvements in the bottom line, leading to a resurgence of fundamental-driven analysis.

Similar to the preceding 30 years, these changes are not expected to be permanent; they are merely part of the cyclical nature inherent in long-term investment cycles. We believe that this evolving environment will present incredible opportunities, and the market behavior observed from November 2021 to the end of 2022 is more likely to replicate itself than to be characterized by trends similar to those experienced in 2023.

As central banks become politically constrained due to the exponential growth in overall debt, these institutions are likely to be compelled to use monetary policy as a funding mechanism to ensure the financial stability of their respective government securities markets. Consequently, even more meaningfully than in prior decades,

Impending Macro Tailwinds Favoring Commodities

The debasement of fiat currencies will likely be an important macro theme worldwide as a hard asset cycle is unleashed, particularly on a relative basis compared to historically expensive financial assets.

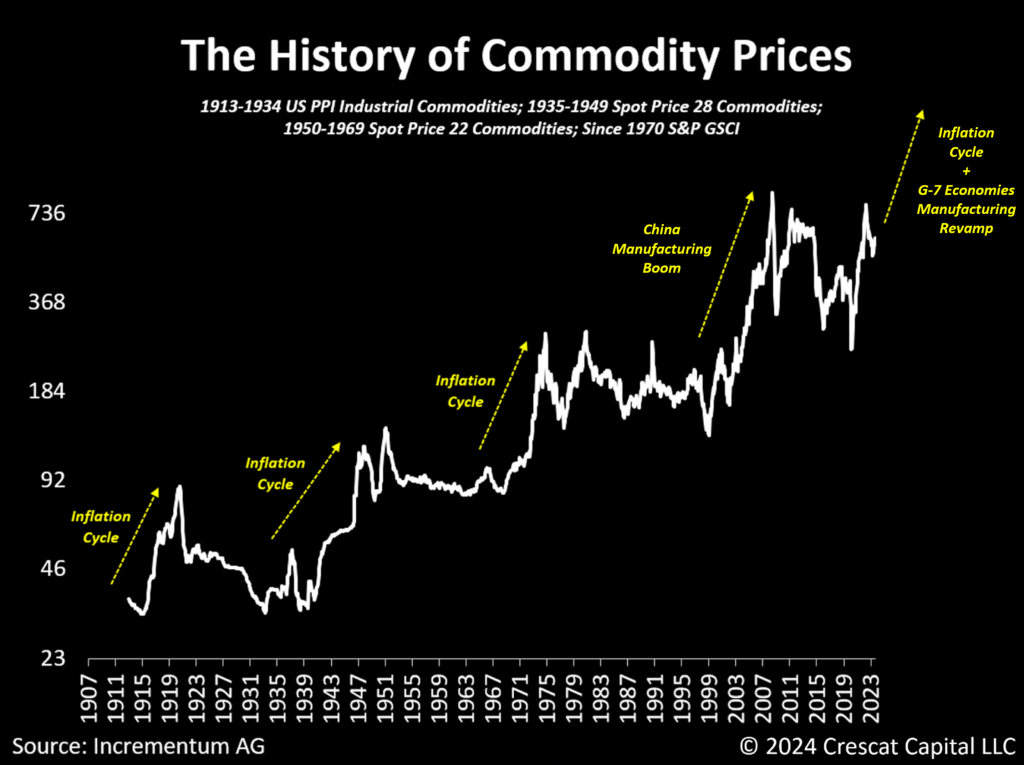

Courtesy of our friends at Incrementum AG, the historical perspective suggests that a second commodity cycle is underway. Since the 1900s, four notable commodity cycles have occurred. Three of them coincided with inflationary periods in the 1910s, 1940s, and 1970s. The fourth cycle took place in the early 2000s alongside China’s entry into the World Trade Organization, sparking one of the most extensive construction booms in history.

Now, two macro tailwinds favoring commodities seem imminent:

- The likely onset of another long-term inflationary cycle;

- A global manufacturing ramp in G-7 economies.

Inflation Setting the Stage

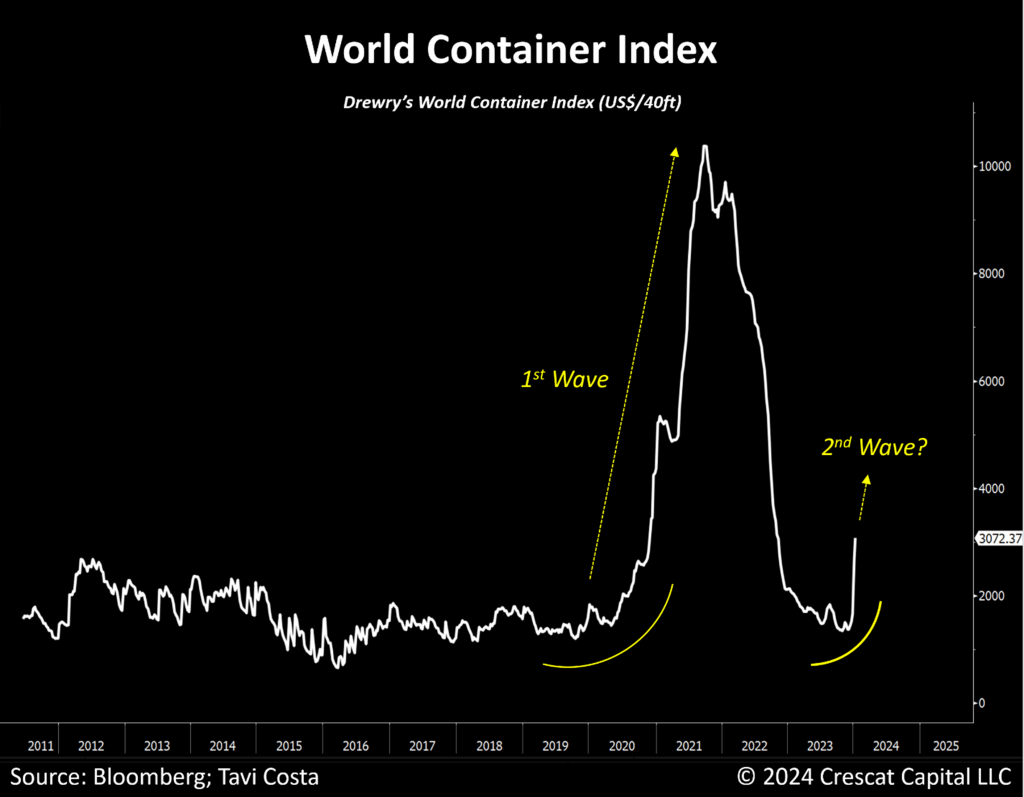

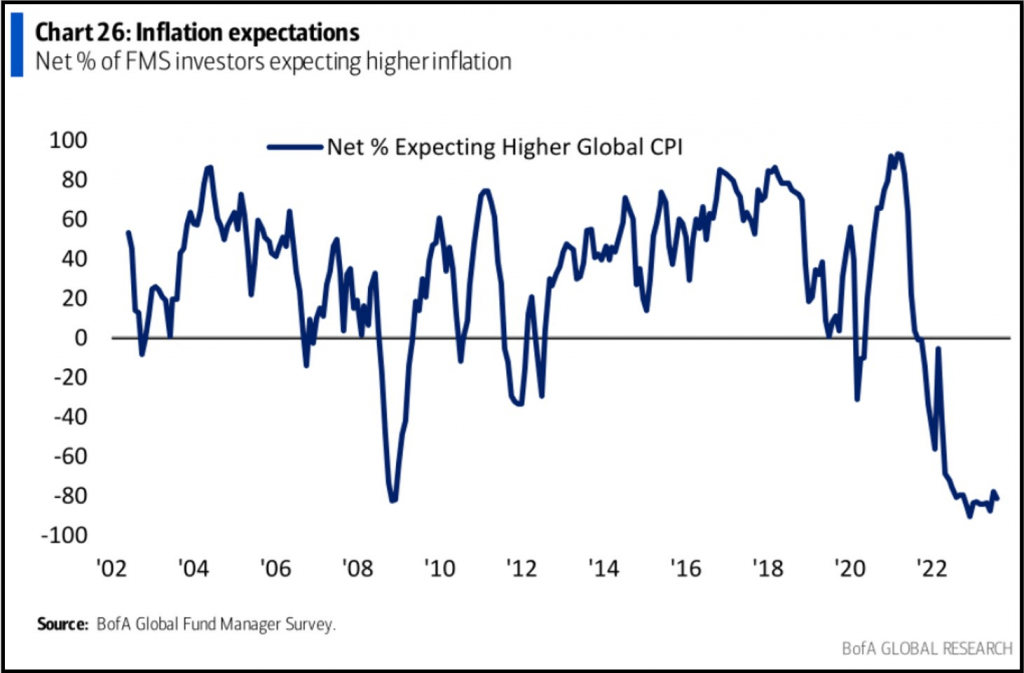

The Federal Reserve contends that the fight against inflation is over, citing the economy’s inability to sustain this level of debt. However, we strongly believe that the inflation genie is out of the bottle, and a second wave is likely in progress.

A substantial 61% surge in the global freight rate for containers has been observed over the past week, driven primarily by geopolitical conflicts in the Red Sea region. Far from isolated occurrences, these deglobalization trends are interconnected, exerting upward pressure on consumer prices over time.

An Imminent Steepening of the Yield Curve

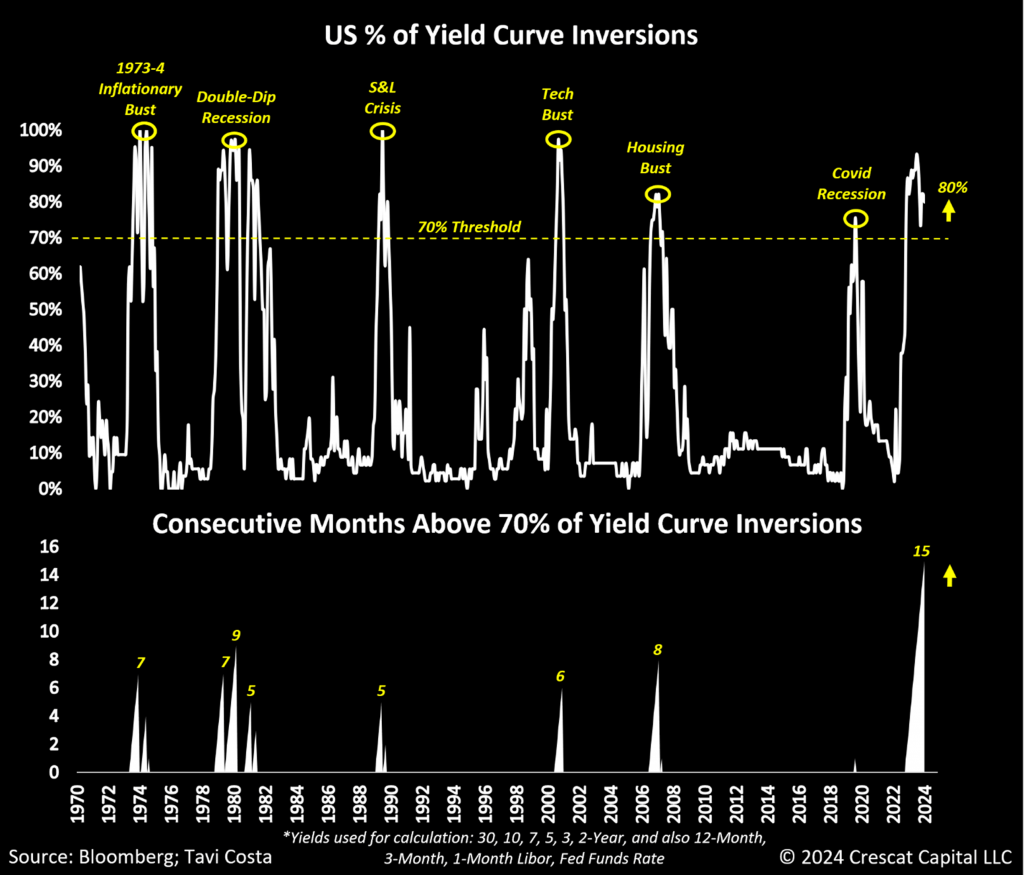

Currently, the percentage of yield curve inversions in the US Treasury market has stayed above the recessionary threshold of 70% for 15 consecutive months, the longest period in history. After reaching extreme levels, the yield curve tends to steepen abruptly as an economic downturn unfolds.

Following a robust 2-month decline in 10-year yield interest rates, a significant de-inversion of short versus long-term rates is anticipated as economic growth faces major challenges. The prolonged dip in the global Purchasing Managers’ Index (PMI) suggests a complex economic landscape with simultaneous recessionary and inflationary risks.

One-Sided Market Breadth

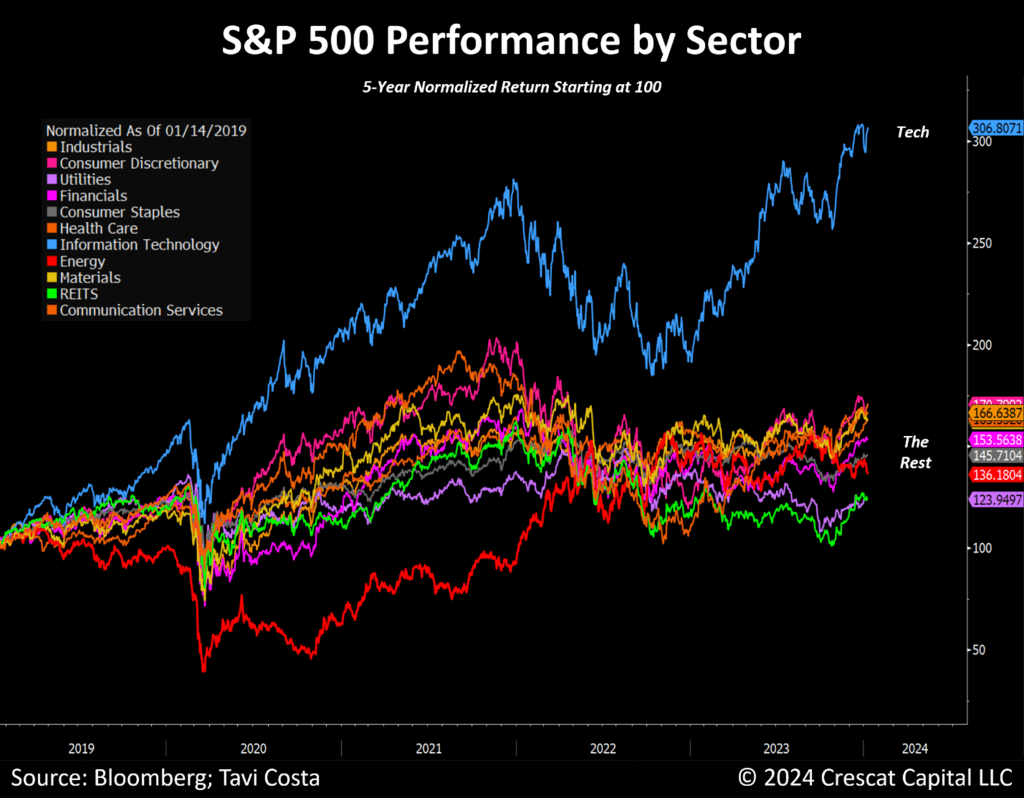

The S&P 500 (SP500, SPX) is suspiciously narrow in its breadth of leadership, dominated by richly valued mega-cap tech companies, akin to the tech bubble in the early 2000s.

Underlying this, the technology sector has predominantly attracted capital flows and attention, reminiscent of the final stages of the tech bubble. This period saw the S&P 500 peak on March 24, 2000, followed by an 83% plunge in tech companies from peak to trough.

Deteriorating Growth Outlook for the Tech Giants

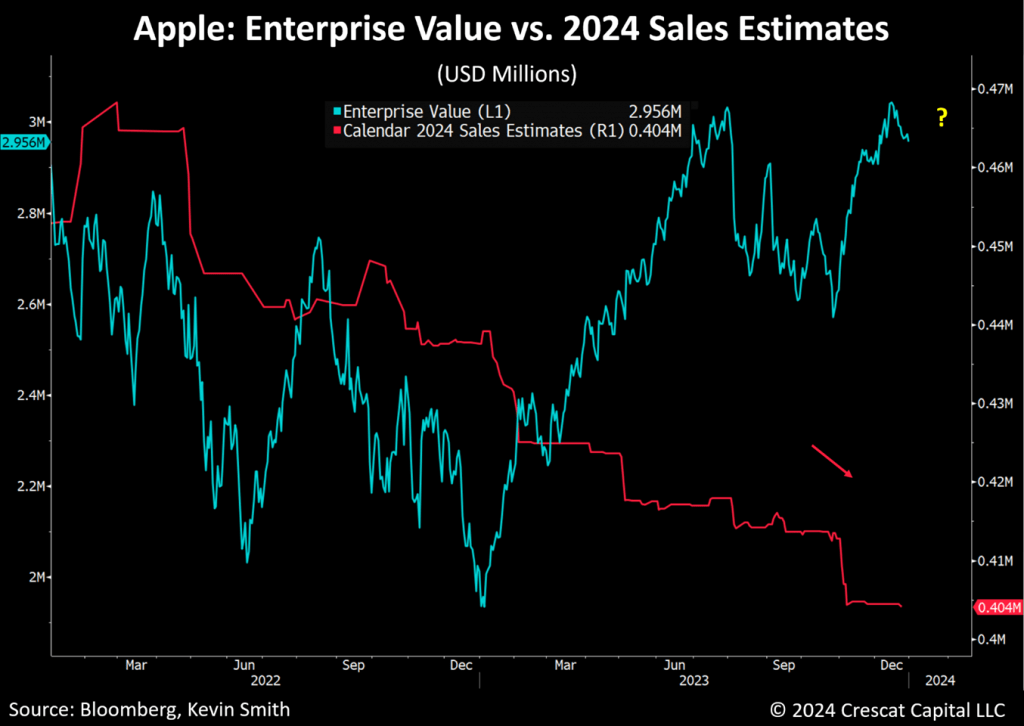

The largest technology firms are priced for future growth significantly higher than the economy at large, which will likely be impossible to deliver. Apple’s sales estimates for 2024 have been steadily declining for two years, raising concerns over its future prospects and overvaluation.

Similarly, at Microsoft (MSFT), the promise of artificial intelligence is fueling a renewed hype in valuations, but with questionable investment prospects given their high valuations.

These factors collectively suggest a complex economic landscape with simultaneous recessionary and inflationary risks, pointing towards a potential valuation reckoning and an ensuing economic recession.

The Capital-Intensive Tech Sector

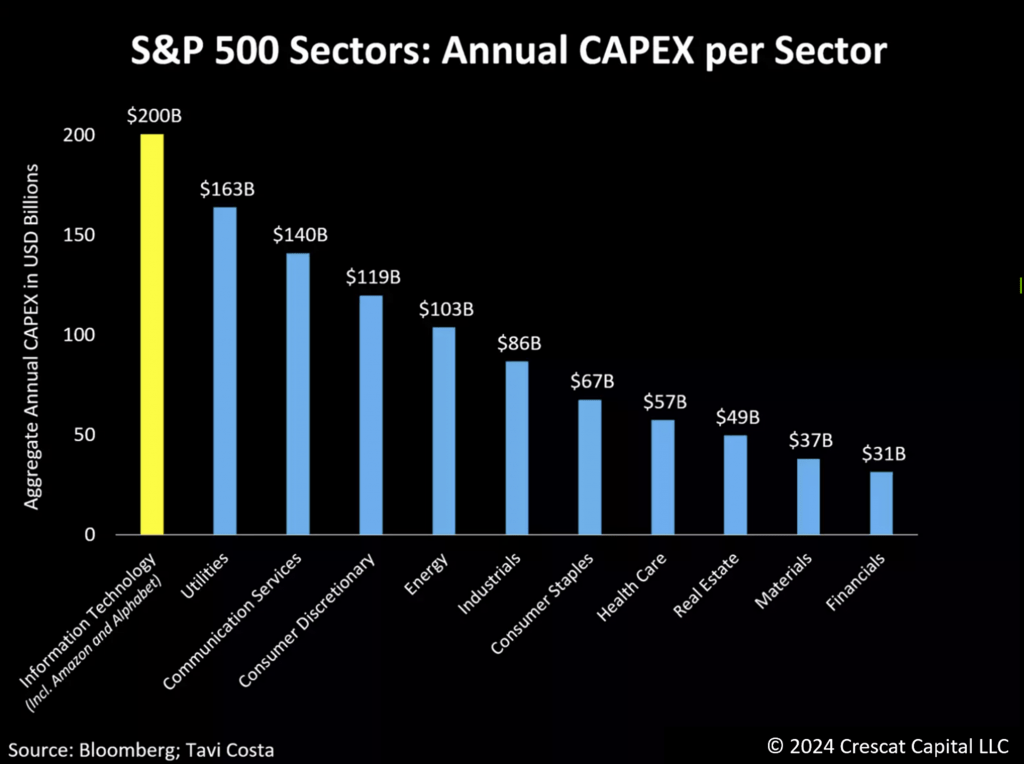

US companies have recently engaged in one of the most extensive capital spending booms in history, indicating a shift in the market. While the technology sector has seen exponential growth, the monumental investments in this sector may face substantial challenges in the foreseeable future.

The Financial Landscape: A New Era for Capital-Intensive Businesses

Capital-intensive businesses have long dictated the financial landscape, but the dominance of technology companies has been unprecedented in shaping this investment ecosystem. The reliance on megacap technology companies to fuel capital expenditure has been glaringly evident over the past year. However, their growth potential is reaching a precarious point, demanding a redefinition of strategies for expansion into uncharted territories. Despite hefty investments in artificial intelligence (‘AI’), the expected returns remain elusive, presenting a significant challenge to the future of these companies.

The Relationship Between Interest Rates & Stocks

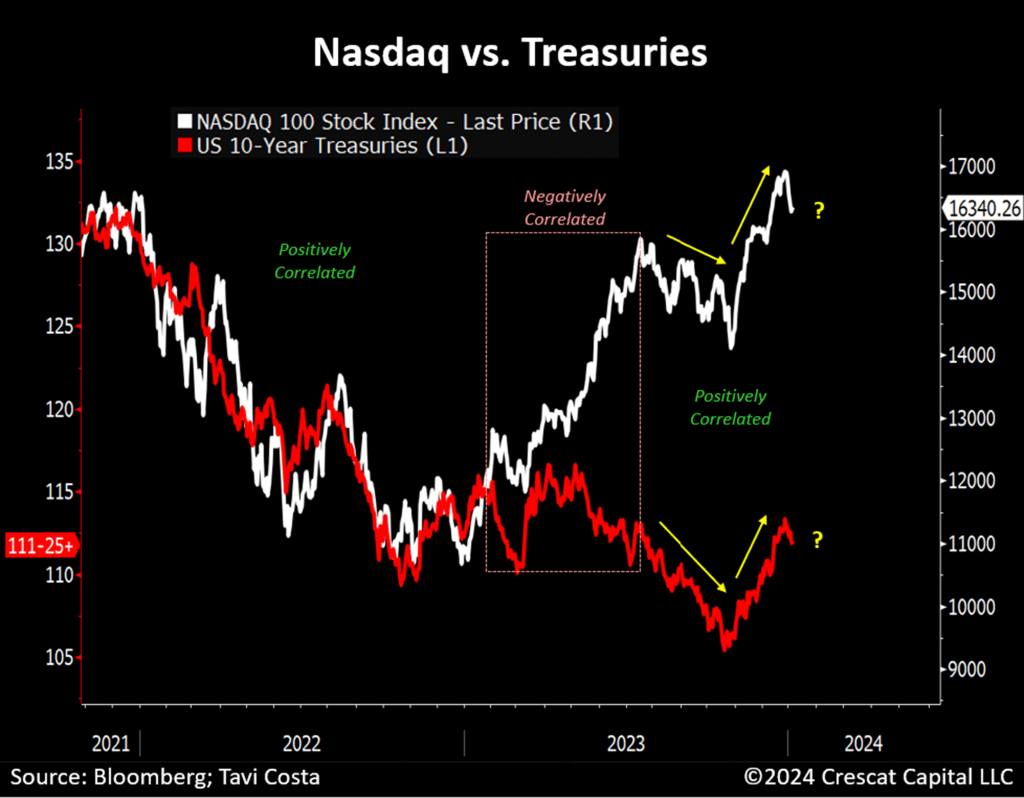

The correlation between Nasdaq stocks and Treasuries has fluctuated in recent times, particularly during the ChatGPT release and the AI frenzy. Subsequently, the link has reverted to the synchronicity observed in 2022. The recent decrease in interest rates has been a driving force behind the upswing in US equities. However, the looming specter of inflation and the impending re-issuance of $8.2 trillion in Treasuries over the next 12 months could potentially exert pressure on US stocks in 2024.

The Bond Conundrum

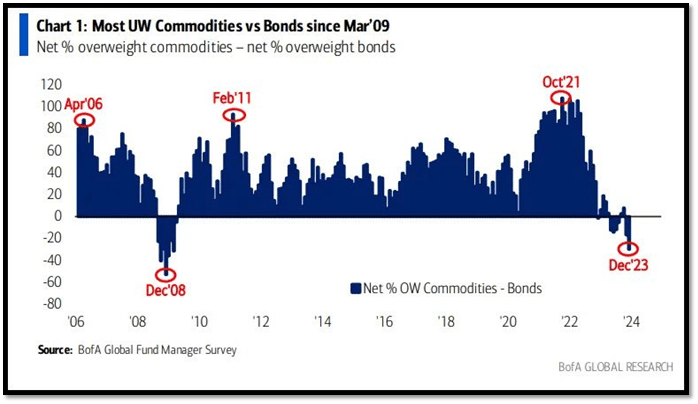

A significant research piece by the Bank of America Global Research team has underscored the historic disparity in valuation between commodities and bonds. The tilt towards resource industries, juxtaposed against rising geopolitical tensions and escalating costs, could inexorably stoke the flames of inflation, leading to a surge in commodity prices.

Breaking Free from Limitations

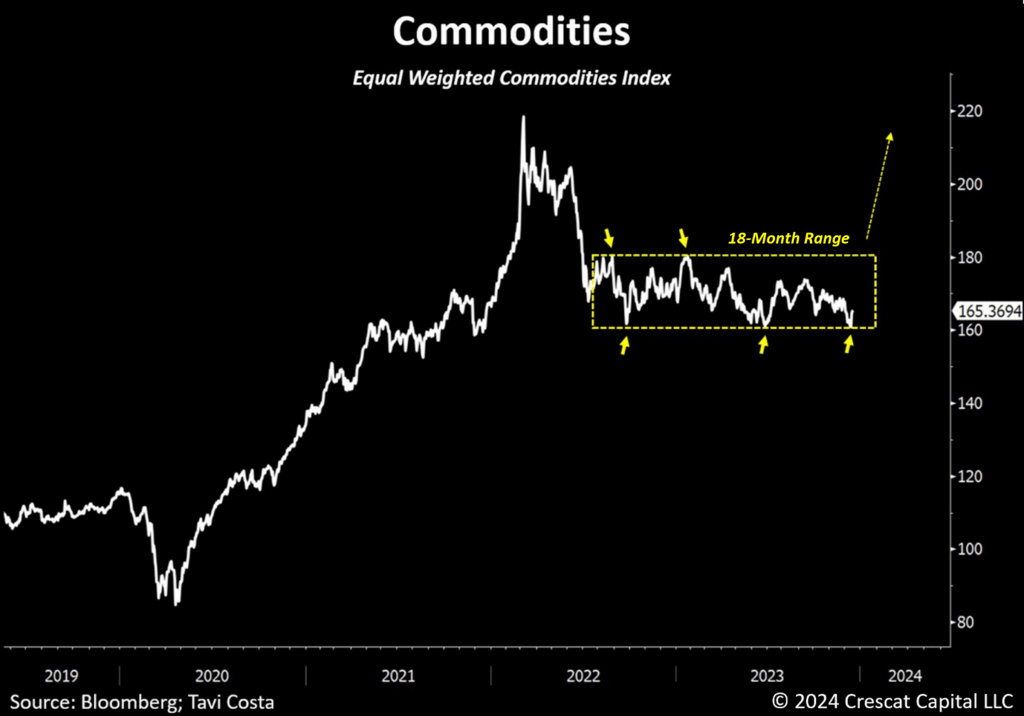

Commodities have been ensnared within a confined horizontal channel for an extended period, consistently presenting prime buying opportunities near its nadir. With the Federal Reserve adopting a seemingly nonchalant stance towards inflation, there is a palpable anticipation for commodities to transcend these confines and revisit the highs experienced during the Russian invasion in 2022.

Treading Contrarian Waters

The prevailing consensus projecting a decline in global inflation seems to be sailing against historical tides. This tenet is bolstered by the overwhelming bullish sentiment towards long-term Treasuries, as indicated by the Bank of America Global Fund Manager Survey. However, history has demonstrated that crowded market views often falter in the face of contrary forces, and the current inflationary undercurrents seem to possess a robust structural foundation.

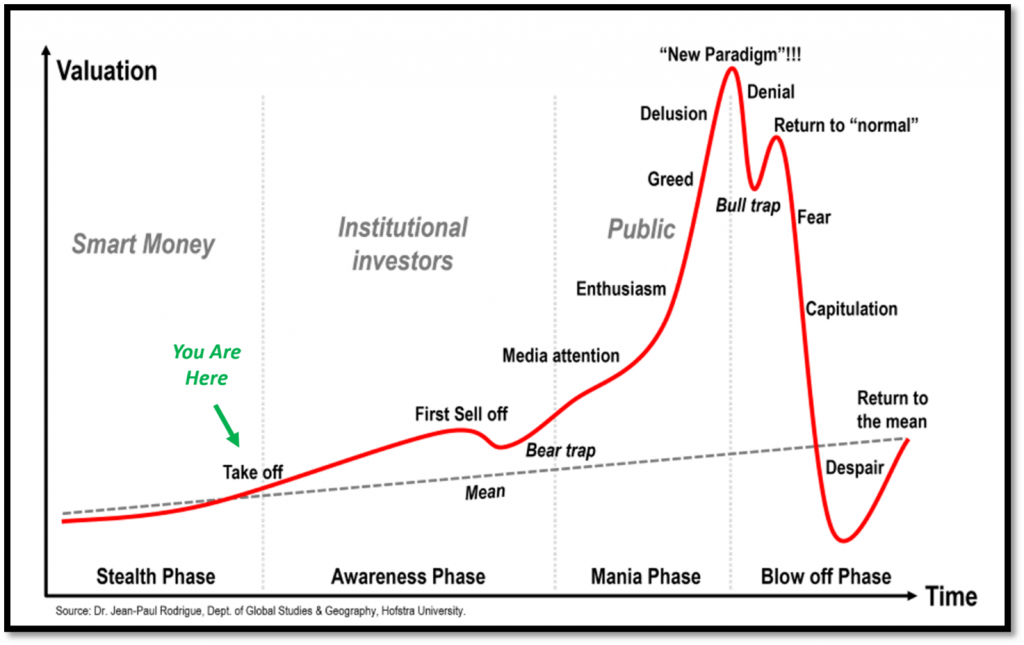

The Golden Shift

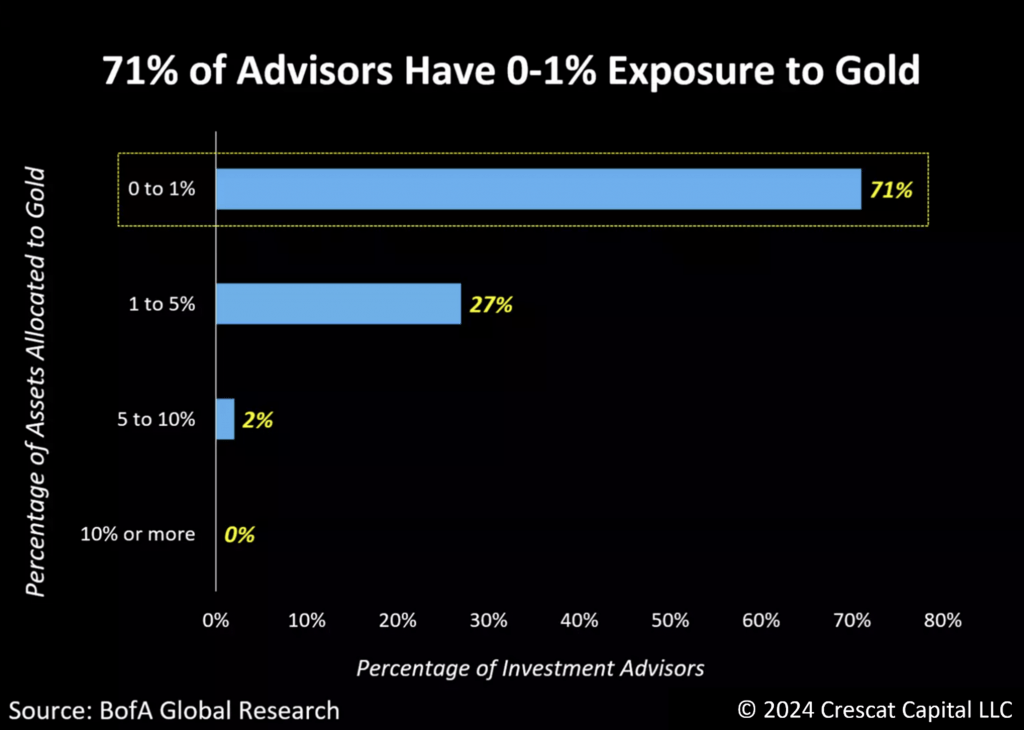

Precious metals and mining companies stand as alluring investment prospects, with gold poised for a momentous breakout that heralds the initiation of a new long-term cycle. The increasing negligence of gold as a defensive alternative is evident, with wealth advisors significantly underrepresenting precious metals in their portfolios. The current backdrop presents an opportune moment for a decisive shift towards gold allocation.

An Opportunity in Distress

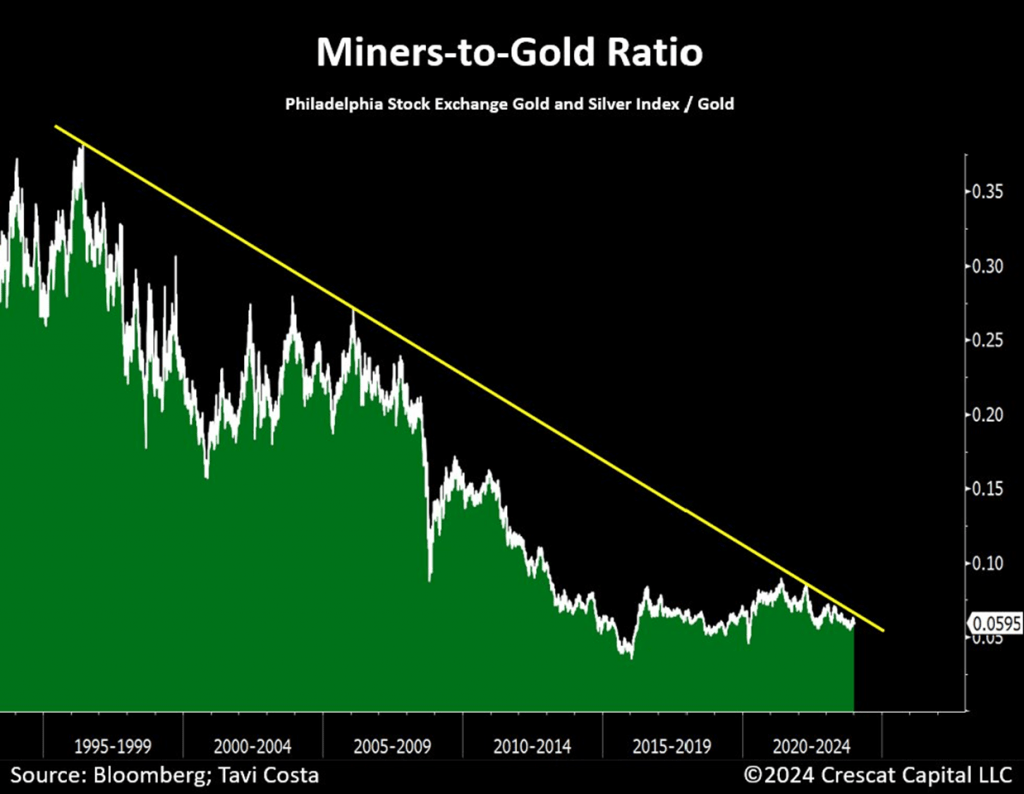

Amidst apprehension surrounding the mining industry, there is a discernible indication that 2024 will be the year for precious metals. The resilience of mining stocks in the face of tumbling gold prices, coupled with their distressed valuations, suggests an impending resurgence.

The Ascendance of Miners

The metals and mining sector appears poised to commence its ascent. With increasing M&A activity and institutional capital influx, coupled with the imminent breakout of precious metals, a long-awaited bull market for mining companies could be on the horizon.

The High-Stakes Game of Silver

Silver, on the cusp of a historic breakthrough, appears positioned as a standout performer in the upcoming year. The imminent breakout from historical resistance underscores the strategic emphasis on deploying capital into silver-rich projects with an eye on substantial gains over the next decade.

Impending Tremors in Treasuries

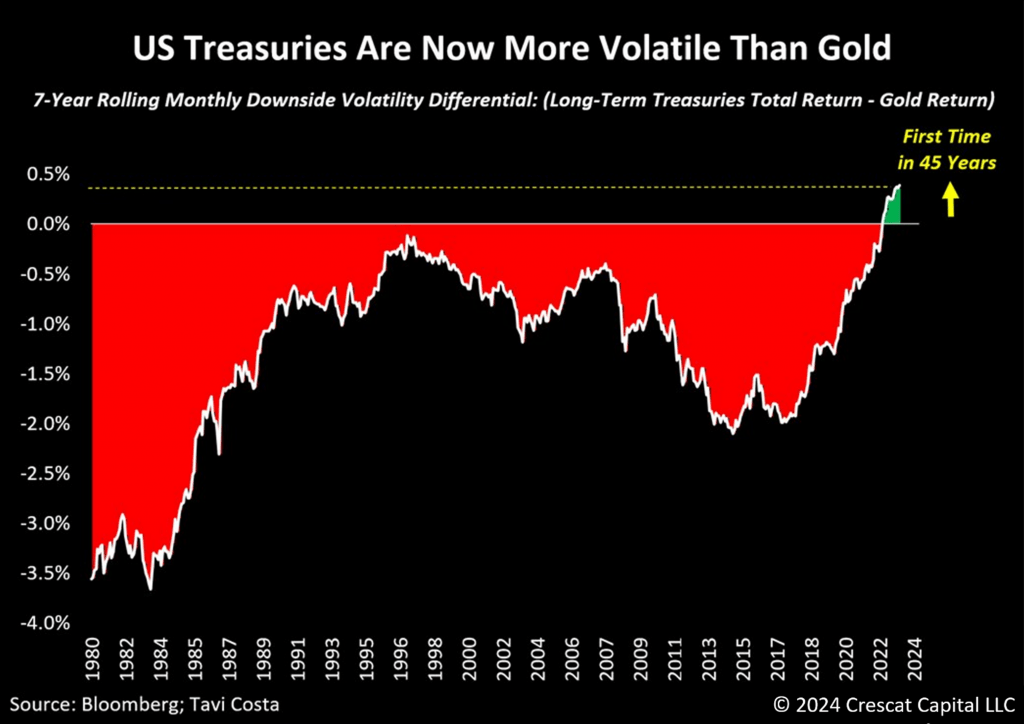

The New Paradox Shaping the Modern Investment Landscape

As we approach another year, it’s time for investors to take stock of the shifting dynamics in the world of finance. One of the most telling signs from the year gone by is the change in the volatility landscape. That’s right, for the first time in nearly half a century, US Treasuries are exhibiting higher downside volatility than one of the most coveted precious commodities, gold.

A New Era of Potential

As capital moves away from traditional stocks and bonds, the quest for fresh investment vistas could potentially transform financial markets for years to come. It’s a transitional phase, and the roles of gold, commodities, and hard assets are set to gain prominence as investors look for alternatives to the traditional 60/40 portfolios.

Bright Prospects for 2024

Amidst the twists and turns of the past year, there is an air of optimism about the prospects of Crescat’s strategies in 2024 and beyond. Although 2023 was a challenging year for shorting overvalued companies in our Global Macro and Long/Short funds, we are looking forward to a potentially rewarding 2024. We anticipate that our activist metals long strategy will continue to bolster our offerings, providing robust returns for our loyal long-term clients for years to come.

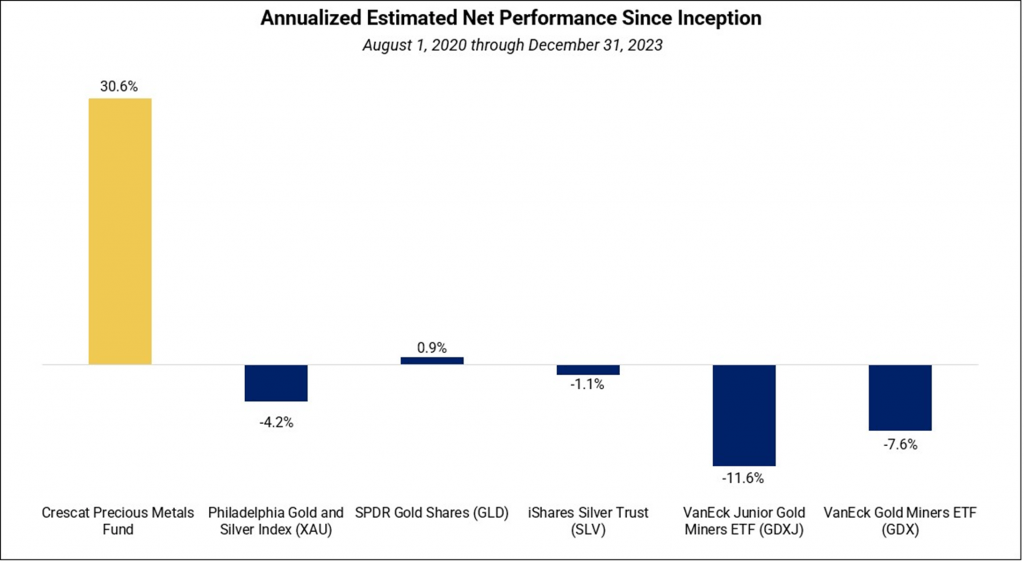

Precious Metals Fund Performance Since Inception Vs. Benchmarks

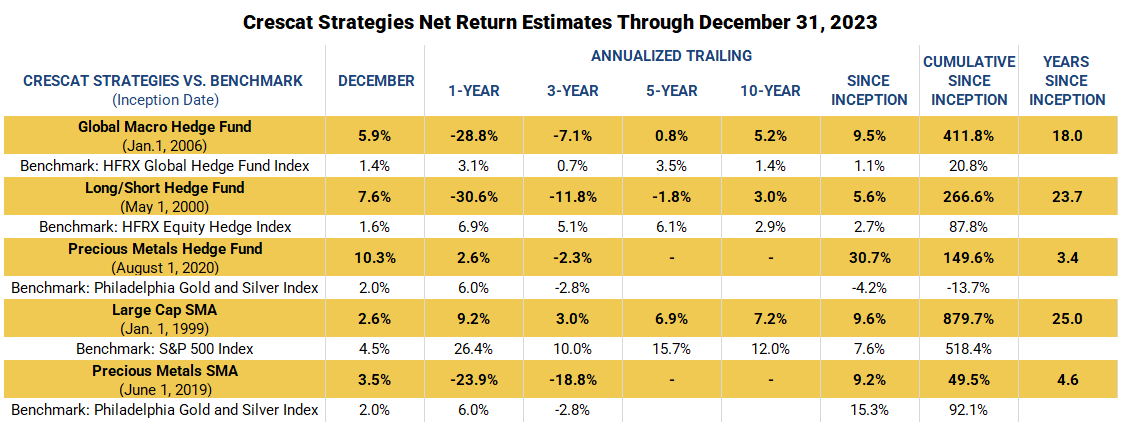

Performance of Crescat Strategies Since Inception

|

Investors should bear in mind that performance data is historical and does not guarantee future results. It undergoes revision after each monthly reconciliation and/or annual audit. Historical net returns reflect the performance of an investor who has been involved from inception and who is eligible to participate in new issues. The figures incorporate the reinvestment of dividends and earnings and the deduction of all fees and expenses (including a management fee and incentive allocation, where applicable). Individual performance may diverge from the presented data. The performance of Crescat’s private funds may not be directly comparable to the performance of other private or registered funds, and the currency used for expressing performance is the U.S. dollar. Investors can obtain the most current performance data and private offering memorandum for Crescat’s private funds by emailing a request to [email protected]. |

We are more than happy to address any queries you may have about how our vehicles can align with your individual requirements and objectives.

Warm regards,

Kevin C. Smith, CFA, Founding Member & Chief Investment OfficerTavi Costa, Member & Macro StrategistQuinton T. Hennigh, PhD, Member & Geologic and Technical Director

|

© 2024 Crescat Capital LLC Important Disclosures The reliability of performance data is historical and does not guarantee future outcomes. Individual investors may experience divergence due to the timing of capital transactions. Performance for all strategies is expressed in U.S. dollars, and cash returns are included in the total account without separate detail. It is essential to consider that tax liabilities incurred by taxable accounts are not accounted for in the net performance, and there is no direct investment in an index. Market conditions fluctuate and can lead to a decline in market value owing to substantial market or economic conditions. No particular strategy promises profitability or a specified return. Case studies are included for informational purposes and provide a general overview of our investment process but do not indicate any investment experience conclusively. Investors must base investment decisions solely on the information presented in the Offering Documents, conduct necessary investigations, and consult their investment, legal, accounting, and tax advisors before making a decision. This presentation does not offer securities of any investment fund nor solicits offers to buy any such securities. Securities of a fund managed by Crescat can be offered to select qualified investors only through a complete offering memorandum and related subscription materials. Any decision to invest must be based solely on the information set forth in the Offering Documents, after reviewing such documents thoroughly and consulting the investor’s advisors for an independent determination of the suitability and consequences of an investment in the fund. Risks of Investment Securities: CPM’s investment strategies intend primarily for long-term investors. Prospective clients and investors should consider their investment goals, time horizon, and risk tolerance before investing in CPM’s strategies, mirroring an activist investment strategy that may involve additional restrictions on resale. The precious metals mining industry comes with specific risks related to changes in the price of gold, silver, and platinum group metals, inflation expectations, currency fluctuations, speculation, industrial and consumer demand, among other factors. |

The Impact of Global Events on Precious Metals Companies

Recent developments in the precious metals market have given investors a cause for pause regarding the investment potential of companies in this sector. Heightened government and environmental regulation pose significant challenges to these companies, thus impacting their financial performance. Additionally, the influence of world events and economic conditions cannot be discounted, underscoring the potential risks faced by precious metals companies in their operational environments. These factors, alongside market, economic, and political risks, are crucial considerations for investors in these companies. The thin capitalization and limited product lines, markets, financial resources, or personnel of these companies further compound the challenges they face. The possible illiquidity of certain securities can also lead to discounted valuations, affecting the overall investment outlook for precious metals mining companies.

Inherent Risks and Performance Volatility

Precious metals mining companies operate in a high-stakes environment where they may dramatically outperform or underperform more traditional equity investments based on market conditions. This volatility is not for the faint of heart and requires a thorough understanding of the potential risks involved. It’s important to note that companies engaged in this sector often face significantly greater risks than larger, better-known companies due to the nature of their operations.

Valuation and Market Sensitivity

The fair value of positions in private placements cannot always be readily determined using observable inputs such as market prices. This poses unique valuation risks and challenges for investors. Moreover, smaller market capitalization companies, in which precious metals investment funds and SMA strategies may invest, may not be well-known to the investing public, potentially impacting their market sensitivity and trading volumes.

Impact of Regulatory Compliance and Global Environment

The impact of government and environmental regulation on the operations of precious metals mining companies cannot be overstated. The complexities and costs associated with compliance have become a significant burden, posing challenges to these companies and potentially undermining their financial performance. Furthermore, world events and economic conditions have the potential to further exacerbate the operating environment for companies in the precious metals mining industry.

Benchmarks and Performance Indexes

Several key benchmarks provide insight into the performance of precious metals companies and related investment vehicles. The HFRX Global Hedge Fund Index represents a broad universe of hedge funds and is a suitable benchmark for evaluating the performance of various investment strategies. Additionally, the Philadelphia Stock Exchange Gold and Silver Index is a longstanding index of global precious metals mining stocks and offers valuable comparative data for investors.

Investment Instruments

Investment instruments such as the VanEck Vectors Junior Gold Miners and Gold Miners ETFs provide investors with exposure to the performance of small and mid-cap companies in the gold mining industry, offering alternative avenues for investment in this sector. Similarly, the SPDR Gold Shares and iShares Silver Trusts offer investors access to the price movements of gold and silver, respectively.

Conclusion

Precious metals companies operate in a dynamic and challenging environment, where a confluence of factors including government and environmental regulation, global events and economic conditions, and market risks can significantly impact their performance. Investors must carefully consider these risks and the inherent volatility of this sector to make informed decisions about their investment strategies.

The above article provides valuable insights into the challenges and risks faced by precious metals companies in the current economic and regulatory landscape, and underscores the need for a prudent and informed approach to investing in this sector.